India’s Adani Group has been in the news for the last couple of years, mostly for controversial reasons. While the group’s shares have created immense wealth for investors and helped catapult chairman Gautam Adani to among the richest persons globally, many accuse the company of crony capitalism and outright fraud.

Among others, the Adani Group is facing allegations of over-invoicing of the coal that it imported and sold to state utilities in India. Now, there are reports that it passed off low-quality coal as high-grade. In the process, it not only allegedly overcharged utilities and by its extension consumers who end up paying a higher power tariff, but also worsened India’s pollution problem.

As Tim Buckley, founder and director of Australia-based Climate Energy Finance said, “The implications are that you have overpaid for the fuel, the second implication is that you need to burn more coal for every unit of electricity you produce, which results in more fly ash, and more pollution.”

Adani Allegedly Passed Off Low-Grade Coal as High-Grade

Documents secured by the watchdog Organized Crime and Corruption Reporting Project (OCCRP) show that Adani purchased low-grade thermal coal in Indonesia, and the same amount was sold off as high-grade to Tamil Nadu Generation and Distribution Company (Tangedco).

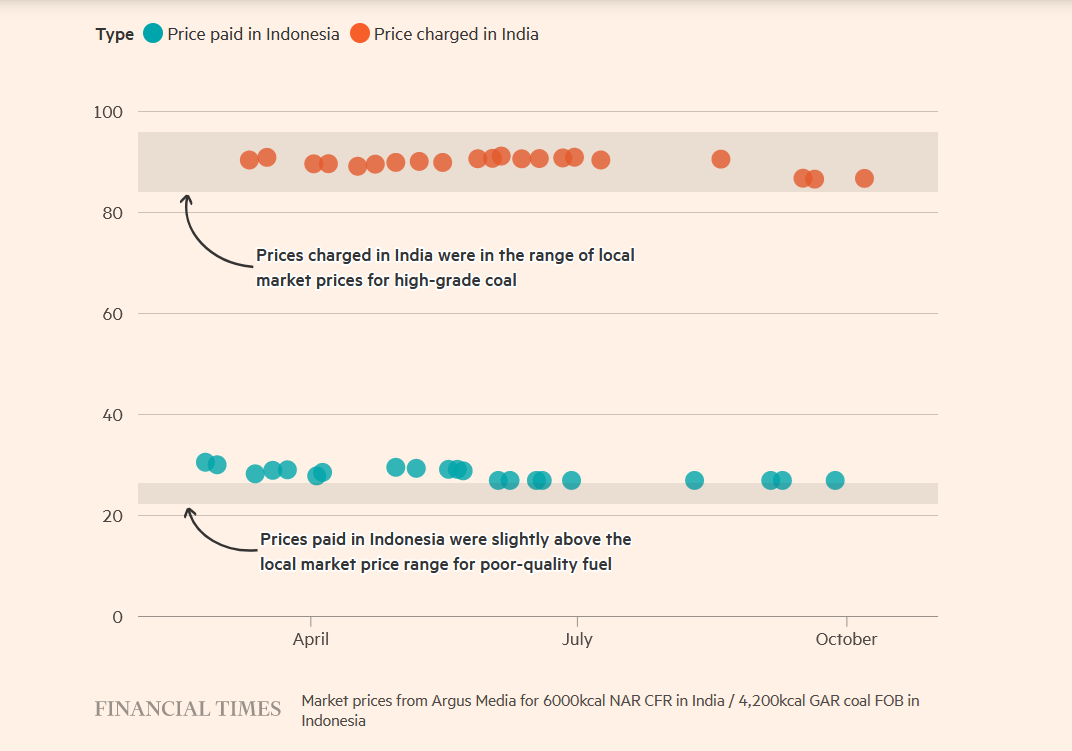

These Documents show that in December 2013 the MV Kalliopi L ship left Indonesia with coal at a listed price of $28 per metric ton. However, Adani sold the same coal to Tangedco for almost $92 per metric ton. Naturally, shipping coal from Indonesia to India is not so expensive that it would make up for anything close to this price difference. While the company raked in fat profits from the transaction, the state utility recorded massive losses, partially due to high coal prices.

