The shipping industry stands as a crucial thread binding nations, businesses, and consumers together.

The biggest shipping companies have expanded their operations, contributing to economic growth and facilitating global trade, making this topic absolutely crucial for understanding current market dynamics.

This article offers insights into the top players in the shipping sector, emphasizing how market capitalization is a clear measure of a company’s influence.

Business2Community highlights the importance of transportation and logistics services in powering supply chain solutions, promoting efficient shipping across an extensive network, and spearheading technological advancements in the maritime industry.

Top 10 Shipping Companies Worldwide

- Hapag-Lloyd: Based in Hamburg, Germany, Hapag-Lloyd operates over 250 ships, offering emission-reduced container shipping with a market cap of $26.49 billion.

- COSCO Shipping: A Chinese leader in logistics, COSCO operates 1,400+ ships and focuses on sustainability with green fuel investments. Market cap: $22.06 billion.

- Maersk: Headquartered in Denmark, Maersk was the largest container ship operator, pioneering green technologies. Market cap: $20.28 billion.

- Nippon Yusen (NYK Line): Tokyo-based, with a fleet of 800+ ships, NYK aims to achieve net-zero GHG emissions by 2050. Market cap: $12.36 billion.

- Evergreen Marine: Known for its green-painted ships, Evergreen operates 200+ vessels and has invested heavily in methanol-powered containerships. Market cap: $11.09 billion.

- Mitsui O.S.K. Lines (MOL): This Tokyo-based company leads in adopting hydrogen fuel technology, with 850+ ships. Market cap: $10.80 billion.

- “K” Line: A Tokyo-based company with versatile operations, including LNG carriers and car carriers, focusing on autonomous navigation. Market cap: $9.35 billion.

- HMM: South Korea’s primary shipping company, operating 100+ ships, received government support to recover from financial losses. Market cap: $8.10 billion.

- Orient Overseas Container Line (OOCL): Hong Kong-based, with a strong focus on technology and AI-powered shipping solutions. Market cap: $7.88 billion.

- SITC International: Specializing in intra-Asia routes, SITC has 80+ vessels and focuses on partnerships to enhance logistics services. Market cap: $4.90 billion.

The World’s 10 Biggest Shipping Companies

The global shipping sector, integral to international commerce, was worth $2.1 trillion in 2021, with an expected CAGR of a little over 7%, meaning the sector is set to be valued at $4.2 billion by 2031. The industry value reflects the critical role global cargo shipping has in the world, and these are the top companies that keep goods moving.

1. Hapag-Lloyd – $26.49 Billion

Founded in 1970 through the merger of two German companies, Hapag-Lloyd has become one of the largest container shipping companies, with a revenue of approximately $19.2 billion in 2023.

Headquartered in Hamburg, Germany, it operates with a fleet of over 250 ships, navigating global trade routes and offering timely deliveries.

Hapag-Lloyd, alongside industry giants such as COSCO Shipping, Orient Overseas Container Line (OOCL), CMA CGM, and Port of Qingdao, has pledged to establish the Global Shipping Business Network (GSBN).

The GSBN initiative aims to revolutionize the shipping industry through enhanced transparency, operational efficiency, and innovation, with preparatory work underway to ensure regulatory compliance and pilot applications testing the viability of blockchain technologies.

Hapag-Lloyd has also made strides in minimizing its carbon footprint, aiming to reduce the CO2 emissions of its entire fleet by 30% by 2023, compared to 2019 levels.

