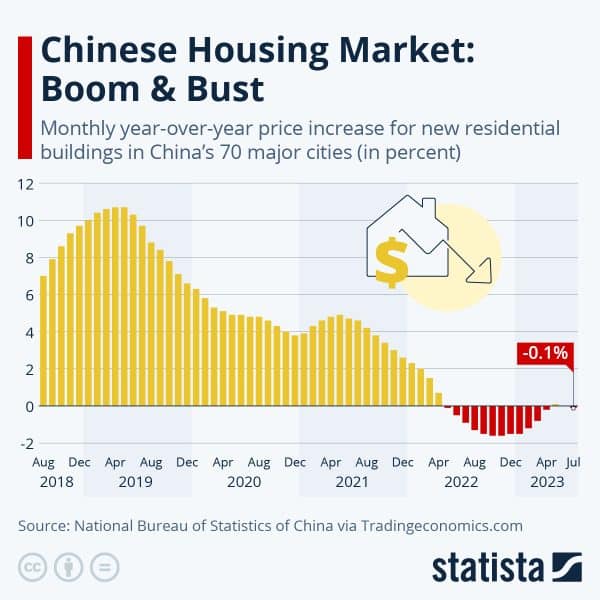

The staggering collapse of China’s real estate market serves as a stark reminder of the perils of leaving speculation and excessive debt unchecked, even for the most powerful economies in the world.

What was once hailed as an engine of economic growth for the Asian country has now spiraled into a crisis of historic proportions, leaving a trail of financial distress, unfinished projects, and shattered dreams in its wake.

This cautionary tale offers valuable insights into how economic bubbles are formed and why they inevitably burst, often with devastating consequences.

The Aftermath: China’s Real Estate Crisis

- Evergrande’s Liquidation: A Hong Kong court ordered Evergrande’s liquidation, a significant marker in China’s real estate crisis, affecting its $300 billion debt.

- Country Garden’s Debt Woes: With $205 billion in liabilities, Country Garden is teetering on the brink of collapse .

- Global Implications: The crisis is impacting global markets, posing risks to international trade and economic stability .

The Rise of the Chinese Real Estate Frenzy

In the early 2000s, China embarked on an ambitious urbanization drive, fueling a voracious demand for housing.

Developers, emboldened by easy credit and a seemingly insatiable appetite for property, embarked on an unprecedented construction spree. Developers would sell homes before they were even built to borrow even more money to fund the next round of homes.

Cities mushroomed with skyscrapers and residential complexes, while home prices soared to dizzying heights.

A speculative fever gripped the nation, with buyers snapping up multiple properties, often leaving them vacant.

Housing quickly became the most popular way for middle and upper class citizens to invest their money as they saw the Chinese stock market as untrustworthy (for good reason). Developers were confident that property prices would continue to rise despite the signs that construction was advancing too quickly and outpacing demand.

The Warning Signs Were Completely Ignored

As the bubble inflated, the warning signs became more and more obvious.

Independent analysts and researchers raised red flags about overstretched valuations, extraordinarily excessive debt levels among real estate developers, and a growing disconnect between property prices and the underlying fundamentals.

Visits to unoccupied developments and ghost cities painted a grim picture of overbuilding and irrational exuberance.

However, these warnings fell on deaf ears. Developers found creative ways to obscure debt levels, mostly aided by complicit bankers and lawyers. Buyers, gripped by fear of missing out and having access to no other trusted venue of investing, kept pouring money into the market.

Foreign investors, lured by the promise of juicy returns, eagerly funded developers through opaque financing structures. Local governments looked the other way because land revenues were a massive source of funding, even though they likely knew it would have to blow up eventually.

Crucially, the prevailing belief that the Chinese government would never allow a catastrophic crash emboldened everyone to double down on their bets. With the majority of household wealth tied up in real estate, the psychological and political costs of a collapse were deemed too high.

The Bubble Bursts

In 2020, Beijing finally cracked down on the sector’s unsustainable debt-fueled growth model, implementing the “three red lines” policy to restrict borrowing by over-leveraged developers.

This move proved to be the proverbial pin that ultimately burst the bubble (but also prevented it from being even worse).

