Swarm Markets, a German blockchain company, has introduced an innovative product that tokenizes gold to bring the precious metal to the Web3 space.

The company is part of an emerging segment of the crypto industry that aims to create digital versions of real-world assets (RWA) and it is licensed and regulated by BaFin – Germany’s financial watchdog.

It's time we unveil our Plan ₿…

⚡We've launched gold on Bitcoin! ⚡ 👇 pic.twitter.com/8JNexIb9zi

— Swarm (@SwarmMarkets) October 17, 2024

Its latest product uses the OrdinalsBot platform to allow investors to mint and trade physical gold on the Bitcoin Blockchain via the Ordinals Protocol.

Their approach links satoshis (a 1/100,000,000 unit of a BTC token) with one unique gold kilobar’s serial number as an ownership certificate to the buyer.

Existing on-chain synthetic assets linked to gold don’t offer the kind of transparency and flexibility that Swarm Markets is introducing with this novel scheme.

The launch comes just months after they successfully expanded their flagship gold NFT to the Ethereum network to complement the product’s initial availability on the Polygon blockchain.

Swarm Markets Partners with Vaults in the UK, Dubai and Switzerland

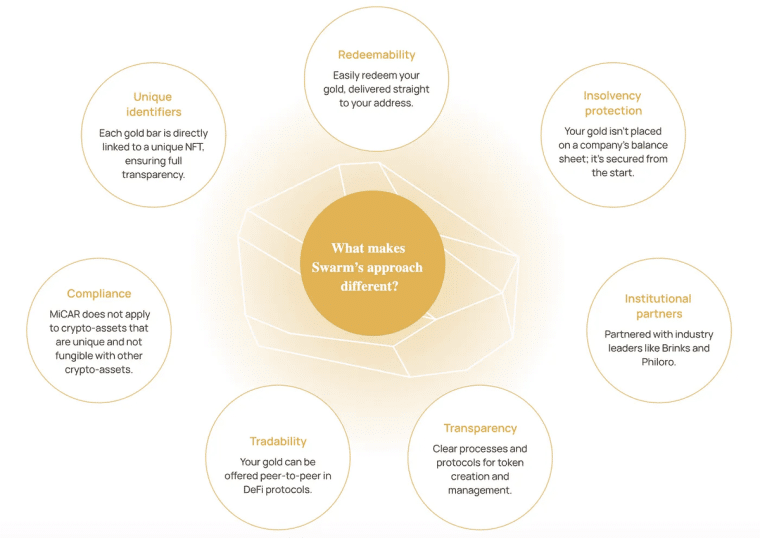

Swarm Markets’ enticing offering includes partnerships with leading global gold custodians like Brink’s Global Services alongside a network of secure vaults spread throughout the globe where the gold bars bought by investors are safely stored.

The company claims to be fully compliant with the Markets in Crypto-Assets (MiCA) regulations in Europe, which require the implementation and enforcement of Know Your Customer (KYC) protocols for physical delivery.

Moreover, the direct ownership model ensures that there’s a 1:1 ratio between the number of non-fungible tokens (NFTs) created and the number of gold bars in physical storage. Investors also have the right to redeem their BTC ordinals for their physical gold bars at any given point.

The minimum investment for this product is quite low and immediately positions Swarm Markets as a tough competitor in the gold dealing space as investors can buy “commodity tokens” for as little as $1 to democratize access to the precious metal via the blockchain. Eligible investors can also engage in trading and options issuance.

“Gold is the ultimate safe haven asset because it is one of the few rare assets that you can hold in your hand. Swarm’s technical approach to bringing gold on-chain offers unrivaled transparency and flexibility to any other gold product on-chain today,” commented Philipp Pieper, co-founder of Swarm Markets.

Gold’s Positive Performance in 2024 Helps Increase the Adoption of Tokenized Assets

With this new gold product, the platform is aiming to allow all kinds of investors regardless of their qualifications, net worth, or even knowledge of how the Web3 space works to easily buy and store gold.

Swarm Markets is also exploring how to partner with institutional players to offer broader access to its products.

Tokenized gold has been in high demand lately, especially by crypto enthusiasts who believe that there are enough good reasons to invest in the precious metal.

Thus far in 2024, the price of gold has increased by over 20%. This growing demand creates a positive environment for on-chain products like this to thrive while they may also increase adoption rates for blockchain technology.

Aside from this new product based on the Bitcoin Ordinals protocol, Swarm has also partnered with Uniswap and dOTC to allow investors to invest in real-world assets via tokenized products like xGold.

The multi-chain compatibility of bundle tokens and the ability to bridge and trade between different blockchains have positioned Swarm Markets as a pioneer in the digital gold trading space.

Swarm Markets Aims to Become the Amazon Web Services of Tokenized Gold

Swarm Markets’ technical approach revolutionizes traditional gold investment by offering enhanced liquidity through faster and more efficient transactions.

The platform’s architecture enables easier trading, buying, and selling through tokenization while lowering barriers to entry for smaller investors through fractional ownership.

The direct ownership of specific gold bars, which can be verified via on-chain records provides complete transparency about the underlying assets that back the ordinals and provide investors with unprecedented control over their investments.

The platform’s integration with DeFi protocols allows gold tokens to be used as collateral and opens up lending, borrowing, and yield-generation opportunities.

According to Pieper, the platform’s vision is to become the “Amazon Web Services of gold on-chain.”

Swarm Markets Could Revolutionize Gold Investments with On-Chain Products

Swarm Markets is strategically positioned for significant growth through planned partnerships with institutional players and expansion to additional blockchain networks.

The platform continues to develop new tokenization methods, enhanced trading features, and improved accessibility features. The development of structured on-chain products and deeper integration with broader DeFi ecosystems demonstrates their commitment to innovation in the space.

The platform’s multi-chain approach, robust security measures, and regulatory compliance position it as a key player in bridging traditional finance and digital assets.

As the platform evolves, the founders aim to remain focused on revolutionizing how investors interact with one of the world’s oldest and most trusted assets while simultaneously pushing the boundaries of blockchain technology adoption.