A federal judge in Massachusetts has denied a motion filed by DraftKings to dismiss a class action lawsuit that alleges that its non-fungible tokens (NFTs) should be considered unregistered securities.

The ruling sets the stage for a trial that could have far-reaching consequences and implications for the NFT market and how these assets are treated based as per the securities laws of the United States.

The case, Dufoe v. DraftKings Inc., was filed in March 2023 by plaintiff Justin Dufoe on behalf of himself and other purchasers of DraftKings’ sports-themed NFTs.

DraftKings, a major player in the daily fantasy sports and sports betting industry, offers these non-fungible tokens (NFTs) in a marketplace powered by the Polygon blockchain.

Dufoe’s lawsuit alleges that DraftKings’ NFTs meet the criteria of the Howey test, the legal test used to determine if an asset qualifies should be considered an investment contract and thus be treated and regulated as a financial security.

The plaintiff claims that he and other customers purchased DraftKings NFTs during their first public offering with the expectation of realizing profits through the company’s efforts to promote these assets to a wider audience.

Detailed Allegations Against DraftKings

According to the class action lawsuit, DraftKings “had actual knowledge of facts” indicating that the NFTs they advertised and sold were securities under federal and state securities laws. However, they failed to register them as such.

The lawsuit charges DraftKings with violating the Securities Act of 1933, the Securities Exchange Act of 1934, and two Massachusetts general laws.

Dufoe seeks to represent a large group of individuals located in various corners of the world who purchased a DraftKings NFT in 2021 and forward.

Court Rules that DraftKings’ NFTs Satisfy Three Items of the Howey Test

In her recent ruling, Judge Denise Jefferson Casper found that the plaintiff “plausibly alleged that DraftKings’ NFTs satisfy three prongs of the Howey test.” Specifically, the court agreed they involved:

- An investment of money.

- Pooled assets into a common enterprise with shared risks and profits.

- A reasonable expectation of profit from DraftKings’ efforts.

The court believes that it is reasonable to conclude that the success of these assets is heavily dependent on the progress of the DraftKings Marketplace, which also relies on the company putting up its best effort to grow and expand the reach of that project. This issue has been addressed in prior cases examining NFTs.

Implications for the NFT Market

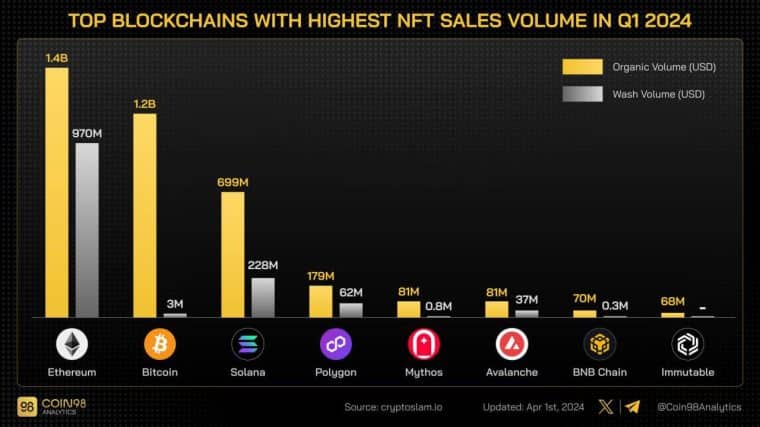

The ruling could have a significant impact on the evolution of the NFT market moving forward. Lately, this market has experienced a significant drop in trading volumes according to data from CryptoSlam, which indicates that sales declined by 45% during the second quarter of 2024 compared to the previous quarter. Total sales reached $2.3 billion during this period – the lowest reading since Q3 2023.

If NFTs are classified as securities, this could dramatically impact how companies create and market these digital assets. Brands may need to reconsider their NFT strategies to ensure compliance with security laws. These concerns could limit creativity and innovation in the space.

Also read: How to Invest in NFT Tokens – Beginner’s Guide

For a company like DraftKings, this lawsuit is quite important considering that NFTs are responsible for 5% of its earnings according to data provided by Matthew Sigel, head of digital assets research at VanEck.