As credit dried up, developers found themselves in massive defecits, unable to complete projects or repay loans. Home buyers, rattled by the possibility that the properties they bought may never be delivered, stopped making purchases. Sales plummeted and a wave of defaults swept through the industry with giants like Evergrande and Country Garden serving as the most notable cases among the casualties.

The consequences were severe. Hundreds of thousands lost their jobs, while an estimated $440 billion is needed to complete millions of unfinished housing units. Local governments, deprived of land sale revenues, grappled with debt servicing challenges. The real estate sector, once a pillar of the economy, became a drag on growth.

Is the AI Boom in the US Any Similar to the Chinese Real Estate Bubble?

After an aggressive campaign of interest rate hikes to combat stubbornly high inflation, the Federal Reserve now faces a delicate balancing act – engineering a long-sought “soft landing” for the US economy or risking a severe downturn.

The stakes are high, with many analysts and policymakers weighing in on the two potential scenarios.

The Case for a Soft Landing

Growing optimism has emerged in recent months that the economy can achieve a soft landing – slowing inflation without tipping the economy into recession. Fed officials themselves have penciled in rosier economic forecasts than just a few months ago, projecting higher growth and lower unemployment through 2025.

Ryan Sweet, Chief US Economist at Oxford Economics, notes that the Fed’s reduced expectations for future rate cuts “likely suggests that the central bank is assigning a higher probability of a soft landing”.

Historically, the Fed’s standard inflation-cooling tactics have often resulted in recessions, with only a handful of instances where high inflation was tamed without an economic contraction.

Bolstering the soft landing case, some analysts contend that the economy may have already touched down smoothly. In this regard, Stephen Bartolini from T. Rowe Price highlighted: “This is what a soft landing looks like… We’re living it”. Some key metrics are slowing but positive GDP growth and a resilient labor market are cited as evidence.

However, some believe that the path to a soft landing remains fraught. Economist Preston Caldwell warns that even though a soft landing is a real possibility, nothing is guaranteed. The expert cites risks like potential “financial fragility” if monetary policy overshoots. The inverted yield curve – with short-term rates exceeding long-term – is also cited as a traditional recession warning though the curve has been inverted for nearly two years straight, longer than any other period of inversion in recorded history.

Meanwhile, Denise Chisholm, a director at Fidelity, argues that economic conditions have already endured a “hard soft landing” or “soft hard landing” with earnings, income, and GDP contracting at times. The over 30% peak-to-trough stock market decline echoed typical recession patterns before rebounding.

Historically, the Fed has struggled to orchestrate soft landings, with academics debating if the commonly cited 1994 example truly qualifies given lower inflation levels. The hurdles of achieving this “holy grail” of monetary policy are still quite visible and should not be ignored.

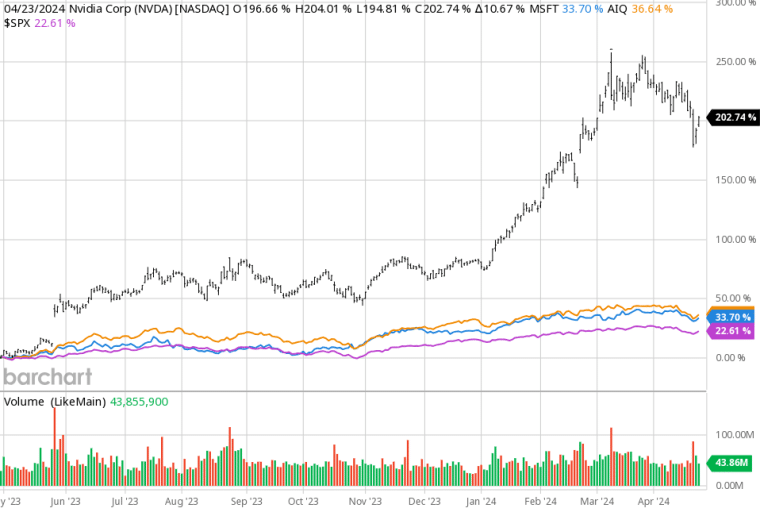

The AI Wildcard – Is It a Bubble?

