US President Donald Trump is reportedly pressurizing Taiwan Semiconductor Manufacturing Company (TSMC) to either acquire a 49% stake in Intel or commit to investing an additional $400 billion in the US.

Trump has been asking countries to invest more in the US to receive tariff relief, and his demands from TSMC are reportedly linked to lowering the tariffs on Taiwan. However, there is a question mark over whether TSMC would be interested in buying a stake in Intel, considering the troubled business of the once iconic US chipmaker. Moreover, the $400 billion investment seems high for TSMC, whose market cap is below $1 trillion, and is already investing $165 billion stateside.

Why Does Trump Want TSMC to Nuy a Stake in Intel?

As the pre-eminent US-based chip company, Intel is strategically quite crucial to the country. The importance of chips has increased multi-fold with the pivot towards artificial intelligence (AI), and the US does not want to be reliant on overseas companies for this crucial piece of the AI ecosystem. On a related note, both the Biden and Trump administrations clamped down on exports of advanced AI chips to China in an apparent bid to thwart the Communist country’s progress in AI. However, President Trump recently allowed Nvidia to resume selling some of its high end AI chips to Chinese companies again.

https://x.com/thinking_panda/status/1953054081632940203

Why Does Intel Needs Support from the Trump Administration?

It might sound ironic that Intel, which was once the world’s biggest chipmaker and, among others, developed metal oxide semiconductors and the world’s first programmable microprocessor, needs support from the Trump administration to find a buyer for the company.

Intel’s decline is a story of strategic miscalculations and poor execution. To begin with, it misread the smartphone market and turned down the offer to supply processors for Apple iPhone, a catastrophic mistake. The company believed that Apple might not be able to sell enough phones, and it was a tiny market to bet on.

Intel was quite slow with innovation in general, so its main US competitor, AMD, gradually ate up its market share in the PC market. Intel’s situation worsened when Apple stopped using Intel chips for its Mac and instead pivoted to its own chips.

Intel’s woes are far from over, and Nvidia, AMD, and Qualcomm are looking to further eat into its PC market share with Arm-based semiconductors.

More recently, Intel lost out on the race in (AI) chips even as rivals, especially Nvidia, are absolutely printing money selling AI chips.

INTC Has Been Rumored to Be Up for sale

For nearly a year now, there have been reports that Intel is looking to sell itself, either in parts or in entirety. The rumors gained further ground after the company’s CEO Pat Gelsinger, who was said to be opposed to selling the company, was forced out in December 2024.

Qualcomm, Broadcom, TSMC, and Arm Holdings were among the companies said to be in talks with Intel at various times over the last year. While Intel reportedly rebuffed Arm’s bid to buy its products division, none of the other deals went through.

There are various issues that any company acquiring Intel would face. The first is its stretched balance sheet with debt of over $44 billion at the end of June. Secondly, the company’s technology is seen as behind most of its peers.

Finally, any such deal is set to face regulatory scrutiny. Large deals in the chip space have faced scrutiny from regulators, and Chinese regulators previously blocked Qualcomm’s proposed acquisition of NXP Semiconductor as well as Intel’s bid to acquire Tower Semiconductor. Arm and Nvidia also had to mutually call off their merger as they failed to get regulatory clearances.

Would TSMC Be Interested in Buying Intel?

It remains to be seen whether TSMC would really want to buy Intel, given their different business model and the financial difficulties it would bring. While TSMC is a pure-play foundry and does not design chips, Intel has both foundry and chip design business. The issue is quite complicated as some of TSMC’s customers, including Nvidia, are Intel’s competitors, and if TSMC were to acquire Intel in its entirety, it would also become a competitor to its customers.

Secondly, both TSMC and Intel use different manufacturing processes, and integrating the two companies would be difficult. Finally, Intel is seen as strategically important for the US, and TSMC acquiring a stake in Intel would put the company’s business with Chinese clients at a peril.

Notably, Intel has received generous support from the US government and received billions of dollars under the CHIPS and Science Act. While Trump had vowed to reverse the Act that was cleared by the Biden administration, he has continued with it, as he pushes for the onshoring of manufacturing in the US.

Finally, TSMC is already investing $65 billion in advanced semiconductor manufacturing operations in Phoenix, Arizona, and announced an additional $100 billion investment in February, weeks after Trump’s inauguration. The company might not want to commit more to the US.

Can Trump Force TSMC to Buy INTC?

On purely legal grounds, Trump cannot force TSMC to acquire Intel. However, the President has been using leverage in trade to get other countries to agree to his demands. For instance, in the trade deals that were announced, the trading partners vowed to open up their markets to US products while eliminating the tariffs, even as the US has kept the minimum tariff at 10% for all countries.