“DraftKings’ Reignmakers, an NFT game on Polygon, is set to generate $70M in high-margin revenue over the next year & boost EBITDA by ~5%,” Siegel revealed. The company could also be hit with a major fine for selling unregistered securities.

DraftKing Claims that Its NFTs Should Be Treated as Baseball Cards

DraftKings, represented by attorneys from Wilmer Cutler Pickering Hale and Dorr, argues that its NFTs should be considered collectible items like trading cards rather than securities.

“The digital images of professional athletes that Plaintiff purchased are collectibles and trading cards, some of which may be used in online fantasy sports-style contests. They are plainly not ‘securities’ under well-established law. This case should be dismissed,” a memorandum that accompanied the company’s rejected motion to dismiss reads.

The company contends that the digital nature of NFTs does not fundamentally change their character as collectibles. However, the court found that the plaintiffs had plausibly alleged key differences. In particular, the court emphasized the dependence on DraftKings’ continued operation of its marketplace for the NFTs to retain their market value.

A similar case ended up badly for the defendant recently as Dapper Labs, a company that markets NFTs via a proprietary blockchain named Flow, was forced to pay $4 million to settle a class-action lawsuit involving the sale of its NBA Top Shot NFTs, which were classified by the court as unregistered securities.

Although there’s a difference between the two cases as DraftKings relies on a third party (Polygon) to distribute the digital assets, the precedent is dangerous as it could be referenced by the judge and taken into consideration for his final ruling.

The Broader Context: NFTs and Securities Laws

The DraftKings case is part of a larger ongoing debate about how NFTs should be classified under existing securities laws. The US Securities and Exchange Commission (SEC) has been increasingly scrutinizing the crypto and NFT space, arguing that many digital assets should be considered securities.

Also read: 5 Best NFT Lawyers in 2024 – Top NFT Law Firms

The challenge with NFTs is that they can vary widely in their characteristics and use cases. For example, some NFTs are purely collectible or artistic in nature while others carry features that more closely resemble traditional securities.

Potential Impact on NFT Issuers and Marketplaces

If the court ultimately rules that DraftKings’ NFTs are securities, this could have far-reaching consequences for NFT issuers and marketplaces. Companies (and individuals) offering NFTs may need to:

- Register their offerings with the SEC or seek exemptions.

- Provide detailed disclosures about their NFTs and their associated risks.

- Implement know-your-customer (KYC) and anti-money laundering (AML) procedures.

- Restrict sales to accredited investors in some cases.

- Comply with reporting requirements.

NFT marketplaces might also need to be registered as securities exchanges or alternative trading systems, depending on how they operate. This could significantly increase compliance costs and potentially limit access for retail investors.

Challenges Involved in Classifying NFTs

The DraftKings case highlights the broader challenges that lawmakers and regulators are dealing with to classify NFTs by relying on the existing legal and regulatory framework.

NFTs can serve a wide range of purposes. They could be considered purely artistic or collectible items or more complex financial instruments that could produce earnings for the holder. This diversity makes it difficult to apply a one-size-fits-all approach to their regulation.

Some key elements to consider to classify NFT appropriately may include:

- Utility vs. Investment: Some NFTs have practical utility within a platform or ecosystem while others are primarily bought by speculators with the expectation of turning a profit by reselling them in the future.

- Centralization: The degree of control exercised by the issuer over the NFT and its natural market – including exclusive secondary markets – can influence whether they should be treated as securities.

- Marketing and Promotion: How NFTs are marketed to potential buyers can also impact their treatment if they create a reasonable expectation of profits.

- Underlying Rights: The specific rights conveyed by an NFT, such as ownership of digital art or access to exclusive content, can influence how it’s viewed by applicable laws.

As the NFT market continues to evolve, regulators and courts will need to tackle these challenges right on to solve the many legal cases that may emerge in the future as the popularity of this type of digital asset continues to grow.