In a landmark move, the United Kingdom’s Financial Conduct Authority (FCA) announced on Monday that it would not object to requests from recognized exchanges to create a market segment for cryptocurrency-backed exchange-traded notes (ETNs).

However, these products will only be available to professional investors such as investment firms and credit institutions authorized to operate in the financial markets.

The FCA’s decision is not considered a direct shift in the regulator’s perception regarding crypto-linked investment products and their suitability to retail investors as they are still considered too risky for this group. The UK’s financial watchdog maintains that the ban on the sale of crypto ETNs and derivatives to retail consumers will remain in place due to the “harm they pose”.

“The FCA continues to remind people that cryptoassets are high risk and largely unregulated. Those who invest should be prepared to lose all their money”, the regulator highlighted in its official press release published today.

However, the measure does impact the overall demand that cryptocurrencies may experience within the next few months as deep-pocketed institutional investors and high-net-worth individuals who qualify to purchase these ETNs may invest billions of dollars into these exchange-listed products.

What are Exchange-Traded Notes (ETNs)?

An exchange-traded note (ETN) is a debt security issued by a bank or other financial institution. Unlike an exchange-traded fund (ETF), which holds the underlying assets, an ETN is an unsecured debt obligation that promises to pay out at maturity the full value of the underlying index or benchmark minus management fees.

ETNs vs ETFs – Are They Good for the Crypto Market?

ETNs have become increasingly popular investment vehicles as they provide exposure to alternative asset classes like cryptocurrencies without the need for direct ownership or custody of the underlying assets. Investors can trade ETNs on major stock exchanges, just like regular stocks or ETFs, during normal trading hours.

This could be somewhat positive for the crypto market as it could drive ETN-makers to purchase large amounts of the underlying asset. However, because they are ETNs and not ETFs, the issuers don’t actually have to hold the underlying asset. So, ETN inflows may have a significantly smaller effect on crypto prices than the recent surge of spot Bitcoin ETF demand.

Bitcoin Reaches New All-Time High While Value of Crypto Ecosystem Stands at $2.7 Trillion

The FCA’s announcement has generated significant excitement within the crypto community as it signals a growing acceptance of digital assets by regulatory authorities. Bitcoin’s price surged by more than 4% in the past 24 hours to a fresh all-time high of $72,400 following the announcement while Ethereum also climbed 4.4% to $4,050.

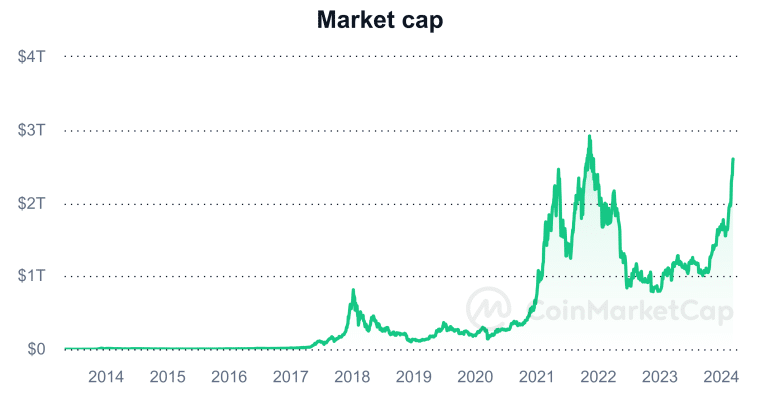

The overall value of cryptocurrencies as tracked by CoinMarketCap is standing at $2.72 trillion as of today and is just 7.4% away from the all-time high recorded in November 2021.

“Bitcoin is by far the most well-known crypto asset, and for it to be very difficult for the UK public to be able to buy it, how can we claim to be a crypto hub if we only offer risky ways of buying this asset?”, commented Tim Lowe from the London-based Ethereum staking facilitator Attestant.

The London Stock Exchange (LSE) was quick to respond to the FCA’s announcement, confirming that it would accept applications for the admission of Bitcoin and Ether ETNs from the second quarter of 2024.

In its Crypto ETN Admission Factsheet, the LSE outlined strict requirements for these products, including that they must be physically backed, non-leveraged, and have a publicly available market price or value measure of the underlying asset.

Institutional Interest is High for Crypto-Linked Exchange-Traded Products

The FCA’s decision to allow crypto ETNs for professional investors aligns with a broader global trend of increased institutional adoption of digital assets. In January, the US Securities and Exchange Commission (SEC) approved the first-ever spot Bitcoin ETF, paving the way for major financial institutions like BlackRock and Fidelity to offer crypto-linked investment products.

According to data from CoinShares, the newly approved group of US spot Bitcoin ETFs has collectively pulled in $10 billion in assets since their launch in January, underscoring the strong institutional demand for regulated crypto investment vehicles.

Despite the positive developments, the FCA remains cautious about the risks associated with cryptocurrencies. In its statement, the regulator reiterated its stance that “cryptoassets are high risk and largely unregulated”, repeatedly warning investors that they “should be prepared to lose all their money.”

Jake Green, Global Head of Financial Regulatory at law firm Ashurst, commented that, although the regulator is green-lighting ETNs for institutional investors, the watchdog “clearly does no be want to go near” the notion that “retail investors may purchase crypto in the form of a financial instrument which FCA regulates.”

The FCA’s concerns echo those of other regulators around the world who have expressed apprehension about the potential risks posed by cryptocurrencies, including price volatility, market manipulation, and their use in illicit activities.

To address these challenges, the FCA has stated that it is collaborating with the UK government, international partners, and industry stakeholders to develop a comprehensive regulatory framework for the crypto sector as it aims to lead international standards in this space.

The regulator has already taken steps to protect consumers like introducing new financial promotion rules that require crypto firms to comply with regulations similar to those that are already in place for high-risk financial products like contracts for difference (CFDs).

FCA’s Decision May Mark Pivotal Moment for Exchange-Traded Products Across the Globe

As the crypto industry continues to evolve and gain mainstream acceptance, the FCA’s decision to allow crypto ETNs for professional investors is likely to be a precursor to further regulatory developments in the UK and beyond.

Market participants and industry experts alike believe that clear and sensible regulation will be crucial in fostering innovation while protecting investors and maintaining market integrity.

As the crypto rally continues to heat up, other positive news like this could continue to add fuel to the uptrend. Once again, Bitcoin is making headlines, and if history proves to be true, everything points to the notion that this could be the beginning of a new bullish cycle for the asset that could end up hitting the widely expected milestone of $100,000.