The Commodity Futures Trading Commission (CFTC) is facing opposition from cryptocurrency exchanges and other important players in the crypto industry for its proposed rules to govern prediction markets.

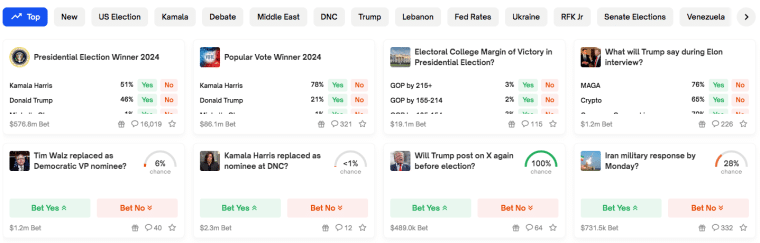

In May this year, the agency published a proposal that would categorize event contracts, also known as prediction markets, as a gaming activity as it involves betting on the outcome of different types of events. The proposal comes at a time when prediction markets like Polymarket are more popular than ever with thousands of users betting on various outcomes, mostly in financial markets and politics.

The move was supported by three Democratic commissioners who were reportedly concerned about the integrity of the market and believed that the CFTC had the authority to weigh in.

The CFTC Proposal Would Effectively Ban Political Wagers Within Prediction Markets

The proposal would ban any outcome-based wagers concerning controversial and possibly unethical events like terrorism and war. However, the part that outraged most industry professionals was a clear intention to prohibit wagers involving political events like the upcoming 2024 US presidential election. This would be especially problematic for industry players because a large portion of the volume in prediction markets is related to politics.

The CFTC’s approach would result in a categorical ban on broad types of event contracts rather than evaluating them on a case-by-case basis. This would help the CFTC keep the space clean from things like political corruption and market manipulation as it would be incredibly difficult (or functionally impossible) for the CFTC to evaluate every single event contract.

Market manipulation in particular could be a big problem with these sites as insiders could make unfair bets with nonpublic information with little oversight.

The agency argues that some prediction markets may be harmful to society, citing potential risks to the democratic process in the specific case of wagers associated with political events. The proposal also raises questions about the extent to which the CFTC has statutory authority to regulate this type of offering.

If implemented, the CFTC’s proposed rules would have far-reaching implications for this ecosystem. Many popular prediction markets, particularly those focused on political outcomes or sporting events, could be effectively banned in the United States. Even if the platforms are able to pivot to other events, they will almost certainly receive less traffic and interest these kinds of wagers.

Critics argue that this broad categorization could hinder innovation in the space as it would limit the development of new and potentially valuable forecasting tools. The rules could potentially push prediction market activity offshore or into unregulated spaces, which would result in reduced transparency and increased risks to bettors.

Meanwhile, other industry participants argue that the proposal overlooks the positive economic impact of prediction markets, including their ability to aggregate information efficiently.

Prediction Markets Are Huge – Over $1 Billion in Bets Have Flowed Through Them

Political events have catalyzed an increase in the popularity of prediction markets, particularly in the United States, as an important election is about to take place in November this year.

These markets efficiently collect and aggregate information as participants have a financial stake in whatever outcome they believe would come to fruition. In a way, this gives prediction markets an advantage over traditional polls and surveys as the latter are influenced by lighter decision-making processes from those who participate.

Blockchain technology has helped prediction markets be as transparent as possible as they rely on smart contracts to determine the odds of all outcomes and automatically distribute the proceeds of the wager to those who successfully predicted it.

Some prediction markets serve as tools for hedging against various risks, including political and economic outcomes. Supporters argue that prediction markets offer valuable insights into future events, backed by financial accountability.

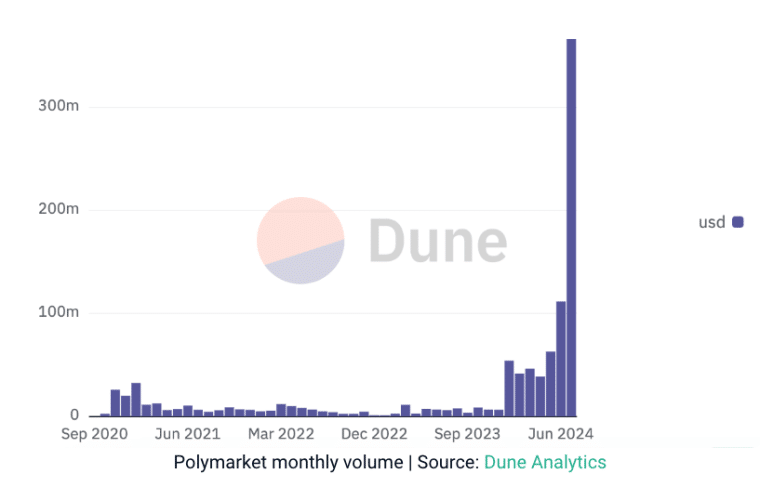

Polymarket has emerged as arguably the most successful of all prediction markets with betting volumes of nearly $400 million as of July 2024 according to data from Dune Analytics. Meanwhile, wagers associated with the United States 2024 presidential election have single-handedly amassed $550 million from bettors.

