The US Securities and Exchange Commission (SEC) has filed a lawsuit against the crypto unit of the Chicago-based trading company DRW Holdings and is effectively opening up another chapter in the agency’s relentless quest to bring order to this nascent sector.

The SEC alleges that Cumberland DRW – the name of the company’s crypto subsidiary – acted as an unregistered dealer for more than $2 billion worth of digital assets that the agency categorizes as financial securities.

The charges look into the company’s activities dating back to the beginning of 2018. The lawsuit claims that they bought and sold assets 24 hours a day and 7 days of the week without adequately registering them.

Jorge G. Tenreiro, Acting Chief of the SEC’s Crypto Assets and Cyber Unit (CACU), emphasized the agency’s stance on the case: “The federal securities laws require all dealers in all securities to register with the Commission, and those who operate in the crypto asset markets are no exception.”

The SEC’s complaint specifically charges Cumberland with violating Section 15(a) of the Securities Exchange Act of 1934. As part of its legal action, the agency is seeking permanent injunctive relief, disgorgement of ill-gotten gains, prejudgment interest, and civil penalties.

What is Cumberland DRW?

— Cumberland (@CumberlandSays) October 10, 2024

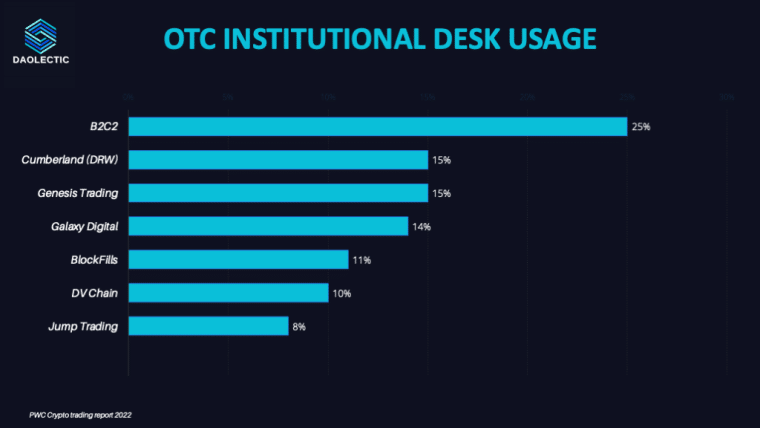

Launched in 2014, Cumberland DRW grew to become one of the largest trading desks in the crypto space. The company was founded by Don Wilson in 1992 and became widely known for its trading activities in the derivatives market.

They are typically viewed as liquidity providers to the crypto ecosystem. Through its online platform, Marea, and its telephone trading service, the firm provides services including over-the-counter trading and bilateral options products.

They have enabled over 1,500 accredited investors and institutional players to participate in the crypto market via a secure interface and robust platform.

In June of this year, the company obtained a license to operate a crypto business in the state of New York that showcases its desire to comply with regulations pertaining to the industry.

The SEC Once Again Classifies Five Crypto Tokens as Securities

The agency claims that Cumberland violated securities laws by acting as an unregistered dealer in the space that facilitates transactions for third parties.

While the SEC’s complaint did not provide an exhaustive list, it specifically mentions five crypto assets that the regulator considers to be securities: Solana (SOL), Polygon (MATIC), Cosmos (ATOM), Algorand (ALGO), and Filecoin (FIL).

“Through the Marea Platform and other methods, Cumberland trades crypto assets that are offered and sold as investment contracts and thus as securities. Each of the crypto assets was offered and sold as an investment of money in a common enterprise from which the investor reasonably expects profits or returns derived from the entrepreneurial or managerial efforts of others,” the legal complaint reads.

This list solidifies the agency’s controversial stance on crypto assets, which involves treating them as traditional securities. Despite the objections of prominent players in the industry, they continue to apply laws that were designed for older and more straightforward assets like stocks to the blockchain space.

Moreover, the SEC says that Cumberland has a team of dedicated researchers who create materials for investors and characterize crypto assets as “investment opportunities.”

“Cumberland’s research reports and update emails promote crypto assets as investments and invite investors to reasonably expect that they could profit from investing in such assets based on the entrepreneurial and managerial efforts of the issuers and promoters of the particular crypto assets that are the subjects of those reports and emails,” the lawsuit reads.

Cumberland Will Fight the SEC in Court

Cumberland DRW has already stated its intention to enter a legal battle with the SEC and referred to the proceeding as “an incredibly frustrating and disappointing development.”

“We and others in the crypto industry have repeatedly sought clarity from regulators on the appropriate application of securities laws in the cryptoasset space. For the SEC to meet these good-faith efforts with legal action is an incredibly frustrating and disappointing development, although not surprising given the enforcement-first approach we have seen in recent years from the SEC,” a spokesperson for the company said.

The firm further highlighted its effort to comply with federal regulations including the acquisition of a registered broker-dealer in 2019. However, Cumberland was forced to limit this company’s operations to Bitcoin (BTC) and Ether (ETH), which dealt a dramatic hit to the feasibility of the business.

They also referred to a legal victory they obtained against the Commodities and Futures Trading Commission (CFTC) in 2018 when they were accused of market manipulation. The judge claimed back then that the regulator failed to provide enough evidence to substantiate its complaint and dismissed the case.

The SEC Keeps Fighting Crypto Companies Instead of Providing Regulatory Clarity

The lawsuit against Cumberland DRW is part of a larger pattern of enforcement actions brought by the SEC against various players in the cryptocurrency industry. In recent years, the agency has targeted multiple companies in the space including Kraken, Coinbase, Consensys, and Uniswap with similar notices or lawsuits, some of which are still engaged in legal proceedings.

This aggressive approach by the SEC, led by Chair Gary Gensler, has been met with criticism from industry participants and a group of US politicians. Critics argue that the agency has adopted a “regulation by enforcement” strategy rather than providing clear guidelines for compliance in the rapidly evolving crypto industry. On the other hand, the SEC would argue that it’s just enforcing the laws it was given.

The SEC’s actions have not been limited to trading platforms and dealers. In a recent development, Crypto.com filed a lawsuit against the SEC after receiving a Wells Notice indicating the regulator’s intention to sue the digital asset exchange for operating as an unregistered broker-dealer and securities clearing agency.

This new lawsuit is targeting a crypto trading desk that caters primarily to accredited investors and institutional parties, meaning that the agency is expanding its scope when it comes to regulating the digital asset space.

Previously, they primarily focused on companies that offered “securities” and services to retail investors.

The lawsuit could imply that the agency may be preparing other enforcement actions of similar nature against companies that provide services similar to those performed by Cumberland.

The outcome of this case, along with other ongoing proceedings, could set important precedents for how securities laws are applied to cryptocurrencies and related businesses.

The upcoming US presidential election could impact the SEC’s approach to crypto regulation as former President Donald Trump appears to be a pro-crypto candidate. His election could result in changes in the SEC’s leadership that would influence the agency’s actions and views concerning the sector.