Russia has legalized crypto mining and the use of cryptocurrencies to make international payments to circumvent the financial pressures and sanctions imposed by Western nations.

President Vladimir Putin signed the bills into law in early August and crypto payments could start to be sent out starting this month.

Although cross-border payments will commence in September, legal mining activities will have to wait until November to start. These activities will allow Russia to engage in trade operations with international partners to procure much-needed products and services for its local economy.

President Putin emphasized the importance of this regulatory shift, urging Russia “not to miss the moment” in regulating cryptocurrencies.

Central Bank of Russia Will Be In Charge of Overseeing Crypto Payments

Russia sees the move to reduce its reliance on the US dollar and mitigate the impact that sanctions have on the country. Anton Gorelkin, a member of the Russian Federation, authored the bill with the help of Central Bank of Russia (CBR) Governor Elvira Nabiullina.

Both have openly acknowledged that the bill aims to facilitate international payments.

Despite the approval of this bill, Russians are still not allowed to use cryptos to make payments within the country. However, digital assets are used frequently by residents as highlighted by the Global Crypto Adoption Index – a measure of crypto adoption that lists Russia at the top when it comes to digital asset usage.

Also read: Future of Crypto in the Next 5 Years

Moreover, several banks have facilitated crypto payments for businesses. One example is Rosbank, a financial institution owned by the Russian billionaire Vladimir Potanin, which started offering cross-border payments to companies in the country in June 2023.

The Central Bank of Russia (CBR) will be in charge of overseeing crypto payments and monitoring transactions closely. Russia has been testing a central bank digital currency (CBDC) and could be gearing up to launch it in 2025. The digital Ruble will come to serve as a blockchain-based means of exchange.

Apart from this law, Russia has been pursuing other projects like a gold-backed stablecoin and a blockchain-based initiative launched in partnership with member countries of the BRICS group. However, none of these ventures have yielded the kind of results needed to facilitate international payments to the extent that the country needs.

Crypto Exchanges Thrive in Russia Despite Lack of Legal Framework

Russia is also moving forward with the launch of two official crypto exchanges. Unofficial and unregulated alternatives are present in the country but they operate without an adequate regulatory framework.

Some examples of centralized exchanges that do not force customers to go through KYC protocols include Tetchange, Suex, and Garantex. Many of these companies have been headquartered near the Federation Tower, a high-end business center located in Moscow.

Garantex is the most important exchange of all and will likely remain instrumental for Russia to succeed in this crypto-focused payments strategy. However, the company has been sanctioned by the Office of Foreign Assets Control (OFAC) and Office of Financial Sanctions Implementation (OFSI) in the US and UK, respectively.

Garantex has reportedly processed transactions worth over $100 billion since 2018, particularly for Russia and Iran – two of the most heavily sanctioned countries by Western allies.

This does not necessarily mean that the Russian government has sponsored these activities directly. However, operating freely to this extent within a highly centralized country is not as easy as it seems. Hence, the government may have opted to overlook the illegality of these operations as they benefit from these services either directly or indirectly.

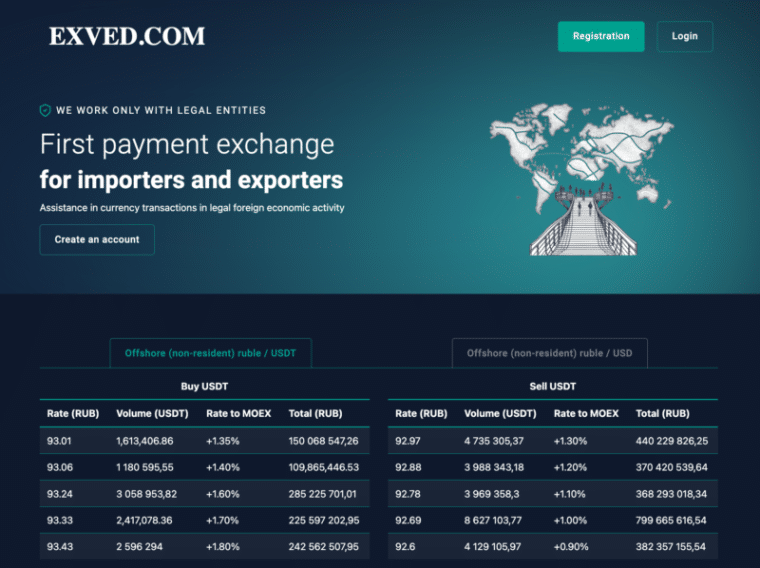

In addition to Garantex, an exchange called Exved has also been facilitating imports and exports via DeFi payments like flash loans and has been working on the development of an Ethereum-based stablecoin pegged to the Ruble.

