Jump Trading, a Japanese crypto trading business, reportedly offloaded a significant portion of its Ether (ETH) holdings this week right before the market crash that took place on Monday.

According to a report from CoinTelegraph, Jump sold approximately $315 million worth of staked ETH as the value of the yen skyrocketed against the US dollar amid the Bank of Japan’s decision to raise its benchmark interest rate.

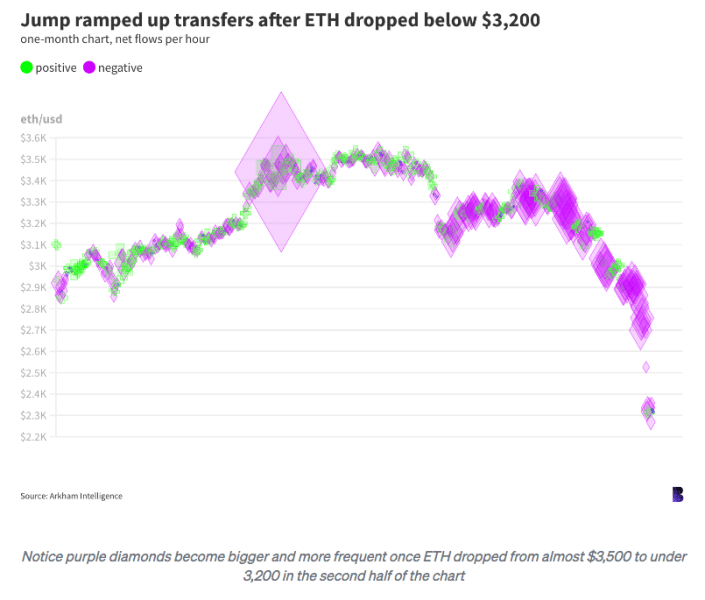

Arkham Intelligence data shows that Jump started to move large loads of Wrapped Staked ETH (wstETH) since July 20 when it took out 120,000 tokens from the Wormhole Counter-Exploit Fund address.

In addition, another $341 million in wstETH tokens were converted to unstaked stETH tokens just days later was taken out of Lido Finance and moved to various exchanges. This is typically considered a bearish signal as trading firms commonly do this when they plan to sell their assets quickly to raise liquidity.

Finally, in the past 24 hours, data from SpotOnChain indicates that Jump moved nearly $47 million worth of ETH tokens to centralized exchanges – primarily Binance – that may have been immediately sold.

Blockworks Reveal Total ETH Sales Exceeding $100M Since Friday

Meanwhile, a report from Blockworks indicates that the total amount of ETH sent to exchanges in the past four days or so adds up to $136 million. Even though that may sound like a lot, their data highlights that the market for ETH/USDT could easily digest that figure as average daily volumes for this pair stand at over $2 billion.

This significant sale comes just a few days after the United States federal government published the country’s latest labor market report for July 2024 last Friday. According to the data, only 114,400 jobs were created in the US during this month resulting in a significant slowdown compared to the 206,000 new positions filled the month before.

Analysts were surprised by this figure as the consensus estimate stood at 185,000 new positions as per data compiled by Dow Jones. The reaction from market participants was swift and decisive as evidenced by the significant drop that different asset classes including stocks, commodities, and cryptocurrencies suffered right after.

Meanwhile, on Monday, the Bank of Japan’s decision to raise its interest rate by 0.25% and slow the pace at which it buys fixed-income instruments caused a surge in the value of the yen against the North American currency.

As a result, traders like Jump who may have opened leveraged positions on various assets were forced to wind-down their portfolios to avoid having to pay massive financing costs. Moreover, most firms typically convert their JPY to USD and then open their trading positions in dollars.

When cryptos started to sell off, Jump may have been forced to liquidate these assets quickly to cover those positions as they were being hit on two sides. First, a decline in the USD value of their cryptocurrencies would result in direct losses. Second, the value of their collateral plummeted in terms of JPY as it broke out against the dollar.

“… it would make sense, based on Jump’s expertise in traditional space, they’re very aware of foreign exchange moves and might have to preemptively protect or correct carry trades with the JPY or just anticipated a market pullback,” commented Justin d’Anethan from the market-maker firm Keyrock.

Other Financial Firms Dumped Loads of ETH Tokens as Well

Jump Trading recently redeemed $410 million worth of 120,000 wstETH into ETH and then transferred it to CEXs such as Binance and OKX. Since July 25, 83,000 wstETH have been redeemed into 97,500 ETH, and 66,000 ETH (worth $191.4 million) have entered the exchanges.…

— Wu Blockchain (@WuBlockchain) August 4, 2024

Jump is not alone in taking this kind of action as data from Arkham also shows that Grayscale, the large asset management firm that oversees various crypto-linked exchange-traded funds (ETFs), also got rid of approximately 600,000 ETH tokens since late July.

Meanwhile, data from CoinShares indicates that Ether-linked ETFs saw outflows of $146 million globally last week, primarily in the United States market as recession fears may have triggered a risk-off move.

However, the motivations behind Jump’s activities may have been different. Some analysts cite that this is part of a planned wind down of the group’s crypto operations. In late June, the head of Jump Crypto, Kanav Kariya, resigned from his position as he was apparently being investigated by the Commodities Futures Trading Commission (CFTC) in the United States.

It is worth noting that Jump Crypto has been involved in various tumultuous affairs including the hack of Wormhole Bridge, which resulted in total losses of over $300 million for investors. Jump owned the company that developed this faulty protocol.

Meanwhile, the firm also had money invested with the bankrupted crypto exchange FTX and was accused of manipulating the price of Terra’s UST token – the infamous stablecoin created by Do Kwon that ultimately collapsed and caused losses of over $7 billion to investors.

ETH Faces Sharper Decline Compared to Other Similar Assets

“Jump liquidating their crypto book into thin markets on a summer Sunday afternoon perfectly sums up why their crypto operation is such a mess,” commented Adam Cochran, managing partner of Cinneeamhain Ventures.

The performance of Ether in the past 7 days was significantly worse than that of other crypto assets of similar sizes. During this period, ETH has declined nearly 27% and stands at $2,447. Meanwhile, the price of Bitcoin (BTC) only retreated 17% while that of BNB and Solana exhibited losses of 17% and 23% respectively.

It seems that Jump’s actions may have had a higher impact on ETH prices. This could create opportunities for investors interested in buying the dip if they believe that the price of the native token of the world’s most popular smart contracts network is currently undervalued.

“In any case, if Jump truly did cause panic, then the worst of it is probably over for now. Hopefully, the markets also see it that way,” David Canellis from Blockworks writes.

In a similar fashion, Mads Eberhardt, a senior crypto analyst for Steno Research, noted: “If they show strong inflows this week, it may calm crypto market participants in general, while the opposite is true if the ETFs see outflows.”