OCCRP stresses that this wasn’t an isolated case. The Documents “reveal that at least 24 other shipments that landed on the Tamil Nadu coast between January and October 2014 were originally priced as low-quality coal but ultimately sold by India’s Adani Group to the state’s power company for triple the cost.”

Incidentally, the price that Adani Group paid for buying the coal was at a slight premium to the benchmark for low-quality 4,200-calorie coal from Indonesia. However, the price that Tangedco paid was in line with high-quality 6,000-calorie coal, which according to Argus was then between $81 and $89 per tonne, including freight costs. This kind of coal is much more valuable because it’s more efficient in terms of both energy production and pollution.

Documents show that the calorific value of coal was checked by Tangedco’s own scientists as well as third-party testing companies. However, the price differential shows a different story.

A senior power sector employee told the Financial Times that such large variations “can only happen with the connivance of the people at the unloading end.”

India’s Pollution Problem

While India is committed to lowering its carbon emissions, it’s the second-largest consumer and producer of coal – the dirtiest top energy source. The country’s pollution problem is getting severe and it is home to 14 of the world’s top 20 most polluted cities. Its neighbor, China, which is the top consumer and producer of coal, is suffering similar problems to an even greater degree.

A 2022 study by Lancet showed that outdoor pollution accounts for over 2 million deaths in India, which recently surpassed China to become the world’s most populous country.

In its report, the OCCRP adds, “While not definitive, the data adds strong new evidence to over-invoicing allegations against the politically powerful Adani Group, which is perceived as close to Prime Minister Narendra Modi and is India’s largest importer and private producer of coal.”

Allegations of Crony Capitalism in India

India ranks poorly on the global crony capital index and has a long history of crony capitalism, which is discussed in the video above.

Notably, Adani’s alleged proximity to Modi and the ruling Bhartiya Janta Party (BJP) has been an issue opposition parties have been raising in India’s ongoing national elections. Adani owns several ports and airports in India (which some allege the billionaire was able to acquire using his political connections) and his wealth has exploded exponentially in Modi’s 10-year tenure.

