Bitcoin is falling below $60,000 today (and $58,000 soon after) and is once again testing important physiological support levels. This is the third consecutive day of sharp drops for the largest cryptocurrency in the space and analysts are already jumping on the charts to predict what could come next.

In June, Bitcoin (BTC) booked losses of 7.1% and this downtrend appears to be spilling over to July as well. However, the asset is still positive for the year with annual gains of nearly 35% amid an improvement in macro conditions, the launch of the widely awaited spot Bitcoin ETFs, and the latest halving.

Although BTC has toyed with breaking the $60,000 barrier multiple times in the past couple of weeks, this is the sharpest decline the digital asset has experienced since early May.

It also marks a significant downfall from the all-time high booked on March 14 when BTC surged to $73,835.

Analysts Weigh In on BTC: Possible Contributing Factors

Naturally, the entire crypto market is looking for answers after the most recent Bitcoin plunge. Analysts have pinpointed a few major factors that are likely driving this decline. Here’s how they break down:

Selling Pressure from Mt. Gox Creditors

One factor that could be contributing to this week’s drop is the sale of a significant number of the BTC coins owned by creditors of the bankrupted crypto exchange Mt. Gox as liquidators announced that these holdings would be distributed to their rightful owners starting in early July.

Market analysts have been sounding the alarm that this event could generate significant selling pressure on BTC as these tokens were out of the system for a long time and will come to flood the market in an instant.

This chart will blow your socks off and slap you in the face.

The entire history of this chart has disappeared because an enormous sum of Bitcoin moved onchain, 10X more than the previous highs. $9B. But by who?

Mt. Gox.

It looks like those distributions really are coming. pic.twitter.com/ViOudFQasb

— Charles Edwards (@caprioleio) July 2, 2024

Charles Edwards, founder of Capriole Investments, expressed his concern in an X post saying: “The entire history of this chart has disappeared because an enormous sum of Bitcoin moved on-chain, 10X more than the previous highs. $9B. But by who? Mt. Gox. It looks like those distributions really are coming.”

On-Chain Metrics Signaling Weakness

Several on-chain metrics also suggest that Bitcoin may be struggling to achieve new highs:

- Bitcoin Long-Term Holder (LTH) Inflation Rate: This metric is typically used to analyze if Bitcoin holders are in an accumulation or distribution phase. Historically, an LTH value of 2.0 indicates that the market has reached a top. At this moment, the value of this metric has been rising steadily until reaching its current level of 1.9.

- Bitcoin Dormancy Flow: This other metric measures coin spending and compares it to the overall trend. When Dormancy Flow peaks, it typically precedes cycle tops by three months.

Also read: Is It Time to Sell Your Bitcoin Now? Experts Weigh In

Large-Scale Selling by Whales

There have also been reports of significant Bitcoin sales by large holders (whales) in the past few weeks including the following instances:

A popular crypto analyst named Zaheer unveiled a large sale of $180 million made yesterday. The transaction was completed in just three minutes – an unusual speed for such a large disposal.

Moreover, the on-chain analytics firm Lookonchain spotted a transaction involving 1,723 BTC tokens moved from cold storage to Binance. This increases the liquid supply of Bitcoin and could precede further drops if the coins are sold in the open market.

Finally, reports have been circulating about the German government’s decision to dispose of hundreds of millions of dollars worth of Bitcoin seized during an operation that took down a piracy website.

“After months of Bitcoin ETF euphoria, the market suddenly feels bearish,” commented Bernstein analysts Gautam Chhugani and Mahika Sapra. This change in sentiment is reflected in recent trading activity as Bitcoin withdrawals at crypto exchanges exceeded deposits by $522 million in the past five days.

Other Major Cryptocurrencies Affected

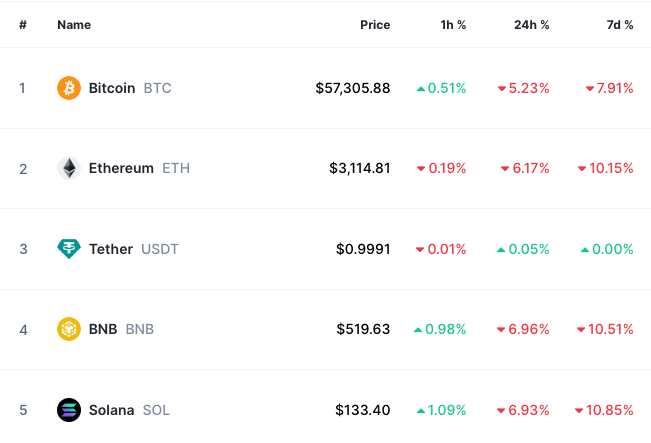

The recent downturn isn’t limited to Bitcoin. Other large cryptocurrencies have also experienced significant price drops, including the following.

- Ethereum (ETH) has lost nearly 6% in the past 24 hours and currently trades at $3,124.78.

- Solana (SOL) accumulates a 7.5% loss and stands at $133.2.

- Binance Coin (BNB) has seen losses of 7% as well at $520.84.

- Meme tokens like Dogecoin (DOGE) and Shiba Inu (SHIB) are losing nearly 10% each.

- PEPE, the latest sensation in the meme space, has lost more than a quarter of its value in the past 7 days.

Today’s Drop Prompts Sizable Liquidations Across the Market

Today’s sharp price drop is also prompting sizable liquidations across the cryptocurrency market:

- Total liquidations reached $262 million, with $233 million of these being long positions.

- Bitcoin and Ethereum-tracking futures have experienced over $60 million in long liquidations.

- Products tracking DOGE, SOL, XRP, and Pepe Coin (PEPE) are booking at least $4 million in losses.

- The crypto exchange Binance took over $110 million in liquidations, the most among its counterparts.

Experts Offer Short-Term and Long-Term BTC Price Predictions

The trading firm QCP Capital anticipates a subdued market in the next quarter due to the uncertainty created by the Mt. Gox Bitcoin distribution. The firm stated: “This overhang of up to 140,000 BTC should continue to weigh on markets, especially since the exact release schedule is unknown right now.”

However, despite the current downturn, some analysts remain optimistic about Bitcoin’s long-term prospects.

Standard Chartered analysts predict that Bitcoin could reach a new all-time high in August, followed by a surge to $100,000 by the U.S. presidential election in November. However, this forecast is contingent on certain political scenarios and relies heavily on the perception that Donald Trump will be “bitcoin-positive” if he is once again elected President. Then again, the election might not be a massive factor for Bitcoin, as the SEC under Biden has started to become more friendly to the crypto space in general.

Factors to Watch in the Following Weeks

Looking ahead, the market will be closely watching how these elements come into play:

- The actual impact of the Mt. Gox Bitcoin distribution.

- Broader economic indicators, such as the upcoming U.S. labor market report.

- Changes to the Federal Reserve’s monetary policy and interest rate decisions.

- Political developments, particularly in the lead-up to the U.S. presidential election.

To Sum Up

The recent drop in Bitcoin’s price below $60,000 marks a significant moment in the cryptocurrency market’s journey as we enter the second semester of 2024. While concerns over Mt. Gox repayments, some large-scale selling by whales, and a potential shift in the market’s sentiment could have contributed to this downturn, it’s important to analyze these developments in the context of Bitcoin’s overall performance this year.

As the market navigates through this brief period of uncertainty, investors and analysts alike will be keenly observing how various factors – from macroeconomic trends to crypto-specific events – shape the future trajectory of Bitcoin and the broader cryptocurrency market.