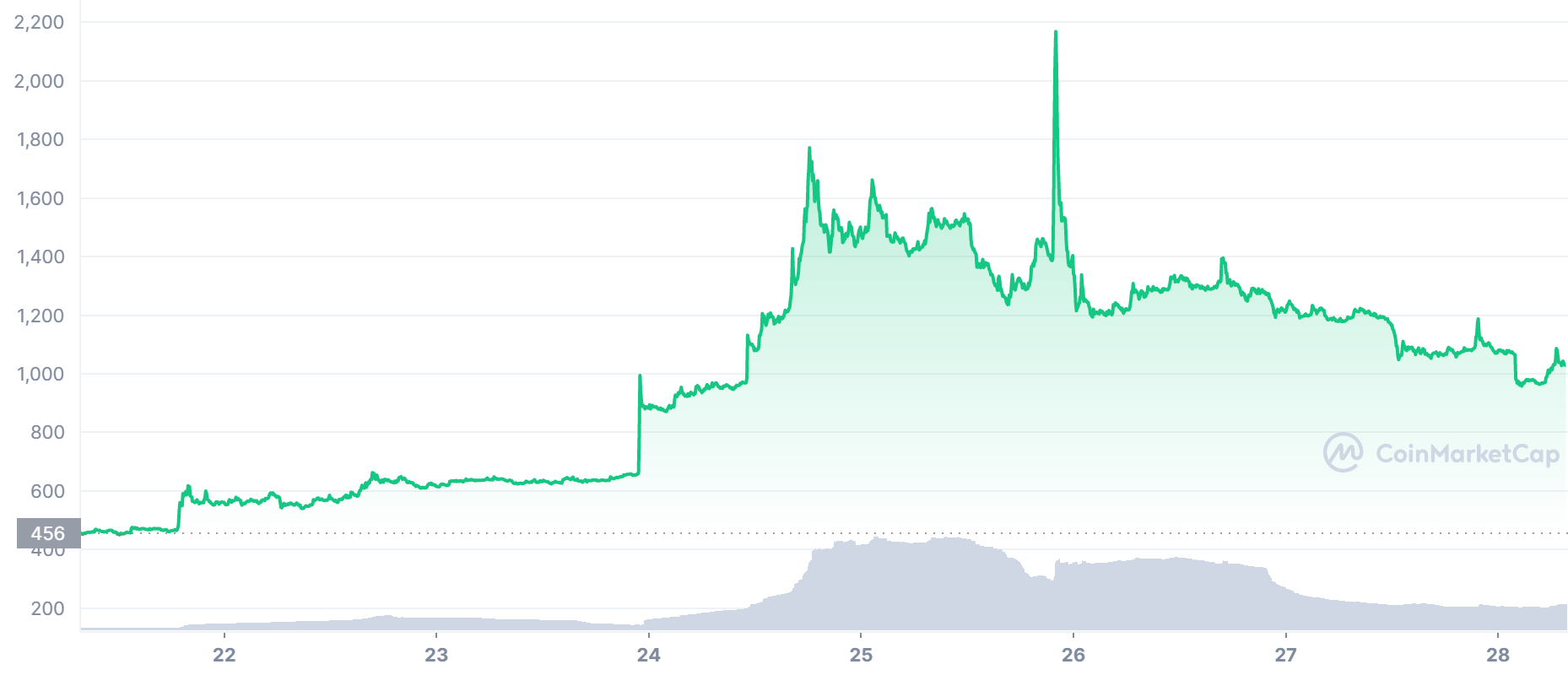

The past week was a boon for the cryptocurrency and decentralised finance (DeFi) spaces. Digital assets, after weeks of price losses, experienced price gains last week. While most of the large-cap coins hugged the headlines, several small-cap coins posted impressive gains. DFI.Money (YFII) posted 150% gains in the past week. Should investors buy YFII now? We’ll answer this question below.

The past week was a boon for the cryptocurrency and decentralised finance (DeFi) spaces. Digital assets, after weeks of price losses, experienced price gains last week. While most of the large-cap coins hugged the headlines, several small-cap coins posted impressive gains. DFI.Money (YFII) posted 150% gains in the past week. Should investors buy YFII now? We’ll answer this question below.

YFII Technical Analysis

Currently, YFII trades at $1009. The digital asset’s price is up by an impressive 121% in the past week, making it one of the best-performing coins in the market.

With a positive moving average convergence divergence (MACD), YFII is showing a buy signal. For investors looking to invest in cryptocurrency, this indicator will also serve as an encouragement to buy YFII. The coin’s relative strength index (RSI) of 57.38 indicates that YFII is trading in the underbought region – another encouraging buy signal.

Cryptoassets are a highly volatile unregulated investment product.

DFI.Money: Yearn Finance’s Hyperactive Fork

DFI.Money is a yield aggregation tool that focuses on helping DeFi market participants to optimise yields on their investments.

As a result, a group of users decided to fork the protocol, enacting the YIP-8 proposal to reduce yield payouts weekly.

Today, DFI.Money serves the same purpose as Yearn Finance – helping users who would like to invest in DeFi protocols to optimise their yields. On its website, DFI.Money claims that it is entirely community-owned and doesn’t offer any commercial incentives to users.

Market Action Leads to YFII Pump

Presently, there seems to be no traceable reason for the surge in YFII’s price in the past week. However, it isn’t a rarity for crypto assets to see significant jumps in the weekly chart. Many large-cap coins saw double-digit jumps in the same period, and YFII’s smaller-cap status makes it more susceptible to large gains if whales step in and buy YFII.

With analysts expecting the market to trend higher this week, it is definitely worth keeping an eye on YFII.

Related News

DeFi Coin (DEFC) - Undervalued Project

- Listed on Bitmart, Pancakeswap

- Native Token of New DEX - defiswap.io

- Up to 75% APY Staking

- Whitepaper and DeFi Tutorials - deficoins.io