The cryptocurrency markets are experiencing an incredible surge in meme coins, with the total market cap for this area surpassing $50 billion this week. This remarkable rise is driven by several factors, such as increasing demand from retail investors, heavy speculation, and a general positive outlook in the market.

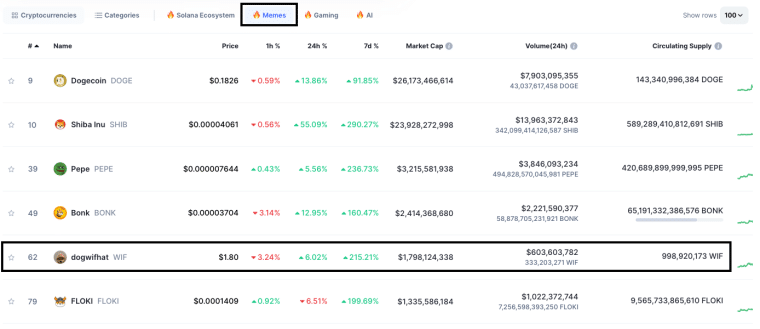

Leading the charge in this meme coin frenzy are Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Bonk (BONK), and the newcomer Dogwifhat (WIF). These coins have seen their prices skyrocket in recent days, with many posting astronomical gains of over 100% in just a matter of weeks. Most of these meme coins dipped following Bitcoin’s rejection after hitting its all-time high of $69k this morning but traders are still on the lookout for the next potential surge.

Meme Coin Rally: Early Sign of Altcoin Season?

Analysts at the respected crypto research firm K33 Research believe that this meme coin rally could be an early sign of an impending “altcoin season” – a period when smaller cryptocurrencies and alternative tokens outperform Bitcoin, the world’s largest cryptocurrency by market cap.

“Judging by history, altcoins will start outperforming about the time we are now”, K33 Research analysts stated in a recent report. The firm highlighted the tremendous gains witnessed by meme coins like DOGE, SHIB, BONK, PEPE, and the Solana-based WIF this week, suggesting that these explosive moves could signal an impending broader altcoin resurgence.

Historically, Bitcoin has led the way in crypto market rallies, with altcoins and smaller tokens following suit and playing catch-up as investors rotate profits from Bitcoin into riskier altcoin plays. The “altcoin season” seems to often start after Bitcoin has made its move and is in a period of relatively low volatility. This cycle has repeated itself numerous times throughout the evolution of the crypto markets.

Swissblock, another prominent crypto analysis firm, echoed a similar sentiment about an imminent altcoin season. In a market update, they advised participants to watch for Ethereum (ETH) – the second-largest cryptocurrency – breaking above the $3,500 price level, which could confirm the start of altcoins outperforming Bitcoin. It passed $3,500 yesterday as it surged hand-in-hand with Bitcoin, but Bitcoin dominance hasn’t shifted much since.

Retail FOMO is Fueling the Meme Coin Surge

The stunning surge in meme coins has been driven primarily by a speculative buying frenzy, particularly among retail investors during the Asia trading session. According to a report from QCP Capital, a leading crypto trading firm, the meme coin rally is being fueled by retail FOMO (Fear of Missing Out), indicating a significant shift in market participation dynamics.

“Altcoins, especially memecoins, are rallying hard as retail FOMO really kicks in now. Leveraged buyers will likely not relent until we break all-time highs, which could be any time now”, the QCP Capital report stated.

This observation aligns with those of analysts from financial giants like JPMorgan, who have noted that retail traders – often referred to as “mom-and-pop” investors – have played a crucial role in driving the broader cryptocurrency market rally observed throughout February.

The increased participation of these “small-scale investors”, as JP Morgan’s Managing Director, Nikolaos Panigirtzoglou, calls them, has been a significant factor in pushing prominent cryptocurrencies like Bitcoin to two-year highs last month.

Meme Coin Madness: Dogecoin and Shiba Inu Lead the Pack

At the forefront of the meme coin frenzy are two of the most well-known and established tokens in the space: Dogecoin (DOGE) and Shiba Inu (SHIB). These two coins have solidified their positions within the top 15 global crypto market cap rankings, demonstrating the significant traction and interest that meme coins have gained among both retail and institutional investors.

Dogecoin, which started as a joke cryptocurrency inspired by the popular Doge meme, has seen its price surge by an eye-watering 67% in the past 7 days alone, and it was up even more before Bitcoin slumped this morning.

This meteoric rise has propelled DOGE back into the top 10 cryptocurrencies by market capitalization, a remarkable feat for a token that was initially created as a satirical take on the crypto craze.

Shiba Inu, often referred to as the “Dogecoin killer” has also experienced a massive rally, with its price skyrocketing by a staggering 194% over the past 7 days.

This remarkable performance has solidified SHIB’s position as a force to be reckoned within the meme coin space as investors continue to flock to these highly speculative and volatile assets. Currently, SHIB stands as the 10th most valuable token in the crypto space, according to data compiled by CoinMarketCap.

The Rise of Dogwifhat and Smog: Newcomers Steal the Show

While Dogecoin and Shiba Inu have been the headliners in the meme coin rally, several newcomers have also stolen the spotlight with their jaw-dropping short-term performances.

One of the standout performers has been Dogwifhat (WIF), a Solana-based token that saw its price explode by over 220% in the past 7 days and by nearly 760% in the past 30 days, reaching a new all-time high during the past weekend. It has since crashed back down to earth to $1.33, but it’s still up 111% this week.