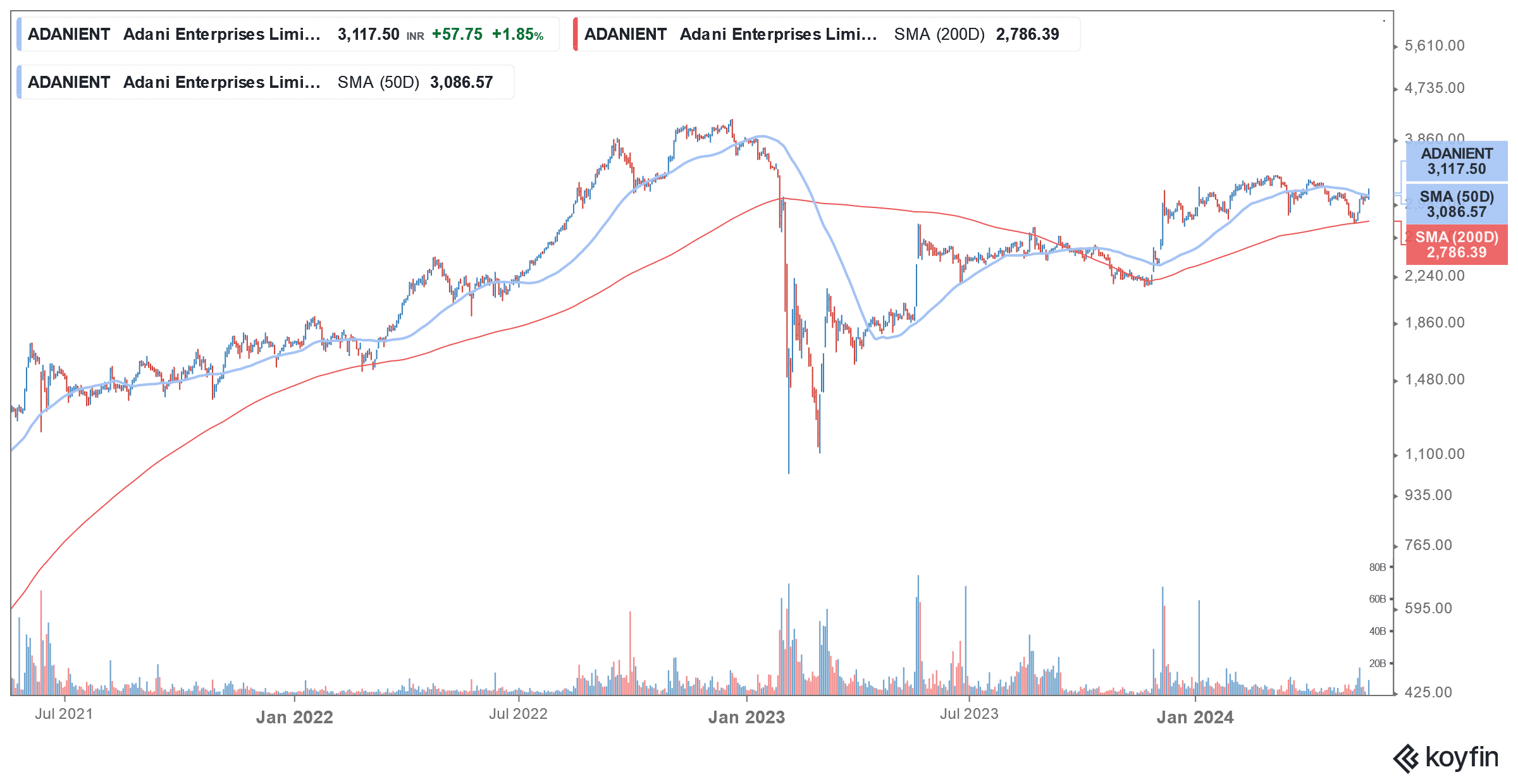

Adani has been accused of quid pro quo many times over the years. For example, in 2022, Gautam Adani purchased the popular NDTV news channel which was quite critical of Modi and his BJP. The country’s regulators have also been allegedly soft on Adani Group which short-seller Hindenburg Research accused of engaging in a “brazen stock manipulation and accounting fraud scheme over the course of decades.”

While Adani Group shares tanked early last year amid the Hindenburg allegation, they have since rebounded, and many trade near 52-week highs.

Adani Group Has Denied All Allegations

Adani Group has termed OCCRP’s findings as “false and baseless.” A spokesperson said in their emailed reply, “The suggestion that Adani Global Pte Ltd supplied to TANGEDCO inferior coal, as compared to the quality standards laid down in the tender and PO [purchase order], is incorrect.”

The company has also denied the extent of environmental damage that Arappor Iyakkam, a Tamil Nadu-based NGO has alleged. An Adani spokesperson said, “By no stretch of imagination can Adani Global Pte Ltd, with a total supply of less than 2% of the coal burnt by TANGEDCO in the relevant period, be held responsible for either air pollution or the losses of [power distribution companies].”

Adani Group Shares Continue to Rise

Meanwhile, the allegations of Adani buying low-quality coal and selling it at inflated prices haven’t had an immediate impact on Adani Group shares, and of the nine listed companies only two – Adani Ports & SEZ and Adani Wilmar closed lower today while the remaining closed in the green.

There could be two reasons why the stocks are not reacting much to the news. Firstly, the reports of Adani inflating coal prices are already under investigation and the new documents only add a new dimension of the allegations, revealing that the company was selling low-quality coal as high-quality coal.

Secondly, given the track record of previous investigations against the group, many are apprehensive that even the current allegations would make any headway.

All said the allegations of Adani adding to India’s pollution problem might not do any good to the conglomerate that is developing a renewable energy portfolio of 25 gigawatts by 2025 and has also sought investment from foreign companies for its multi-billion-dollar capex.