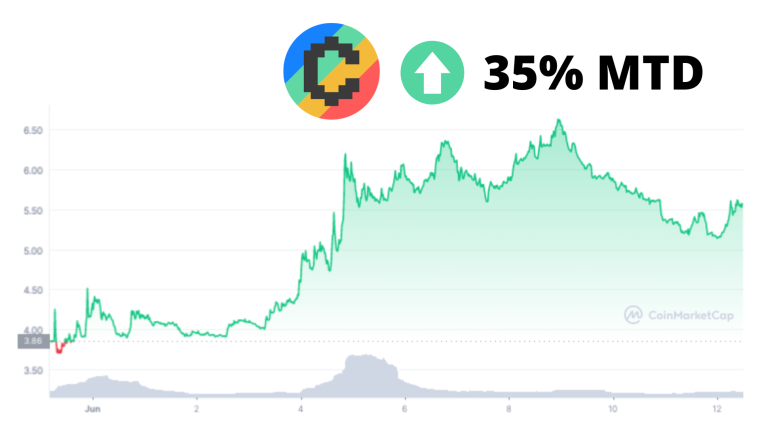

This month has been a positive one for the native token of the Convex Finance protocol – CVX – as it has recorded a 35% gain despite the turmoil and chaos.

It appears that the public’s trust in decentralized staking and yield farming projects could be healing now that the ecosystem has been cleansed and the strongest players have proven their ability to live up to their promises.

At the moment, the total value locked within Convex Finance is $4.17 billion and, even though this metric remains on a downtrend compared to the beginning of the year, data from DeFi Llama indicates that the decline could now be slowing down.

Despite the challenges that the decentralized finance (DeFi) ecosystem has gone through this year, Convex Finance still ranks 6th among the largest protocols by market capitalization – only three spots away from Curve Finance.

This reflects the strength of the community that backs the project as they still trust in its ability to deliver even at a point when market conditions are deteriorating rapidly.

What is Convex Finance?

Convex Finance is a DeFi protocol that allows investors to earn money by either becoming liquidity providers for Curve Finance (CRV) – one of crypto’s largest DEX – or by staking either CRV or CVX – the project’s native token.

Curve’s native token CRV requires liquidity from token holders so users can pay the fees charged by the protocol for swapping cryptocurrencies. CRV holders can use Convex to become liquidity providers and earn a fraction of the trading fees paid by those who use the Curve Finance platform.

Those who opt to participate in this activity can earn rewards in CVX, CRV, and cvxCRV tokens – which is a tokenized version of veCRV – the synthetic token issued when CRV is locked.

This DeFi platform charges minimal trading fees and no withdrawal fees and that makes it an appealing choice in the yield farming space.

How Has Convex Finance Performed in 2022?

The value of CVX has dropped nearly 90% since the year started as the DeFi ecosystem took a strong hit during the crypto winter amid the collapse of protocols such as Terra’s Anchor Protocol.

The severe drop that most cryptocurrencies experienced also prompted what’s known as a deleveraging event in which borrowers’ positions were liquidated as their collateral dropped below the minimum required by the lender.

In addition, market participants have adopted a risk-off attitude this year as the macroeconomic backdrop has changed dramatically with central banks across the world now embarked on a journey to raise interest rates and descale their balance sheets in response to elevated inflationary pressures.

However, the latest positive performance of CVX is encouraging and may be pointing to the beginning of a recovery if interest in DeFi platforms starts to pick up once again.

Convex Finance Price Prediction (2022)

As the chart above shows, the price of CVX recently made a higher high after crossing the $5.2 threshold. This uptick coincides with the launch of a proposal to align the protocol’s Frax gauge with that of the Curve gauge vote.

This proposal was unanimously approved by 13 million CVX holders on 10 July and has already been implemented as its goal is to promote the protocol’s adoption for both CRV and FRAX staking.

Momentum indicators are currently on an uptrend and that favors a positive short-term outlook for CVX as well although it seems too early to tell if bulls have enough ammo to keep the rally going as the Relative Strength Index (RSI) is struggling to remain above 50 while the MACD has not yet entered positive territory.

According to predictions from Wallet Investor, the near-term outlook for CVX is bullish based on an assessment of its technical indicators. In the next 14 days, the algorithm is expecting that the price could surge to $6.3 per coin implying a 15% upside if that target is hit.

Meanwhile, forecasts from Gov.Capital are also favoring a positive short-term outlook with the algorithm estimating that the price could rise to over $6.7 per coin within the next 14 days for a 22% gain.

Other crypto assets like CVX also have a lot of upside potential despite today’s challenging market conditions. This is the case of Battle Infinity and its native token IBAT – an innovative play-to-earn (P2E) cryptocurrency that could soon become the next Axie Infinity. Find out more about this project in its official Telegram group.

Other Related Articles:

- What is DeFi Crypto? Beginners Guide for 2022

- Best DeFi Coins to Buy in 2022

- Best Yield Farming Crypto Platforms of 2022

Battle Infinity - New Metaverse Game

- Listed on PancakeSwap and LBank - battleinfinity.io

- Fantasy Sports Themed Games

- Play to Earn Utility - IBAT Rewards Token

- Powered By Unreal Engine

- Solid Proof Audited, CoinSniper Verified