Seven days ago, the Federal Reserve decided to cut its benchmark interest rate by 50 basis points – the first time it does this since 2020.

The odds among analysts were initially divided between a 50bps and 25 bps cut but the Fed ultimately went for the most aggressive of the two alternatives. This has been interpreted as a sign that officials from the central bank are a bit worried about the trajectory of the US economy.

Market participants believe that, even though they were prepared for this event, it will still have significant consequences on the economy and the performance of various asset classes including cryptocurrencies. Here’s what analysts are saying about the effects the rate cut seems to be having on these assets.

How Will Cryptos React to the Cut?

Analysts have been weighing and commenting on the potential impact of the latest interest rate cut since the news dropped. Dmitriy Berenzon, a partner at Archetype, said: “Crypto still represents a risk-on asset.”

He highlighted that low-interest rate environments tend to attract investors to financial assets that can produce higher yields as is the case of Bitcoin (BTC) and altcoins.

Meanwhile, Jake Ostrovskis, an OTC trader for the crypto trading firm Wintermute, told Decrypt: “Historically, such a move increases liquidity in the financial system, which tends to benefit risk-on assets like Bitcoin.”

He emphasized that the price of digital assets tends to rise in this environment.

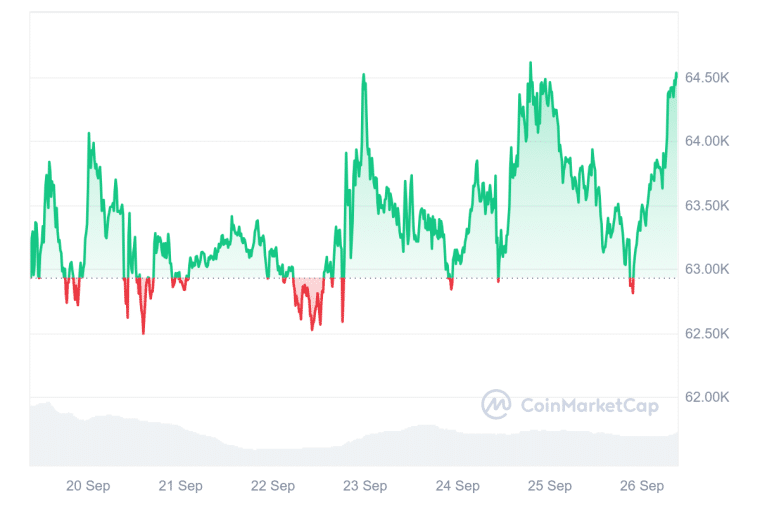

Thus far, the price of BTC has reacted positively to the interest rate cut as it accumulates a 3.3% advance in the past 7 days and currently stands at $64,413. Meanwhile, prominent altcoins like Ether (ETH) and Solana (SOL) have seen even higher gains of 7.5% and 8.8% respectively during this period.

The market sentiment has also shifted according to the Crypto Fear & Greed Index, moving from 45 on September 18 – in the fear zone – to 59. This indicates that market participants are now feeling “greedy” (exposing themselves to more risk) which would also result in an increase in the value of digital assets in the mid-term.

Rate Cuts Result in Higher Liquidity, Which Tends to be Positive for Crypto Assets

Berenzon claimed that, aside from the rate cut, other factors could also weigh on the price of cryptocurrencies in the short term including geopolitical tensions and the situation in the real estate market in China.

Youwei Yang, Chief Economist at the mining firm BIT Mining Limited, emphasized that “the magnitude of the rate cut” could significantly impact “market liquidity, investor sentiment, and the relative attractiveness of these assets.”

The fact that the Fed opted for the most aggressive cut of the two that were on the table should not be ignored. Typically known for his conservative approach, the head of the central bank, Jerome Powell, probably had good reasons to cut rates this much.

However, according to blockchain analytics firm Nansen’s principal research analyst Aurelie Barthere, the Fed’s move to lower interest rates was already priced into the crypto market. In a report shared with Cointelegraph, Barthere wrote: “The Fed put has also been anticipated by rate markets: in a sense, last week, the Fed was catching up with market expectations.”

She claimed that while “keeping crypto allocation or skin in the game makes sense as the Fed has just given more juice to this bull market,” a lot of the potential upside is “already in the price of risk assets.”

Nansen’s “comfortable” strategy involves “trimming crypto allocation on rallies,” given the “asymmetry to the downside.”

BTC Correlation with S&P 500 Rises to 2-Year High

The FOMC was volatile, but crypto buoyancy ensued after the double cut.

BTC just crossed $63,000 and has seen a solid 4.5% gain since the U.S. interest rate decision, while ETH exhibits relative strength.

Amidst DXY weakening, gold, the S&P, and the Nasdaq all see solid days. pic.twitter.com/xQTJh91fRT

— K33 Research (@K33Research) September 19, 2024

Other analysts have resorted to technical analysis to try to predict the trajectory that BTC and digital assets could take for now. K33 Research analysts emphasized a major change in the 30-day correlation between BTC and the well-known S&P 500 index.

They claim that the correlation has increased to levels not seen since 2022, which indicates that BTC is now more sensitive to the Fed’s policy and may behave increasingly similarly to how equity indexes do.

FalconX Head of Research David Lawant told Decrypt: “Correlations between cryptocurrencies and broader risk assets are at an 18-month high, prompting crypto investors to pay closer attention to these economic trends.” He added that a surprise 50 basis-point cut could give risk assets an “unexpected boost.”

Meanwhile, Arthur Hayes, the co-founder of BitMEX, made some bold statements about cryptos and claimed that they may crash a few days from now as he expects a spike in inflation levels and a stronger yen.

“The rate cut is a bad idea because inflation is still an issue in the US, with the government being the biggest contributor to the sticky price pressures. If you make borrowing cheaper, it adds to inflation,” Hayes said.

He added: “The second reason is that the interest rate differential between the U.S. and Japan narrows with rate cuts. That could lead to sharp appreciation in the yen and trigger unwinding of the yen carry trades.”

Arthur Hayes Claims BTC Could Crash Soon

The Fed’s decision to cut rates by 50 basis points comes against a backdrop of growing macroeconomic instability. The US labor market, which had been resilient in 2022, is showing signs of strain. