Coinbase, the largest crypto exchange in the US, has been engaged in a legal fight with regulators for years now. Recently, it filed various bombshell lawsuits to find legal documents that may implicate the US Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) in what they deem a coordinated effort to prevent crypto companies in the country from accessing banking services.

According to court filings, Coinbase is demanding access to internal documents that reveal the agency’s approach to enforcing securities and banking laws to the detriment of the crypto exchange’s growth and operational viability.

Also read: SEC Sues Another Crypto Trading Desk Cumberland DRW

At the center of the legal complaint is the Freedom of Information Act (FOIA), a law that gives companies and individuals the capacity to request internal communications and other similar documents from agencies like the SEC and FDIC to provide clarity and transparency about the way they deal with certain matters.

The exchange is seeking to uncover what it characterizes as a “deliberate and concerted effort” by regulators to deny crypto firms access to the federal banking system – a strategy that the industry has called “Operation Chokepoint 2.0.”

Federal Agencies Have Not Fulfilled Coinbase’s Multiple FOIA Requests

Coinbase is targeting three investigations performed by the SEC between 2018 and 2024 on crypto firms and entrepreneurs including a recently concluded proceeding involving a project based on the Ethereum blockchain network.

If court find that Coinbase’s arguments have merits, the documents provided by the two agencies could provide insights into their evolving views on digital assets.

Coinbase has been sending FOIA requests to both federal agencies for years and has not received the documents it has requested.

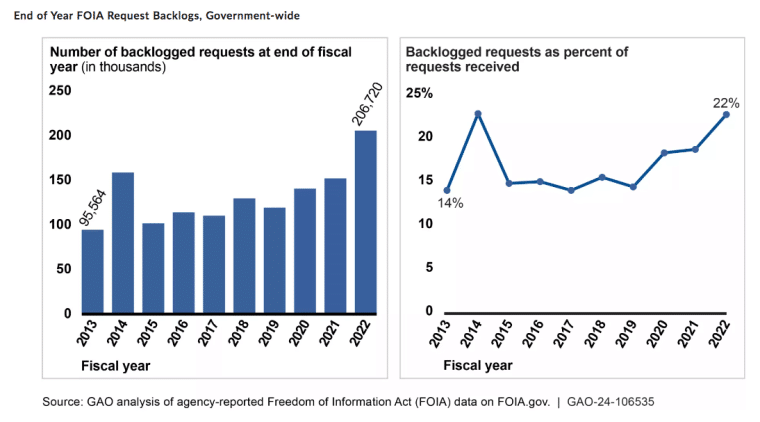

According to an investigation from the Government Accountability Office, there is a massive backlog of FOIA requests resulting from an increase in the volume of information requested by both individuals and corporations. By 2022, the number of requests that were not yet fulfilled exceeded 200,000.

These documents, Coinbase argues, could provide crucial insights into the SEC’s evolving perspective on digital assets.

Coinbase claims that the FDIC sent “pause letters” to banks between March 2022 and May 2023 where they were instructed to abstain from providing services to crypto businesses until they received further guidance on the risks that they posed to these institutions.

The existence of these letters was revealed in October when the agency’s Inspector General published a report that revealed its strategies for managing the risks associated with the crypto industry and its dealings.

Additionally, Coinbase has filed requests seeking information about any caps or limits the FDIC may have imposed on American depository institutions regarding digital asset holdings.

The crypto exchange has also requested data about how the agency has handled other FOIA requests since early 2022 to establish patterns in how crypto-related information requests are processed.

‘Operation Chokepoint 2.0’ Allegations

Coinbase’s legal filings reference an initiative named by crypto industry insiders as “Operation Chokepoint 2.0” that draws parallels to a 2013 Obama administration initiative that denied banking services to businesses deemed “high risk.”

The exchange argues that financial regulators are employing similar tactics to restrict cryptocurrency companies from accessing essential banking services.

Coinbase is not the only company that has experienced this kind of limitation as other industry participants have reported similar experiences. Erik Voorhees, founder of cryptocurrency exchange Shapeshift, recently reported that the fintech firm Revolut had terminated his account for “interacting with crypto.”

Also read: Binance Founder Warns Against Deepfake Crypto Scams After Getting Out of Jail

Meanwhile, the Wyoming-based crypto bank Custodia is appealing a judge’s decision that allowed the Federal Reserve to deny it access to a master account, which would have provided access to the central bank’s liquidity facilities and payment services.

Both regulatory agencies have opted to remain silent about the legal proceedings. The SEC has declined to comment on the lawsuit while the FDIC has maintained its policy of not discussing pending litigation.

However, the FDIC’s perspective on cryptocurrency risks was outlined in its 2023 OIG report, which emphasized that crypto-asset-related activities could pose a threat to the agency’s mission of maintaining stability and public confidence in the nation’s financial system.

The agencies claim that they have denied FOIA requests based on various grounds, including potential interference with law enforcement activities. This mirrors the SEC’s recent response to the American Securities Association’s FOIA request regarding Wall Street firms’ record-keeping practices, which was denied to protect ongoing investigations.

Coinbase “Will Not Relent” On Its Pursuit for Government Transparency

Paul Grewal, Coinbase’s chief legal officer, has been vocal about the company’s determination to pursue transparency, stating: “So long as the government will not relent, neither will Coinbase.”

The first is for documents about a digital asset deposit cap @FDICgov and other banking regulators have apparently been imposing on financial institutions. The second is for logs that show how these agencies are handling other FOIA requests. Each is separate from our FOIA filings…

— paulgrewal.eth (@iampaulgrewal) October 21, 2024

By refusing to provide a consistent view on securities laws and their application and interpretation pertaining to digital assets, Coinbase allege that the SEC and FDIC have harmed the sector’s growth and development.

However, some industry observers view these legal actions differently. Todd Baker, senior fellow at Columbia Business School’s Richman Center for Business, Law & Public Policy, suggests that the lawsuit is “another piece of the coordinated project to build political momentum for crypto legislation” aimed at amplifying the industry’s lobbying efforts.

Also read: Is The SEC Changing Its Tune on Crypto? Claims it Regrets Confusion it Caused

“By using legal actions like this to create news stories and social media talking points for sympathetic legislators, the industry seeks to amplify the prodigious amounts being spent by crypto trading interests on direct and indirect campaign contributions as well as traditional lobbying,” Baker added.

The outcome of these legal actions may have implications on the relationship between banks and crypto companies moving forward, especially if the court finds the FDIC’s effort to block the industry’s access to banking services unlawful.