The rapidly accelerating adoption and development of artificial intelligence (AI) has infused a new variable into economic forecasting. Goldman Sachs’ Jan Hatzius, who predicted the 2008 crisis and a 2022 soft landing, now envisions AI as a powerful “productivity enhancer” that could significantly boost long-term economic growth.

AI tools like ChatGPT already augment workers’ output across multiple sectors. However, the IMF cautions that AI may also exacerbate inequality by displacing some jobs while creating new opportunities in other fields. This would demand robust retraining initiatives that don’t really exist at the moment.

As the Fed monitors evolving data, emerging AI capabilities could tilt America’s economic trajectory. However, some analysts warn that frenzied AI stock valuations are echoing the dot-com bubble (and they are in some ways). Overall, many see that the AI boom could fundamentally reshape economic dynamics and perhaps cushion the impact of tight monetary policy.

The most relevant factor that will ultimately determine if the AI hype is pushing valuations to bubble territory is how the technology manages to live up to the heightened expectations that a significant number of investors and business owners have placed on it.

If these projections turn out to be true, then there should be little to worry about as AI does have the power to transform society and the way organizations function.

However, if the adoption and practical utility of this groundbreaking advancement fall behind these forecasts, the end result could resemble that of the dot-com bubble where internet lovers were ultimately disappointed when the technology proved to be still far from becoming as disrupted as initially expected.

Lessons from the Rubble – What We Can Learn from the Chinese Real Estate Debacle

The implosion of China’s real estate bubble offers valuable lessons for policymakers, investors, and the general public:

- The Dangers of Excessive Debt and Speculation: The bubble’s fuel was a potent mix of easy credit and rampant speculation. When the music stopped, overleveraged developers and speculative buyers were left holding the bag, underscoring the inherent risks of debt-fueled growth models.

- The Importance of Regulatory Oversight: Authorities turned a blind eye to mounting risks, perhaps unwilling to jeopardize the economic boom. This inaction allowed imbalances to fester, ultimately worsening the painful correction.

- The Fallacy of “Too Big to Fail”: Many assumed that the government would intervene to prevent a crash due to the significance of real estate on the country’s household wealth and the economy. This moral hazard fueled further excesses until authorities were forced to ‘pop’ the bubble.

- The Need for Diversification: With the majority of household wealth concentrated in real estate, Chinese families bore the brunt of the collapse. A more diversified asset allocation could have mitigated the impact on personal finances.

The Path Forward for China and the US

As China grapples with the aftermath, restoring confidence and reforming the real estate sector is paramount.

Authorities must strike a delicate balance between supporting viable developers, completing unfinished projects, and transitioning to a more sustainable housing model.

In the US, the Federal Reserve has an important role in shaping how the economy will emerge after its aggressive campaign of interest rate hikes. AI is aiding the stock market to bear the impact of these policies in a much better way than expected but the technology still has to prove its capacity to propel the economy to new heights before one can applaud its contribution to the ‘soft landing’ scenario.

Investors and policymakers alike must learn from China’s experience, implementing safeguards against excessive speculation, promoting transparency, and fostering a more balanced and diversified economic landscape.

While economic bubbles may be seductive in their ascent, their inevitable bust serves as a harsh reminder of the perils of unbridled exuberance and the importance of noticing the warning signs before it’s too late.

Latest Updates on China’s Real Estate Collapse

Since the article was initially published, further developments have revealed the ongoing repercussions of China’s real estate crisis. Two of the country’s largest developers, Evergrande and Country Garden, continue to be at the heart of the crisis.

In January 2024, a Hong Kong court officially ordered the liquidation of Evergrande, marking a critical turning point for the once mighty real estate giant, which defaulted on over $300 billion in debt. The court ruling triggered shockwaves throughout the global markets, and Evergrande’s remaining assets are being managed by liquidation overseers .

Meanwhile, Country Garden, another top developer, faces similar turmoil with $205 billion in liabilities. The company is undergoing a liquidity crunch and is evaluating liquidation after missing critical debt payments. These developments suggest the crisis in China’s real estate sector is far from over, with broader economic implications as consumer confidence continues to erode