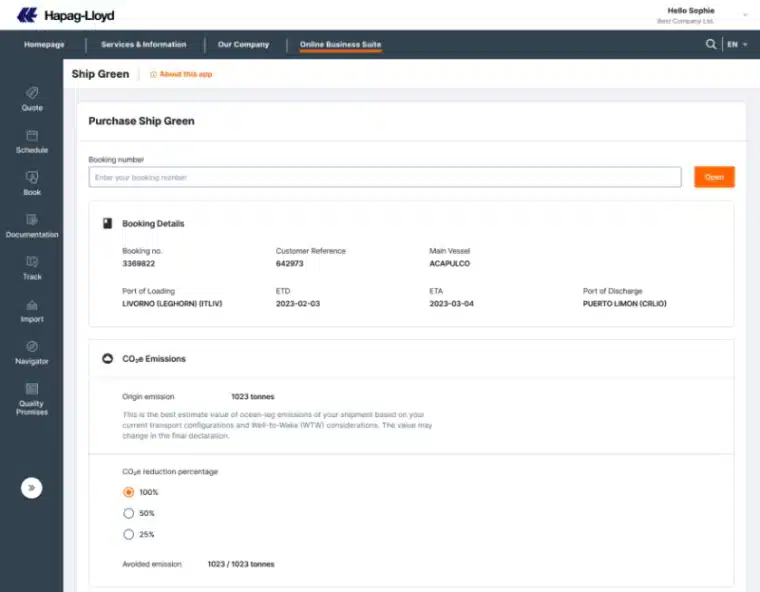

Hapag-Lloyd’s Ship Green options offer emission-reduced container shipping, allowing customers to proactively reduce their carbon footprint. Customers can choose to avoid 25%, 50%, or 100% of emissions on the ocean leg of their shipments.

To achieve its goal of reducing CO2 emissions, Hapag-Lloyd has been investing in modernizing its fleet with eco-friendly ships and pioneering the use of alternative fuels. The company has retrofitted a part of its fleet to use liquefied natural gas (LNG), a cleaner alternative to conventional marine fuels.

| Company: | Hapag-Lloyd |

| Headquarters: | Hamburg, Germany |

| Market Cap USD (Billion): | 26.49 |

| Year Founded: | 1970 |

| Stock Symbol: | HLAG |

| Fleet Size: | 250+ |

2. COSCO Shipping – $22.06 Billion

COSCO Shipping, based in Shanghai, China, was founded in 2016 from the merger of COSCO and China Shipping Group.

With a market cap of $22.06 billion and a recent revenue report showing $1.45 billion, it’s one of the world’s largest shipping companies, benefitting from the incredible growth of China’s manufacturing industry.

Its fleet consists of over 1,400 ships, allowing it to offer a wide range of logistics and supply chain services globally.

COSCO has also been active in expanding its global reach through acquisitions, including a purchase of a majority stake in the Greek port of Piraeus in 2021, with a total stake standing at 67%.

In addition to serving the Asia Pacific region and beyond, COSCO Shipping has shown a commitment to environmental sustainability.

The cargo handling company has embarked on a series of initiatives aimed at reducing the carbon footprint of its fleet, such as by investing $449 million in green methanol dual-fuel crude oil carriers in 2024.

| Company: | COSCO Shipping |

| Headquarters: | Shanghai, China |

| Market Cap USD (Billion): | 22.06 |

| Year Founded: | 2016 |

| Stock Symbol: | CICOY |

| Fleet Size: | 1417 |

3. Maersk – $20.28 Billion

With its headquarters in Copenhagen, Denmark, A.P. Moller-Maersk announced a revenue of $51.1 billion in 2023, down from $81.52 billion in 2022.

The Danish shipping company, established in 1904, stood as the largest container ship operator globally until 2022. In 2022, the Danish container shipping company saw its market capitalization drop 39% from the previous year, decreasing from $64 billion to $39 billion. The financial woes mostly came down to an oversupply of shipping capacity and issues in the Red Sea which led the board to suspend the share buyback scheme.

In 2021, Maersk lost 962 containers at sea, a figure significantly higher than the decade’s average, leading to customer lawsuits and potential insurance premium increases. The losses, primarily due to severe weather conditions during sailings, have prompted Maersk to join initiatives like the TopTier project to reduce container losses and collaborate with various industry stakeholders.

Despite its challenges, Maersk has been investing heavily in advanced technologies like data analytics and green technologies to improve its ocean freight and logistics services.

By 2040, Maersk is committed to achieving net zero emissions to bolster its standing as a leading transportation company and align with global environmental goals.