The surge in WIF’s price has propelled it to become the fifth-largest meme coin by market capitalization, surpassing even the well-established Floki Inu (FLOKI).

Several catalysts have been driving Dogwifhat’s bull run, including its recent addition to the “Innovation & Meme Zone” on the Bitget exchange, fueling speculation about potential listings on major platforms like Coinbase and Binance. Additionally, the growing adoption of the Solana blockchain has provided further tailwinds for the token’s meteoric rise.

Speculation and FOMO Drive Meme Coin Mania

Amidst the meme coin frenzy, analysts have cautioned investors about the highly speculative nature of these assets and the importance of getting out in time to secure profits. Linda P. Jones, the voice behind the “3 Steps to Quantum Wealth” audiobooks on crypto investing, attributes the meme coin mania to three key factors.

Firstly, Jones cited reports from an unnamed hedge fund manager suggesting that capital inflows from hedge funds have been fueling the meme coin rally. Secondly, she noted that meme coins have the ability to provide larger percentage gains than Bitcoin, as a relatively small move in the larger cryptocurrency can translate to exaggerated price movements for these more volatile meme tokens.

Finally, Jones pointed to expectations of intense crypto regulation in 2025, which could potentially curb the meme coin phenomenon. “The profits this year will soar, then they will fade away like the dot coms did.”, she warned. “They were fun and lucrative while they lasted.”

Potential Rotation into Quality Altcoins

As the meme coin frenzy continues to captivate the crypto markets, some analysts have suggested that the liquidity generated by this speculative mania could eventually rotate back into quality altcoins with strong fundamentals and real-world utility.

Polkadot (DOT), for instance, has seen its price wake up in recent days, reclaiming the $10.00 threshold – a level last seen in May 2022. This resurgence in DOT’s price could be an early indicator of investors rotating profits from the meme coin craze into more established and fundamentally sound altcoin projects.

While the meme coin mania may be dominating the headlines currently, some market observers believe that, as the Bitcoin season peaks and the broader crypto market matures, there could be a growing consolidation, with investors shifting their focus back to cryptocurrencies and projects with real-world use cases and long-term growth potential.

Correlation with BTC’s Performance for Meme Coins Remains Strong

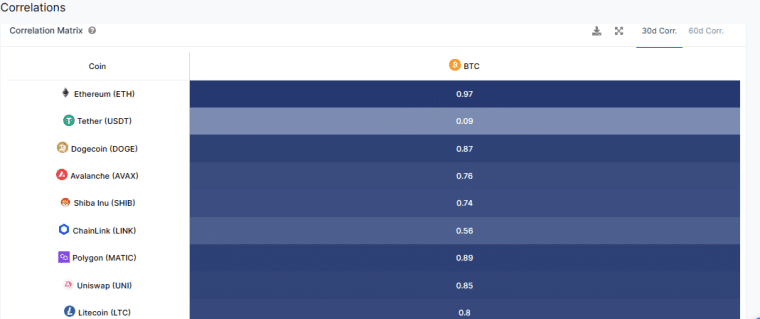

The correlation between the performance of meme coins and Bitcoin (BTC) has remained strong lately, meaning that the positive momentum they are seeing can be explained primarily by the overall sector’s attractiveness and not a niche-specific craze.

Data from blockchain analytics firm IntoTheBlock shows a current correlation of 87% between Bitcoin and Dogecoin, the leading meme coin. This means that as Bitcoin’s price continues its ascent towards its all-time high of around $69,000, meme coins are also rallying alongside it – but with significantly greater percentage gains.

This correlation dynamic highlights the pivotal role that Bitcoin plays in the broader crypto market, with its price movements often setting the tone for the performance of altcoins and meme coins alike.

Meme Coin Market Cap Exceeds NFTs and DeFi

The staggering rise in meme coin prices has had a profound impact on the overall market capitalization of the sector, with the aggregate value of these tokens already surpassing that of both the non-fungible token (NFT) and decentralized finance (DeFi) sectors.

According to data from CoinMarketCap, the combined market capitalization of the meme coin category stood at a staggering $51.61 billion as of press time, marking a 17% growth in just 24 hours.

With the total crypto market capitalization surpassing $2.5 trillion, numerous meme coins have emerged as notable winners, flourishing and exceeding the market caps of entire sub-sectors within the crypto industry.

This remarkable feat underscores the incredible demand and speculation surrounding meme coins as investors continue to pour money into these highly volatile and often controversial assets.

Regulatory Risks and Sustainability Concerns

While the meme coin rally has captured the imagination of investors and crypto enthusiasts alike, concerns have been raised about the sustainability of this phenomenon and the potential regulatory risks that could dampen the frenzy.

As Linda P. Jones pointed out, there are expectations of intense crypto regulation looming on the horizon, with 2025 being cited as a potential turning point. Increased regulatory scrutiny and oversight could potentially curb the meme coin craze, as authorities aim to protect investors and maintain market integrity.

Furthermore, the highly speculative nature of meme coins raises questions about their long-term viability and utility within the broader crypto ecosystem. Many critics argue that these tokens lack real-world use cases and are merely driven by hype and momentum, making them susceptible to sudden and dramatic drawdowns.

Nonetheless, the current meme coin mania has undoubtedly captured the attention of the crypto community, with market participants closely watching for signs of an impending altcoin season and the potential for further gains – or losses – in this highly volatile and unpredictable corner of the market.