Prediction markets have reportedly attracted over $1 billion in bets, which indicates the high interest that users have on these platforms. They facilitate a transparent marketplace where many different types of wagers apart from political ones can be placed. Some other interest and eventful categories include geopolitical events and technological advancements.

Coinbase and Gemini Are Among Those That Oppose the CFTC’s Proposal

Event markets are a promising area of our future economy, and that is why we are responding today to the @CFTC’s notice of proposed rulemaking. We fully support the CFTC’s mission to uphold the integrity of the US derivatives market and believe they can provide a robust…

— paulgrewal.eth (@iampaulgrewal) August 9, 2024

Major cryptocurrency exchanges and industry figures have voiced strong opposition to the CFTC’s proposed rules.

Paul Grewal, Coinbase’s Chief Legal Officer, submitted a letter urging the CFTC to withdraw its proposal. Coinbase argues that the CFTC’s definition of “gaming” is overly broad and ambiguous.

The exchange also contends that the proposal exceeds the CFTC’s statutory authority. Coinbase claims that the proposal fails to recognize the positive economic impact of prediction markets and it advocates for a contract-by-contract evaluation approach rather than use a “one-size-fits-all” method.

Meanwhile, Gemini, another major US-based crypto exchange, also challenged the CFTC’s proposed rule. Gemini believes that the proposal misinterprets the Commodity Exchange Act’s (CEA) goals and Congress’s intent.

The exchange criticizes the proposal for not providing concrete evidence of the harm allegedly caused by prediction markets. It argues that the rule could undermine public interest rather than protect it. Cameron Winklevoss, co-founder of Gemini, emphasized that decentralized prediction markets are an important innovation with genuine public utility. They deemed it a “solution in search of a problem.”

“There is nothing thoughtful about a blanket ban on markets that have been employed for decades in one form or another and have proven extremely reliable tools for forecasting future events. More recently, the growth of these markets built on top of crypto protocols promises greater access, liquidity, and aggregation of the wisdom of the crowd for all,” Winklevoss stressed.

Crypto.Com’s SVP Also Claims “Overreach”

Steve Humenik, Crypto.com’s SVP, also submitted a comment arguing that the CFTC should not overreach its authority. Crypto.com argues that the CFTC must follow a three-step process dictated by the CEA before banning any contracts. The exchange stressed that Congress did not intend to give the agency room to impose such broad prohibitions on event contracts.

“We urge the CFTC not to sidestep its obligations to undergo a three-step review process with respect to these types of event contracts, and to eliminate this aspect of the Event Contracts NOPR [notice of proposed rulemaking],” a statement from Humenik reads.

Several other industry leaders and organizations have joined the opposition. Dragonfly Capital argued that the recent Supreme Court decision that overturned the long-lasting ‘Chevron doctrine’ limits the CFTC’s interpretive authority without a Congressional mandate.

Meanwhile, the popular trading platform Robinhood has also voiced its concerns about these proposed rules.

Democratic Lawmakers Cite National Security Concerns and Call for Stricter Regulation

While the crypto industry largely opposes the CFTC’s proposal, some political figures have voiced their support for increased regulation.

Senator Elizabeth Warren and other Democrats have pushed for the CFTC to draft final rules that clarify which event contracts will be prohibited.

They argue that such markets could pose risks to the integrity of the electoral process. Pro-regulation voices also cite concerns about the potential for prediction markets to become another avenue for unaccounted political influence. Lawmakers expressed concerns about foreign actors potentially using prediction markets to meddle in US elections.

As the debate over the CFTC’s proposed rules continues, several key questions emerge about the future of prediction markets. Regulators face the challenge of striking a balance between fostering innovation and protecting the public’s interest.

The industry must consider which measures can be implemented to ensure the integrity of prediction markets without stifling their potential benefits as data aggregators.

Stakeholders are exploring alternative regulatory approaches that could address these concerns about market manipulation and integrity without resorting to broad prohibitions.