In 2020, Maersk provided solutions leveraging blockchain technology to enhance supply chain visibility for importers like Highland Foods, aiding in real-time tracking and management of shipments.

Through TradeLens, Maersk aimed to improve communication and efficiency across the supply chain, resulting in faster, cheaper, and more transparent logistics processes.

In 2022, TradeLens was discontinued by Maersk and IBM, highlighting a reluctance to fund supply chain effectiveness, an admission of innovation failure by IBM, and underscoring broader challenges in blockchain adoption for enhancing collaboration among trading partners.

| Company: | Maersk |

| Headquarters: | Copenhagen, Denmark |

| Market Cap USD (Billion): | 51.1 |

| Year Founded: | 1904 |

| Stock Symbol: | MAERSK |

| Fleet Size: | 700+ |

4. Nippon Yusen – $12.36 Billion

Tokyo-based Nippon Yusen (NYK Line) was founded in 1885, making it one of the oldest shipping companies on this list. With a 2023 revenue of about $19.53 billion, NYK Line has a market cap of $12.36 billion.

NYK Line offers a range of value-added services that go beyond traditional shipping offerings, encompassing third-party logistics, customs clearance, and even air freight solutions. This strategy ensures NYK Line maintains a strong presence in the competitive logistics company sector, alongside other major Tokyo-based entities like Ocean Network Express.

The company has made headlines for its efforts to achieve net-zero greenhouse gas (GHG) emissions from its operations by 2050.

This commitment aligns with NYK’s broader efforts to integrate environmental, social, and governance (ESG) principles into its business activities, aiming to contribute to sustainable shipping and development goals.

| Company: | Nippon Yusen |

| Headquarters: | Tokyo, Japan |

| Market Cap USD (Billion): | 12.36 |

| Year Founded: | 1885 |

| Stock Symbol: | NPNYY |

| Fleet Size: | 800+ |

5. Evergreen Marine – $11.09 Billion

Established in 1968 and headquartered in Taoyuan City, Taiwan, Evergreen Marine has grown to command a strong presence in global container shipping.

The shipping company reported a 2023 revenue of $8.9 billion, with a market cap standing at $11.09 billion. This was a more than 50% drop in revenue year-on-year, with the company facing similar issues to Maersk – lower demand and higher costs for moving cargo.

With its focus on bulk shipping, Evergreen Marine was among many shipping companies that also experienced fluctuations in shipping rates in 2020. This scenario was observed across the container shipping industry due to varying global demand and the challenges of the pandemic.

Evergreen Marine is known for its iconic green-painted ships and has been involved in several high-profile incidents, such as the Ever Given’s blockage of the Suez Canal in 2021, which highlighted the fragility of global supply chains.

@didntask.info Ever Given: The Ship That Blocked The Suez Canal | #TrueStory #EverGiven #SuezCanal #Shorts #FYP #Viral In March 2021, global trade faced an unprecedented obstacle: the colossal Ever Given ship, lodged firmly in the narrow Suez Canal. For six tense days, the world watched as this maritime mammoth, longer than the Eiffel Tower is tall, blocked a crucial artery of global commerce. Explore the fascinating story of the Ever Given, the rescue operation that captivated the world

In 2023, Evergreen Marine placed a $5 billion order for 24 methanol dual fuel containerships, with construction divided between Samsung Heavy Industries and Nihon Shipyard. This move aligns with the International Maritime Organization’s goal of achieving net-zero greenhouse gas emissions by 2050, as orders for methanol-powered vessels exceed 100 ships.

| Company: | Evergreen Marine |

| Headquarters: | Taoyuan City, Taiwan |

| Market Cap USD (Billion): | 11.09 |

| Year Founded: | 1968 |

| Stock Symbol: | 2503.TW |

| Fleet Size: | 200+ |

6. Mitsui O.S.K. Lines – $10.80 Billion

Mitsui O.S.K. Lines, or MOL, with its headquarters in Tokyo, Japan, was founded in 1964. The company, which reported a revenue of $10.1 billion for the financial year 2023, operates a diverse fleet of over 800 ships.

