The blockchain analytics firm Chainalysis faced a challenging day in court yesterday as it sought a case dismissal from the New York Supreme Court in a legal fight against YieldNodes.

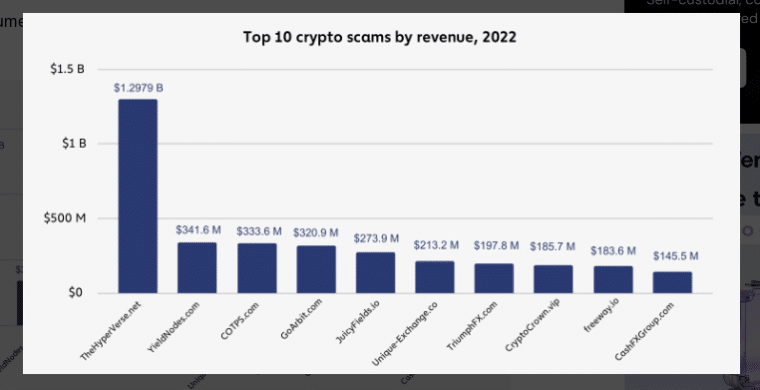

The latter is asking for $650 million in compensation from Chainalysis after it published its Chainalysis’ 2023 Crypto Crime Report in which it deemed the crypto protocol a scam and ranked it as the most productive scam in 2022 as it allegedly generated nearly $350 million in revenue during that period.

Dear #YieldNoders,

As announced the #lawsuit against #Chainalysis has now been officially filed with the Supreme Court of the State of New York, County of New York.

Find the official document here:https://t.co/Vp3Nem1vxc pic.twitter.com/FsdxT63UcF— YieldNodes Official (@YieldnodesOffic) January 23, 2024

YieldNodes, the case’s plaintiff, argues that the report dealt a devastating blow to its business operations and reputation, and opted to take the matter to the court.

YieldNodes Claims to Have Received a Devastating Blow to Its Business

Court documents indicate that Exceptional Media, the parent company of YieldNodes, sees the Chainalysis report as an intentional attempt to negatively affect the protocol’s reputation.

The interactions between the two companies were mentioned in the documents, with the plaintiff claiming that Chainalysis informed YieldNodes that it will label the project a scam. They offered the chance to change that status to “high-risk” but only after the report was published.

Also read: Hackers Increasingly Target Centralized Exchanges as Cyber Crime Evolves

The protocol’s developing team argued that this was unethical and unprofessional on their part and stated:

“They never tried to contact us before publishing their report, and when we tried to contact them to discuss their report, all they did was direct us to their sales representatives and try to sell us licenses for their software.”

Chainalysis Filed a Motion to Dismiss In April 2024

YieldNodes immediately felt the sting after the Crime Report came out. The company reported that it was immediately blocked from depositing or withdrawing money from exchanges and that these institutions froze their business activities.

Apart from the financial damage, their products were also removed from multiple trading platforms that did not want to be associated with a criminal organization.

YieldNodes found out that they were mentioned in the report after receiving transaction error messages. They accuse Chainalysis of using the report as a marketing tool and claim that they had no evidence to make such assertions apart from false positives, false negatives, and margins of error.

The Chainalysis legal team responded by filing a motion to dismiss in April 2024. Their primary argument, as stated in court documents, is that “the complaint fails to allege falsity.”

YieldNodes Has Not Provided Evidence That Contradicts the Report’s Arguments

The company maintains that Exceptional Media and YieldNodes have not provided sufficient evidence to establish that the YieldNodes project isn’t a scam or to refute Chainalysis’ allegations.

The analytics firm argued that the YieldNodes service falls into the category of an investment scam that promises “outsized investment returns” produced by algorithmic trading strategies with 100% success rates.

Since YieldNodes has failed to provide evidence that Chainalysis assertions are incorrect, this suggests that “it is plausible that Yieldnodes is, in fact, an investment scam.”

Also read: Pig Butchering in Crypto is Producing Millions for Organized Crime

Moreover, they believe the case could be dismissed on jurisdictional grounds as they argue that the New York Supreme Court is not the correct legal venue to deal with this type of civil and commercial disagreements.

Chainalysis was founded in 2014 and has progressively established itself as a well-reputed analytics company in the blockchain space. They produce reports periodically about specific projects, criminal trends, and other relevant security matters.

They have received over $3 million in funding from the non-profit venture capital firm InQTel, a non-profit entity operated by the Central Intelligence Agency (CIA), and provides its services to government institutions like the Federal Bureau of Investigation (FBI), the Securities and Exchange Commission (SEC), and the Internal Revenue Service (IRS).

Even though they have been quite proficient at identifying several fraudulent projects, they failed to detect high-profile schemes like FTX.

The upcoming court hearing will determine the trajectory of this case. The judge’s decision on Chainalysis’ motion to dismiss will either result in letting the case advance to the discovery phase or put an end to it if the court finds that there are no merits to proceed legally or that the case was filed in the wrong jurisdiction.

Also read: US Authorities Take Down Huge Web of Crypto Market Manipulators, Seizing $25+ Million

In July, YieldNodes took steps to expand the scope of their legal action, encouraging other projects to join a class action lawsuit against Chainalysis. They cited the significant costs associated with challenging Chainalysis’ claims in court as motivation for collective legal action.

As the cryptocurrency industry continues to mature, this case could set important precedents regarding how liable analytics firms and their research reports and the standards of evidence required when making public allegations of fraud or misconduct.

The outcome may influence how similar situations are handled in the future and could reshape the relationship between blockchain analytics providers and the projects they monitor.