Moreover, both Japan and the EU have announced multi-billion-dollar investments into the US as part of the ongoing trade talks.

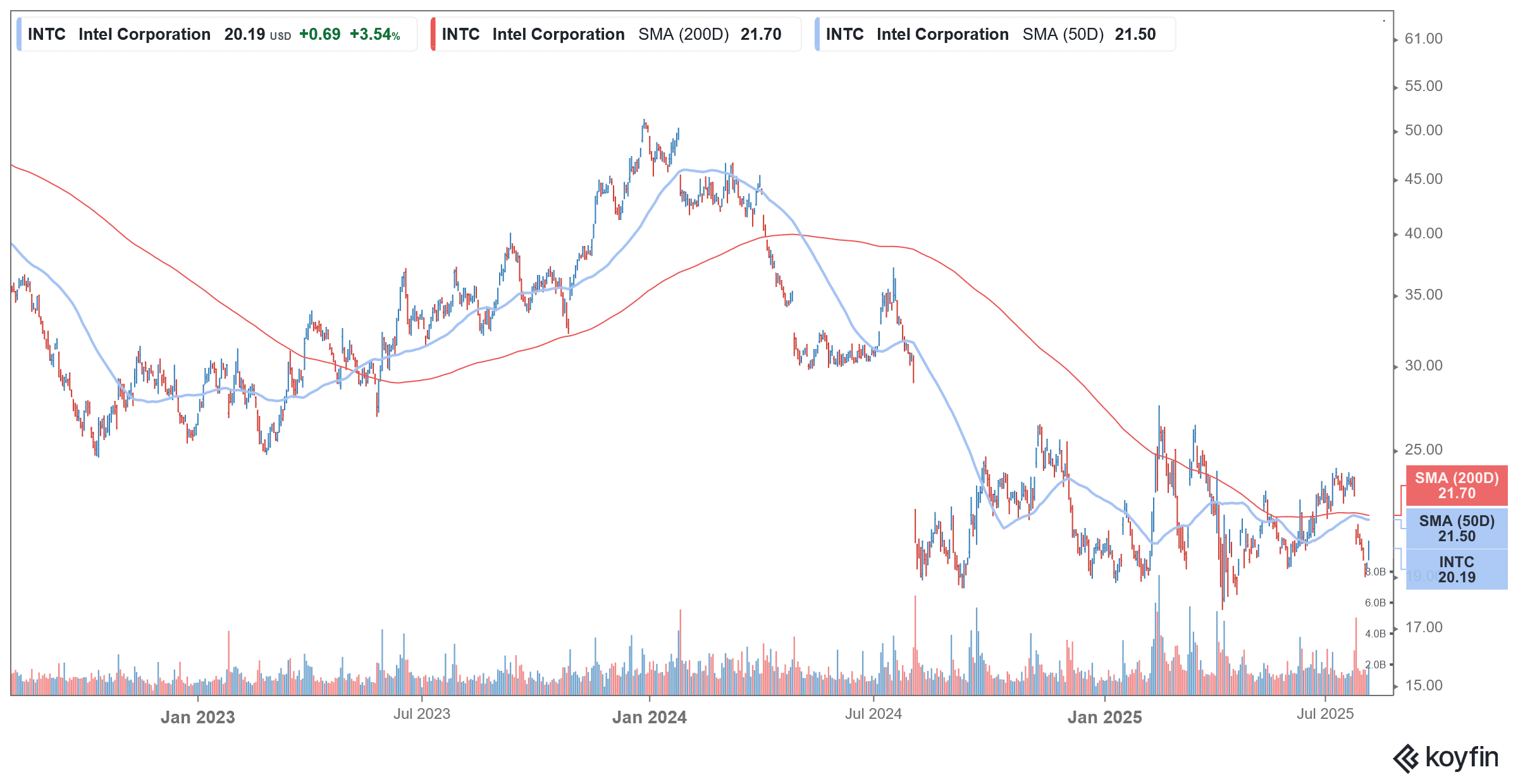

That said, in TSMC’s case, we are not talking about a deal between two countries but two publicly traded companies. For the deal to go through, it would need to be approved by shareholders of both Intel and TSMC. While Intel shareholders might be more than happy to be part of the TSMC umbrella (provided they get a fair price), given how badly the stock has been underperforming, TSMC shareholders might not be too keen to acquire a troubled company like Intel, unless, of course, the deal is offered at very sweet terms.