MOL has been a pioneer in the development of next-generation shipping technologies, including the use of hydrogen fuel to lower maritime carbon emissions.

Mitsui O.S.K. Lines outpaces competitors like Zim Integrated Shipping Services and Pacific International Lines in adopting innovative transportation services, such as its investment in hydrogen fuel technology, with the technology promising a revolution in environmental sustainability.

In addition to its work in hydrogen fuel technology, Mitsui O.S.K. Lines has recently taken strides towards digital transformation. The company launched a project aimed at leveraging artificial intelligence (AI) in the maritime industry to enhance productivity and efficiency.

Their research focuses on various AI applications such as digital transformation, energy efficiency, predictive analytics, and anomaly detection to address challenges and optimize operations in maritime transport.

| Company: | Mitsui O.S.K. Lines |

| Headquarters: | Tokyo, Japan |

| Market Cap USD (Billion): | 10.80 |

| Year Founded: | 1884 |

| Stock Symbol: | MITSY |

| Fleet Size: | 850+ |

7. “K” Line – $9.35 Billion

Kawasaki Kisen Kaisha, known as “K” Line, was founded in 1919 and is headquartered in Tokyo, Japan. It supports a market cap of $6.54 billion with revenue reported for the year up to March 2023 of $6.99 billion.

“K” Line has gained attention for its versatile operations, spanning container ships, LNG carriers, and car carriers. The company is part of the ONE (Ocean Network Express) alliance along with Mitsui O.S.K. Lines and NYK, showcasing its commitment to collaboration in the shipping industry for enhanced efficiency.

In addition to its expansive fleet, “K” Line also emphasizes environmental sustainability, actively investing in green technologies to reduce the ecological impact of its operations. The company aims to adopt 40 LNG-powered vessels in its fleet by 2030.

In 2023, “K” Line successfully completed three demonstration voyages for autonomous navigation on one of its car carriers, achieving a high system operation rate of approximately 96% and accurate coastal navigation.

The autonomous navigation initiative, part of the MEGURI 2040 project sponsored by The Nippon Foundation, aims to develop comprehensive autonomous navigation systems for various vessels and routes, with plans for commercialization by 2025.

| Company: | “K” Line |

| Headquarters: | Tokyo, Japan |

| Market Cap USD (Billion): | 9.35 |

| Year Founded: | 1919 |

| Stock Symbol: | 9107.T |

| Fleet Size: | 400+ |

8. HMM – $8.10 Billion

Hyundai Merchant Marine (HMM), based in Seoul, South Korea, was established in 1976. HMM represents South Korea’s primary shipping company and plays a crucial role in the country’s export-driven economy.

The company provides comprehensive logistics services, including maritime transport, terminal operation, and inland transportation. With a recent revenue report of $6.2 billion for the last financial year, its market cap is currently valued at $8.10 billion.

In 2020, HMM received financial aid from the South Korean government after experiencing losses for 17 consecutive quarters due to a lack of control over costs. The state-owned Korea Development Bank (KDB) allocated $380 million to alleviate HMM’s maturing debt.

The assistance from KDB came as HMM took delivery of the world’s largest boxship, the 24,000 TEU HMM Algeciras, amidst challenging market conditions.

View this post on Instagram

In 2024, HMM’s privatization efforts were suspended indefinitely after negotiations with the Harim Group collapsed, leading to uncertainties regarding future strategies and calls for caution in the sale process. The company has been seeking privatization in 2024 as part of efforts to transition from state control, aiming to enhance operational flexibility, improve efficiency, and access private capital for future growth initiatives in the competitive shipping industry.

| Company: | HMM |

| Headquarters: | Seoul, South Korea |

| Market Cap USD (Billion): | 8.10 |

| Year Founded: | 1976 |

| Stock Symbol: | 011300.KS |

| Fleet Size: | 100+ |

9. Orient Overseas Container Line – $7.88 Billion

Orient Overseas Container Line (OOCL) was founded in 1969 and is headquartered in Hong Kong. OOCL has a market cap of $7.88 billion based on the latest data, with a reported revenue of $7.5 billion for 2023, a nearly 60% decline in 2022 numbers. The company is a key player in trans-Pacific and Asia-Europe trade lanes.

