Investors panicked in 2020 when the Evergrande Group, one of the most important pieces of the Chinese economy, started to crumble under the weight of a ludicrous amount of debt. Analysts warned that its collapse could crash the Chinese real estate sector, which, in turn, would crash the country’s entire economy and plague the entire world. After nearly 2 years of financial troubles and failed restructuring attempts, China’s largest real estate developer has finally received a liquidation order from a Hong Kong court but are the doomsayers right about the potential impacts of the collapse?

The winding-up order, issued by Judge Linda Chan of the Hong Kong High Court on Monday, marks the beginning of the end for the once almighty Evergrande, which has struggled for years under a crushing debt load of $300 billion.

Why Is This So Important to China?

The Chinese economy has long been heavily bolstered by its real estate sector. This is mostly because housing has long been the best investment vehicle for most middle and upper-class people there. China’s stock market is famously unpredictable, marred by devastating sudden judgements from Chinese Communist Party (CCP) leadership, such as its breakup of ecommerce giant Alibaba. So investing in Chinese stocks is much more risky than, say, investing in the S&P 500 or the Dow Jones, pushing them to buy second and sometimes third houses.

Housing represents a whopping 70% of urban household wealth in China, which is almost certainly why the CCP made sure to save Evergrande from the brink in 2020. A sudden collapse of the real estate market could suddenly make hundreds of millions of people much poorer.

What Caused Evergrande’s Downfall?

Evergrande’s downward spiral began long before 2020 when it started taking in massive debts to build as many developments as it possibly could, relying heavily on positive speculation to stay solvent. They even began selling apartments long before they were even built, requiring down payments of 33% of the entire price or more.

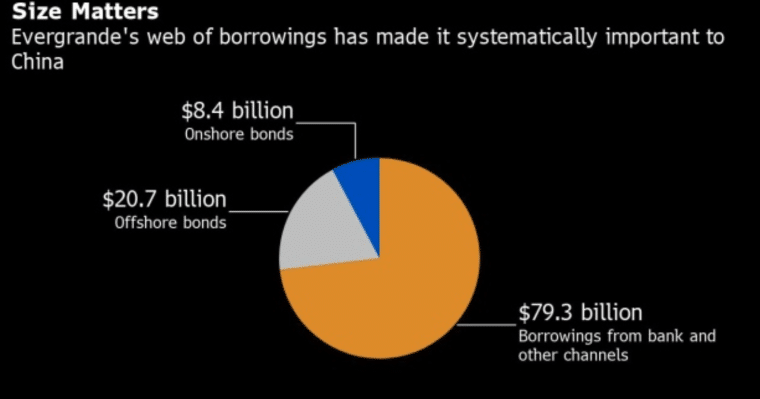

The CCP eventually realized that the excessive debts were becoming a gargantuan bubble and looked to restrict access to more debt. Some measures were partially effective but initial moves mostly failed as developers found loop holes and even started cutting costs by building unsafe apartment structures. Evergrande eventually had over $100 billion in debt in bonds and other borrowings, all to fuel its enormous growth.

The beginning of the end for Evergrande began in 2020 when Chinese authorities took a harsher stance on the bubble and clamped down on excessive borrowing in the real estate sector in an attempt to rein in speculation and sky-high housing prices.

The new restrictions on developers like Evergrande cut off the financing they relied on to keep building new projects and service their debts. Evergrande soon began missing payments to suppliers and bondholders as its cash crunch intensified.

The company defaulted on several dollar-denominated bonds in late 2021, setting off a panic among investors worldwide about potential contagion effects on China’s financial system and the global economy.

At its peak, just a few years before, Evergrande had epitomized China’s real estate boom, growing into the country’s second largest property developer by sales on the back of loose credit and government policies aimed at promoting home ownership.

On Monday, Judge Chan slammed the door shut on Evergrande’s numerous attempts to buy itself more time to negotiate with creditors. “It is indisputable that the company is grossly insolvent and is unable to pay its debts” Chan stated in her ruling.

She criticized Evergrande for only presenting “general ideas” about future restructuring plans over the past year and a half, rather than bringing forth concrete and feasible proposals.

With Evergrande still owing $25.4 billion to foreign creditors, Chan determined that the “interests of creditors would be better protected” through the court ordering a winding-up and liquidation process. She appointed the accounting firm Alvarez and Marsal as provisional liquidators. They will take control of Evergrande and sell off its remaining Hong Kong assets.

The Impact on Evergrande’s Mainland China Business Remains Unclear

News of Evergrande’s collapse is already panicking investors who bought its bonds and especially those who bought apartments before they were built. However, Evergrande sought to reassure the market that its core mainland China real estate development business would not be immediately affected by the Hong Kong liquidation order.

The company’s Chief Executive Officer, Shawn Siu, rushed to make a statement to assure market participants that the Hong Kong ruling only affected Evergrande’s subsidiaries in that country as other businesses within Mainland China were registered separately as independent entities.

Also read: Real Estate Asset Tokenization Is the Next Big Thing and This Project Is in Beta Now

With Chinese courts still operating independently from Hong Kong under the capitalist “One Country, Two Systems” policy, it is questionable whether liquidators will be able to seize control of Evergrande assets in mainland China.

The company’s primary property development and home-building activities are housed under its Hengda Real Estate Group subsidiary, which holds most assets located on the mainland. Siu stressed that Hengda and other mainland China subsidiaries would continue normal operations for now as “independent legal entities”.