Although there are a handful of successful cases in the sector, large global exchanges have opted to exit the Russian markets amid concerns that they have struggled to comply with local laws. Binance, for example, sold its business to CommEX in September 2023. However, the latter ended up shutting down its operations earlier this year as the landscape became even more complex after Russia decided to invade Ukraine.

Russia’s Ability to Circumvent Sanctions Through Crypto is Limited

Russia has proposed the launch of yuan-pegged or BRICS-backed stablecoins to circumvent sanctions and engage in international trade. These would be supported by crypto exchanges based in Moscow and St. Petersburg with the government’s blessing.

Meanwhile, global stablecoins like USDT and USDC have also been considered amid their widespread adoption and popularity. However, since their blockchains are controlled by private entities subject to international laws, the country faces risks that their operations may be blocked or their assets could be seized if law enforcement agencies managed to trace the payments made by sanctioned entities.

Once launched, the digital Ruble could play a big part in Russia’s ongoing crypto pivot as it could be exchanged through various blockchains and held in crypto wallets as any other token.

While Russia’s move to integrate crypto into its financial system may improve its ability to bypass international oversight of the global financial system, on-chain sanctions evasion at scale is challenging.

Russia’s total foreign exchange reserves are just under half a trillion dollars, with approximately $300 billion in dollars, euros, and British pounds still frozen. Crypto markets at their current state simply do not have the kind of liquidity needed to accommodate these large-scale transactions.

However, smaller-scale sanctions evasion on-chain can still have meaningful implications for national security, compliance, and investigations.

Government-affiliated actors who might seek to leverage these new developments would include fundraisers who support pro-Russian militants in Ukraine, individuals who help oligarchs and other politically exposed persons engage in overseas investments, and Russian-based exchanges that facilitate crypto payments for individuals.

Large Miners Will Have to Report Their Activities and Finances to Local Authorities

Apart from helping its domestic businesses solve the issue of sending international payments, Russia appears to be aiming to outpace the United States as a leading force in the crypto mining space.

The recently approved bill creates the appropriate regulatory framework to allow miners to conduct their operations in the country. Among other things, it creates a registry of all Russian entities who will be engaging in this activity.

Small mining ventures will not be affected by the bill and will remain unregistered. However, large entities will now be overseen by the country’s central bank, especially amid their high demand for energy.

The law initially sought to ban crypto trading officially but those provisions were ultimately removed according to the news outlet RBC. Such prohibition would have endangered the thriving ecosystem of centralized exchanges in the country.

Miners will have to report their activities to a local monitoring service called Rosfinmonitoring. They must provide their wallet addresses to subject their finances to the state’s oversight apparatus.

This regulatory move raises important questions about the classification of crypto mining outside Russia, particularly in light of broad US and European sanctions against the country’s energy sector.

Russia’s authorization and oversight of crypto mining suggests a strategic alignment with national interests despite the ongoing international sanctions targeting Russia’s energy resources.

Foreign Regulators Will Scrutinize On-Chain Activities to Identify Russian-Linked Transactions

Although these legislative changes will likely enhance Russia’s ability to engage in international trade through cryptocurrencies they could also prompt the US and EU authorities to increase their vigilance.

As the bill increases Russia’s presence in global trade once again, Western authorities will probably focus on monitoring and mitigating the risks associated with the financial activities of sanctioned entities, both on- and off-chain.

Many heavily sanctioned countries like Venezuela and Iran have historically attempted to use alternative payment mechanisms, including cryptocurrency, to bypass sanctions, but not without its challenges.

The transparency of blockchain technology allows investigators to monitor and disrupt the movement of funds in real time. Wallet addresses associated with CEXs, mining services, and other on-chain entities can be identified, attributed, and potentially sanctioned.

Moreover, the cryptocurrency market’s limited liquidity means that attempting to move large amounts on-chain could draw attention from observers or destabilize the market altogether.

The success of Russia’s initiative will depend on how effectively it can navigate regulatory obstacles, manage sanctioned entities, and build the necessary infrastructure and foreign partnerships to support these transactions.