The case against Caroline Ellison, one of the top executives of the high-profile bankruptcy of the crypto exchange FTX, has finally concluded with a two-year sentence in prison for her involvement in the company’s collapse.

Ellison served as the Chief Executive Officer of Alameda Research, a sister company of FTX, and was romantically involved with the founder, Sam Bankman-Fried.

However, after it became apparent that the empire was crumbling, she started to cooperate with authorities and this is the reason why she received just two years, even though the maximum applicable punishment for the charges against her was life in prison.

Ellison Gave Authorities What They Needed to Imprison Bankman-Fried

Investigators and prosecutors used the information provided by Ellison to locate and seize billions of dollars in assets that were hidden in multiple corners of the world. Her help was categorized as “very, very substantial” and she also played a key role in helping authorities convict Bankman-Fried.

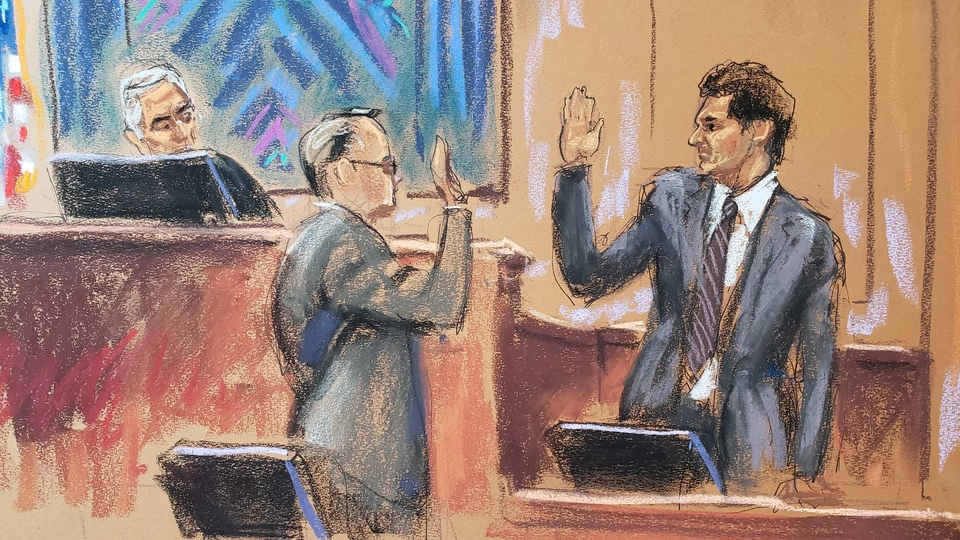

“I’ve seen a lot of cooperators in 30 years here. I’ve never seen one quite like Ms. Ellison,” US Federal Judge Lewis Kaplan stated.

Also read: FTX Victims Won’t Really Get 100% of Their Funds Back, Despite Reports

In addition to the prison term, Ellison was ordered to forfeit more than $11 billion to the court. Judge Kaplan also recommended that Ellison be held in a minimum-security prison and set her surrender date for November 7, 2024.

Ellison’s treatment differs widely from other cases involving FTX executives. For example, Ryan Salame, who also served as an officer for the company, was sentenced to seven years in prison.

Meanwhile, another two individuals involved in FTX’s operations, Nishad Singh and Gary Wang will have their sentencing hearing this fall.

Other FTX Executives May Receive Worst Sentences

Ellison started to cooperate with law enforcement agencies and prosecutors in 2022 shortly after FTX collapsed. She pleaded guilty to seven charges including fraud and money laundering on December that year.

During Bankman-Fried’s trial, the 29-year-old testified against him for three days straight and adopted a different approach to the situation than the former crypto billionaire as he chose to fight the charges and was ultimately convicted and sentenced to 25 years in prison.

Ellison provided details about how the company operated and the fraudulent activities that went on under Bankman-Fried’s supervision.

Ellison’s testimony revealed that Bankman-Fried told her and other executives within the firm to use FTX customers’ funds to engage in high-risk transactions via Alameda Research, buy real estate, and make political donations. She repeatedly emphasized that throughout her years at Alameda, Bankman-Fried was the ultimate decision-maker.

Judge Categorizes the Collapse of FTX as the “Greatest Financial Fraud Ever”

Once valued at $32 billion, the collapse of FTX, which was at the time the third largest crypto exchange in the world, was the result of lax compliance and oversight by Bankman-Fried and bad practices involving the use of customers’ funds for corporate and investment purposes.

Prosecutors accused Bankman-Fried and other top executives of looting customer accounts on the exchange to make risky investments, make millions of dollars in illegal political donations, bribe Chinese officials, and buy luxury real estate in the Caribbean. The scale of the fraud was estimated at over $8 billion in stolen customer funds.

Judge Kaplan emphasized the gravity of FTX’s case by stating that it was “if not the very greatest financial fraud ever perpetrated in this country or anywhere else, close to it.”

Ellison Regretted Her Actions and Shed Some Tears During the Hearing

Ellison expressed remorse throughout the trial for her actions and involvement with FTX and Alameda – the hedge fund arm that handled money for customers. She said she was sorry for her participation in the scheme although she acknowledged that she may not be aware of “the scale of the harm it caused.”

Assistant US Attorney Danielle Sassoon highlighted that Ellison’s testimony was “devastating and powerful proof” during the proceeding against Bankman-Fried.

Prosecutors also noted that Ellison met with them about 20 times to help them understand how FTX worked and assisted them throughout the process of building a case against the former CEO.

They were impressed by the fact that she opted to cooperate instead of jumping off the wagon. She may have calculated that she had a better chance of making a deal by doing so.

However, although Judge Kaplan acknowledged the significance of Ellison’s cooperation, he emphasized that the magnitude of the fraud demanded that she face some prison time. “There’s no way you’re ever going to do something like this again,” Kaplan said.

The sentencing of Caroline Ellison marks the end of another chapter in the FTX saga, a case that has had far-reaching implications for the cryptocurrency industry. The collapse of the exchange and the criminal proceedings that emerged as a result have raised serious questions about the lack of regulatory oversight of the crypto industry.

Also read: Shark Tank Star Kevin O’Leary Blames Binance for FTX Collapse – Here’s Why

The case has highlighted the need for stronger safeguards to protect investors and customers in the volatile world of cryptocurrencies. It also highlights the potential risks associated with the outsized influence that certain figures within the crypto space can rapidly amass when they manage to make enough money from their activities – no matter how unlawful they may be.

Ellison’s sentencing has elicited mixed reactions from the cryptocurrency community. While some have expressed satisfaction that justice is being served others questioned if the sentence is sufficiently severe given the scale of the fraud.

Critics claim that Ellison’s cooperation does not necessarily entitle her to be treated with such leniency as she could have stopped the fraud at any given point. She could have protected the exchange’s customers and their money but she didn’t.

Meanwhile, Bankman-Fried has filed an appeal against his conviction, accusing Judge Kaplan of blocking his legal team from introducing evidence that would have helped his defense. The outcome of this appeal could potentially lead to further developments in the case though it’s quite unlikely that his conviction is overturned.

The FTX saga is far from over as a handful of appeals and other sentencing hearings will take place in the coming months. However, Ellison’s case and its outcome mark the end of an important side of the case that has contributed significantly to mitigating the damage inflicted by Bankman-Fried’s demised empire.