Yesterday, Disney announced its intentions to buy back a total of $3 billion worth of its stock as part of a set of “significant announcements” shared by its legendary Chief Executive Officer Bob Iger. These moves are clearly a part of a concerted attempt to fight off Disney’s activist investors, who are pushing for change and more control over the struggling company.

The head of Disney commented on these and other new developments in the press release and earnings call covering the company’s results during the first quarter of 2024.

The stock buyback program will be fully rolled out throughout this year. In addition, Disney (DIS) declared a $0.45 cash dividend that will be payable in July.

Although positive, the size of the authorized amount represents just a small fraction of Disney’s market capitalization, which stood at nearly $203 billion by the end of yesterday’s stock trading session.

Meanwhile, the latest dividend increase approved by the Board of Directors represents a 50% bump compared to the previous figure. All of these announcements are part of Iger’s ongoing transformative campaign.

Disney Buys $1.5 Billion Stake in Videogame Developer Epic Games

Disney made quite a few announcements regarding its business alongside these financial disclosures, including a fresh $1.5 billion investment in Epic Games, the company behind the popular video game Fortnite.

About this particular deal, Iger commented: “This marks Disney’s biggest entry ever into the world of video games, and offers significant opportunities for growth and expansion”. The deal makes perfect sense for both parties because Fortnite has had tremendous success porting popular characters and figures into its game, driving exorbitant revenues from microtransactions.

Disney will leverage its new relationship with Epic Games to develop games for many of the movies, characters, and stories it owns to create “transformational games and entertainment universe that integrates Disney’s world-class storytelling into Epic’s cultural phenomenon, Fortnite, enabling consumers to play, watch, create, and shop for both digital and physical goods”.

The acquisition comes on the heels of a positive quarter for the entertainment company. During the last three months of 2023, Disney managed to raise its income before taxes by 62% despite its revenues remaining fairly flat on a year-on-year basis.

Moreover, the company managed to overturn a negative free cash flow of $2.2 billion that it booked during this same fiscal quarter a year ago to produce positive cash flows of $886 million during this latest financial period.

“Just one year ago, we outlined an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation”, Iger emphasized in the firm’s official press release.

He added: “We are on track to meet or exceed our $7.5 billion annualized savings target by the end of fiscal 2024, while we continue to look for further efficiency opportunities.”

The Epic Games deal could be Disney’s first decisive step to enter the widely profitable mobile gaming industry at a point when it needs to look for new avenues to raise its bottom line by leveraging its vast intellectual property (IP) portfolio.

ESPN, FOX, and WarnerBros Partner to Create a New Sports Streaming Platform

Other exciting announcements shared by Disney just this week included a partnership with Fox and Warner Bros to create a joint venture (JV) that will allow the three companies to develop a streaming service that combines their rights to broadcast different sports events.

Sports fans will have the chance to subscribe to one platform where they can enjoy most of the sports content that would typically be available on cable TV. The streaming service is expected to go live during the fall season. The company abstained from providing further details about the platform’s pricing but promised to soon inform consumers on that particular front.

“The launch of this new streaming sports service is a significant moment for Disney and ESPN, a major win for sports fans, and an important step forward for the media business”, Iger highlighted. The move could turn out to be a resounding success if the trio is able to secure valuable broadcasting rights from the NFL, NBA, and other top sports leagues. Many users are already paying hundreds if not thousands of dollars every year to watch all of their teams’ games in today’s painfully fragmented streaming environment.

Why Is Disney’s Leadership So Concerned About Its Shareholders?

Disney’s announcement of a $3bn share repurchase program for this year is a positive indication for shareholders as it highlights the management’s intentions to give money back to those who invest in the business. But investors are still worried that it might not be enough to get Disney out of its current slump.

Activist investor Nelson Peltz has been on the hunt for board seats for years now but has been turned down by Disney leadership every time, even though he owns 1.65% of the company’s outstanding shares. Bob Iger is under tremendous pressure to fix Disney’s problems of growing unprofitability and Peltz isn’t the only unhappy shareholder.

Now Peltz is looking to start a proxy contest by partnering with other disenfranchised shareholders to try to win himself a board seat over Bob Iger’s choice, former Disney CFO Jay Rasulo. It’s no surprise that Iger is pushing a higher dividend and a large buyback to help keep shareholders on his side of the vote.

