A landmark moment took place in late May when the United States Securities and Exchange Commission (SEC) gave the green light to an Ethereum (ETH) spot exchange-traded fund (ETF) in a surprising turn of events.

The approval occurred just a month after the agency had delayed its decision over an application for such a vehicle sent by the investment firm Templeton Franklin and caught most crypto-industry watchers by surprise.

Now that the dust has settled and a new crypto-based investment vehicle is available for investors to pour money into, many within the growing community of people who invest in digital assets are asking how this can influence the price of the native token of the smarts contract network.

Throughout the article, we will be sharing the views of various analysts along with interesting metrics and statistics that may provide a clearer picture of what the road ahead looks like for Ether (ETH).

The SEC’s Approval: A Game-Changer for Ethereum

The SEC’s approval of spot Ethereum ETFs marks a pivotal moment for the cryptocurrency industry. The decision came just a few months after the regulator approved spot Bitcoin (BTC) ETFs earlier in January – a decision that has already resulted in billions of dollars being funneled into the space.

The SEC’s ruling on Franklin Templeton’s application resulted in the approval of other similar vehicles managed by companies including VanEck, Grayscale, ARK Invest, Invesco, and Blackrock, all of which have experience in the asset management industry.

They offer a way to experience changes in Ethereum’s price by acting as trusts for a specific number of Ether (ETH) tokens purchased for investors with the funds they invest by buying shares. This approach aims to bring more investors into the idea of smart contracts and decentralized applications, highlighting the game-changing potential of public blockchains in digital commerce.

The move is expected to lure a large number of both retail and institutional investors who may have stood on the fence about cryptocurrencies amid their reluctance to buy these assets via crypto exchanges like Binance, Coinbase, or Kraken.

Ethereum is currently the second largest digital asset by market capitalization and the largest smart contracts network according to a recently updated report from the Grayscale Research Team.

“Ethereum is the largest asset in our Smart Contract Platforms Crypto Sector, and the largest blockchain network in terms of users and applications,” analysts from Grayscale highlighted.

Meanwhile, according to data from CoinMarketCap, the market cap of Ether (ETH) stands at $458 billion while its price has increased by 0.5% in the past 7 days to $3,808.66 per coin.

Analysts Forecast Significant Inflows and a Possible Supply Shock on the Horizon

According to crypto analysts from K33 Research, the approval of a spot Ethereum ETF could attract as much as $4 billion in fresh capital within the first five months of their launch.

“Based on current prices, this would equal 800,000 to 1.26 million of ETH accumulated in the ETFs, or roughly 0.7%-1.05% of the total supply of tokens, creating a supply crunch for the asset,” the K33 Research team stated.

Unlike futures-based products, spot ETF issuers must buy tokens in the spot market as investors buy ETF shares. Naturally, this should help push the price up as long as demand doesn’t fall.

Meanwhile, Vetle Lunde, senior analyst at K33 Research, believes that there will be an immediate imbalance between supply and demand that could significantly impact Ethereum’s price. “As seen in BTC, this monumental supply shock should lead to price appreciation in ETH,” Lunde commented.

Analysts from Grayscale share this optimism, estimating that U.S. spot Ethereum ETFs will lure roughly 25% to 30% of the demand that spot Bitcoin ETFs experienced.

This translates to about $3.5-$4.0 billion in net inflows over the first four months of their existence.

“Ethereum’s market capitalization is about one-third (33%) that of Bitcoin’s market capitalization, so our assumptions imply that Ethereum net inflows could be slightly smaller as a share of market cap,” Grayscale wrote in its report.

Supply Crunch: Large Percentage of ETH Supply is Locked

The potential supply crunch could be further exacerbated by Ethereum’s unique characteristics.

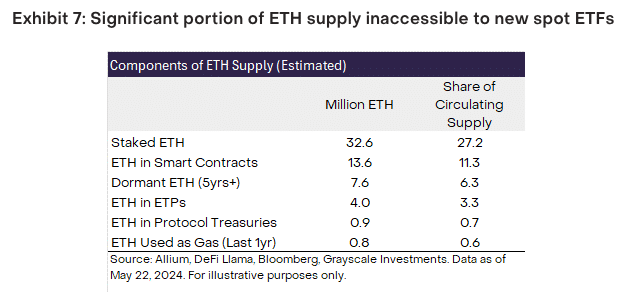

For example: a significant portion of the total ETH supply is either staked or locked in smart contracts, which makes the assets automatically unavailable for purchase by exchange-traded funds (ETFs).

Grayscale’s research indicated that around 27% of ETH’s total supply is staked. Moreover, around 6% of the total supply has been idled – no transactions have been made by the wallets that hold the assets – for at least 5 years, while around 11% is locked in smart contracts.

Additionally, some companies hold billions in Ether as part of their treasury reserves. For example, the Ethereum Foundation has about $1.2 billion in ETH, and Golem holds almost $1 billion in the digital asset too. All these factors prepare Ethereum for a wild ride, especially if ETF inflows reach or exceed expectations.

The Road to $5,000: Analysts’ Price Predictions

The approval of various Ethereum spot ETFs has sparked optimism among analysts who now believe that the road is paved for the digital asset to reach a price of $5,000 for the first time in its history.

David Brickell from FRNT Financial is among those who believe this thesis and even claims that it could happen by the end of June. He cites three positive factors that could aid ETH to reach those heights: Congress’s latest positive steps to regulate the crypto space, a positive economic outlook – which may include a drop in interest rates by the Fed – and the approval of the spot ETF.

Meanwhile, Joe Lubin from Consensys said that he expects a significant increase in the demand for Ether that could automatically result in a supply crunch. He also sees institutions diversifying their crypto holdings by pouring funds into this “second approved ETF.”

However, not all analysts are bullish on ETH. For example, Adam McCarthy from Kaiko warns that Hong Kong ETFs haven’t seen much demand. He also mentions that ETFs inability to stake their assets may further affect how high the price goes. He cautioned investors and urged them to keep an eye on Grayscale’s main Ethereum-based ETF – whose ticker symbol is ETHE. “If [ETHE] it suffers large outflows, that would be significant for prices.”

Similarly, analysts at Bernstein suggest that investors should temper their expectations as the ETH spot ETF will likely not attract the same level of inflows compared to BTC. That said, they note that ETH’s unique supply situation could still generate some positive price action following the launch of these ETFs.

Although what the future holds is entirely unclear considering the significant volatility that the crypto market typically experiences occasionally, most analysts agree that the approval of this spot ETF for ETH will be a positive catalyst for the price.

Are you currently thinking of investing in Ethereum ETFs? Ensure your crypto is stored safely with Best Wallet, Business2Community’s top recommendation for security and simplicity. Learn more