Still, the winding-up order represents a symbolic downfall for a company that only a few years ago ranked among China’s biggest and most well-known corporations. It also serves as an ominous sign for China’s broader real estate sector, which accounts for an estimated 25-30% of GDP and has driven much of China’s rapid economic expansion in recent decades.

Ripple Effects Throughout China’s Economy

Evergrande grew to an enormous size during China’s real estate boom thanks to loose credit policies and government promotion of home ownership. Its unraveling symbolizes how excessive leverage across the housing market has now become a drag on economic growth.

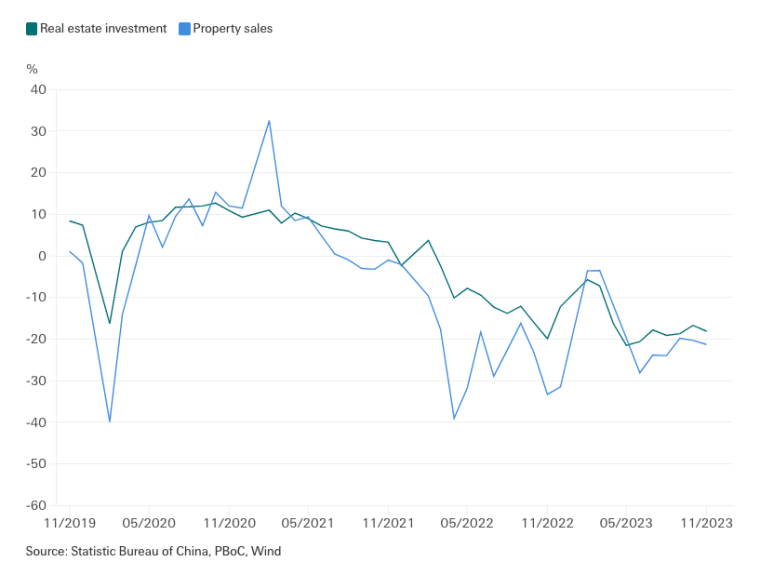

After clamping down on speculation and debt in 2020, Chinese regulators set off a self-reinforcing downward cycle – developers cut back on projects due to financing difficulties, which led to lower economic activity, job losses in construction, and other industries, and falling home prices.

This negative feedback loop continued despite authorities’ attempts to soften restrictions on financing. “Evergrande’s offshore liquidation was mostly expected, but it’s still a significant setback for an already troubled onshore real estate sector, one which will further decay investor sentiment,” Brock Silvers, chief investment officer at Hong Kong’s Kaiyuan Capital, told CNN this morning.

The fall of Evergrande and other struggling developers has spilled over into China’s shadow banking industry. For example, companies like the Zhongzhi Enterprise Group had huge exposure to housing developers and are now defaulting on their own obligations.

With developers owing $100 billion in bond payments this year, local government financing vehicles are facing around $650 billion in maturing debts, which could result in banks and investors taking heavy losses on short notice.

From multiple standpoints, Evergrande’s offshore winding-up order comes at an inopportune time, although it is not necessarily unexpected.

International Investors Set to Suffer Major Losses

Chinese investors won’t be the only ones hurt by this crisis.

For international creditors who poured money into Evergrande’s offshore bonds, the company’s unraveling also serves as a warning about the risks of investing in Chinese businesses considering Beijing’s shifting policy priorities.

Foreign investors attracted by Evergrande’s high yields were burned after the central government refused to bail out overextended developers, crushing assumptions that firms of Evergrande’s scale were “too big to fail”.

With mainland creditors likely to receive priority, foreign creditors will suffer major losses from Evergrande’s off-shore liquidation.

“Given all of these impending solvency issues, Evergrande’s creditors will likely face a near wipe-out” Silvers emphasized during his interview with CNN. The Evergrande debacle serves as a caution sign that portrays mismatched priorities and poor communication between Chinese companies and their global backers.

The crisis could have been much worse, especially if its collapse accelerated in 2020 in the midst of an economic shutdown. The company’s over 160,000 jobs and its importance as a driver of growth makes it a vital piece of the puzzle that is the global economy. If it had fallen apart suddenly, it may have sparked a recession in China, crashing other Asian markets as well as putting tremendous pressure on the country’s biggest trade partner: the US.

Evergrande’s slow liquidation seems like it will still have a significant effect on the Chinese economy, particularly its real estate sector, but it’s unlikely it will become an economic contagion that spreads to the US and other countries.

An Opaque and Protracted Liquidation Process Lies Ahead

Even with Monday’s definitive court ruling, Evergrande’s winding-up process is expected to be messy, complex, and drawn out over months, if not years. Experts say that Chinese officials still have incentives to ensure that Evergrande completes its millions of pending apartments that were pre-sold to buyers to appease internal pressures.

This means that core mainland subsidiaries like Hengda Real Estate may continue operating with business-as-usual facades for some time.

Regulators also want to cushion the social impact as much as possible by keeping developers afloat, preventing half-finished Evergrande projects from being abandoned.

Also read: SafeMoon Files for Bankruptcy – Will the Victims Get Their Money Back?

“The Chinese Communist Party also seems eager to keep developers afloat to make sure that homebuyers who bought property before building work began to get what they paid for”, a note for the Financial Times reads.

Between Evergrande’s opaqueness and China’s competing policy goals, the firm will likely wind down its activities gradually rather than shuttering abruptly.

It may take years before the full extent of the losses is realized and assets are disposed of to satisfy creditors. For now, Evergrande will continue limping along in a diminished state. However, Monday’s liquidation ruling made clear that its privileged position in the Chinese real estate market is now a thing of the past.