How Might the $3 Billion Buyback Affect Disney and its Stock Price?

Stock buybacks are exactly what they sound like. Companies buy back some of their outstanding shares. They reduce the number of common shares in circulation for the companies that perform this corporate action and have an immediate impact on the share price as the firm’s valuation is now divided by a lower number of shares.

Companies buy back shares for various reasons. In most cases, the Board of Directors approves this type of action when they believe that the market is undervaluing the business based on its growth prospects.

Moreover, it could also be that the firm has ample cash reserves that cannot be immediately put to use for the benefit of shareholders by investing in projects that fuel the business’s growth.

In that scenario, the Board tends to lean toward share buybacks as they send a positive signal to both the markets and shareholders regarding the confidence that they have in the business. By the end of the fourth fiscal quarter of 2024, Disney had total cash reserves of $7.2 billion.

Finally, buybacks are a more tax-efficient way to distribute dividends to shareholders because dividends are subject to double taxation. Instead, buybacks tend to produce capital gains to shareholders that are only taxed if the investor sells his/her holdings at a profit.

Disney’s stock delivered a meager 3% gain to shareholders during 2023. However, the stock has accumulated a 22.4% jump so far this year, primarily as investors are feeling more confident about the overall state of the economy.

Iger’s ongoing transformation of Disney toward becoming a 21st-century enterprise may also be influencing the performance of the company’s stock. However, the full impact of these initiatives and investments may not be tangible until these projects start to deliver financial gains to the firm.

Other businesses including Disney have been carrying out stock buybacks. Just last week, Meta Platforms (META) announced its first-ever dividend along with a massive $50 billion buyback program. The news propped up the price of social media company’s stock by nearly 20% in just a few hours.

Meanwhile, in 2023, Apple was at the top of the list on this particular front as the company’s Board authorized a massive share repurchase program worth $90 billion that represented a little more than 3% of its market capitalization.

Moreover, Chevron and Salesforce also authorized similar initiatives valued at $75 billion and $20 billion respectively in a move that sought to strengthen investors’ confidence in their businesses, growth plans, and leadership teams.

Buybacks Tend to Push Up Share Prices by an Average of 12.1% in the Long Run

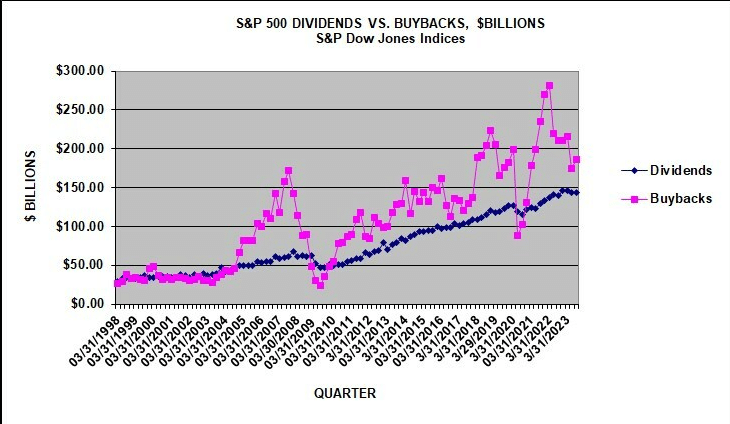

According to data from S&P Global, companies have been steadily increasing the amount they spend on buybacks since 1997, with a total of 53% of companies performing repurchases as of 2018 compared to just 28% in 1997.

Meanwhile, the report from the market analytics company highlights that corporations that perform this kind of corporate action tend to produce positive short-term results in terms of higher stock prices.

This can be attributed to the immediate impact that the share repurchase has on the number of outstanding shares, which is reduced as a result of the measure. It’s simple supply and demand economics.

Finally, the study cites a report that indicates that companies that engaged in share buybacks delivered “abnormal returns” for buy-and-hold investors a few years after the initial announcement was made.

Based on a sample of 1,239 common shares and repurchase actions, the study identifies that there was an average positive share price increase of 3.5% immediately after the buyback was announced while “abnormal” average returns of 12.1% were produced by these firms in the four years that came after the official announcement.

The S&P Global study provides evidence that share buybacks can catalyze positive share price movements. In the case of Disney, the combination of this corporate action and the company’s ongoing business transformation initiative may very well be enough to win Iger the upcoming board seat vote.