It was acquired by COSCO Shipping in 2018, demonstrating the trends of consolidation and collaboration within the shipping industry.

OOCL is recognized for its strong emphasis on technology and innovation in shipping lines, including early adoption of automated and digital shipping solutions.

The MyOOCLReefer (MOR) platform by OOCL offers customers end-to-end visibility of the temperature and humidity levels of their shipments, powered by AI technology for proactive analytics and corrective actions.

Key features of MOR also include auto alerts for temperature deviations, real-time tracking of reefer status, and 24/7 support, enhancing cargo security and providing actionable insights for quality control.

| Company: | Orient Overseas Container Line (OOCL) |

| Headquarters: | Hong Kong, China |

| Market Cap USD (Billion): | 7.88 |

| Year Founded: | 1969 |

| Stock Symbol: | 0316.HK |

| Fleet Size: | 50+ |

10. SITC International – $4.90 Billion

Founded in 1991 and based in Shanghai, China, SITC International is one of the younger companies on this list. However, it has quickly established itself with a market cap of $4.90 billion and reported revenue of $2.43 billion for 2023, a 41% decrease YoY reflecting similar issues other large shipping companies faced as the world emerged from the pandemic.

The shipping company’s fleet includes over 80 container vessels, specializing in intra-Asia trade routes. SITC International not only excels in its fleet operations but also in its logistic services, providing comprehensive supply chain solutions across Asia.

The company’s success can be attributed to its strategic focus on the Asian market, leveraging its geographic advantage and understanding of local trade dynamics. This approach has enabled SITC to build a strong network of routes and partnerships.

In 2024, SITC and Xiamen Port formed a strategic partnership to enhance the global shipping system, focusing on logistics, supply chain, and knowledge exchange. The collaboration aims to deepen cooperation in route network layout, international transit, logistics services, and digital transformation.

| Company: | SITC International |

| Headquarters: | Hong Kong, China |

| Market Cap USD (Billion): | 4.90 |

| Year Founded: | 1991 |

| Stock Symbol: | 1308.HK |

| Fleet Size: | 80+ |

Learning From the Biggest Shipping Companies in the World

The success of premier global shipping entities such as Maersk, COSCO Shipping, and Evergreen Marine Corporation illuminate key strategies for businesses in any field.

These titans of the container shipping industry have carved their niches through innovative practices and occasionally, a daring openness to experiment, learn from missteps, and adapt.

Innovation is a hallmark of these shipping giants, spanning cutting-edge technologies to revolutionizing business processes. Many shipping companies such as Mitsui O.S.K. Lines (part of the Yang Ming Marine Transport Corporation) have introduced advancements in environmental technology, such as adopting hydrogen-powered container ships.

Leadership is paramount in guiding these organizations into expansion while tackling challenges. The proactive leadership demonstrated within these top-notch organizations highlights the value of vision, flexibility, and a commitment to customer-centric approaches.

Strategic mergers and acquisitions, as seen in COSCO Shipping’s absorption of OOCL and the formation of China Ocean Shipping Company, illustrate an aggressive yet strategic positioning. This can help enhance global presence and secure crucial trade lanes in the international shipping market.

The resilience exhibited through challenges, such as Evergreen Marine Corporation’s Suez Canal incident, illustrates how the capability to bounce back is indispensable for long-term success. These companies stand out because they turn challenges into opportunities for future triumphs.

Although the scales at which these major shipping companies operate might be unattainable by many, the lessons from their accomplishments are universally pertinent. Incorporating innovation, exemplary leadership, strategic partnerships for market expansion, and enduring resilience against adversity provides a blueprint for continuous growth and competitiveness in the global economy.

Through such strategies, companies advance in the global logistics and freight forwarding services arena and contribute to driving international trade.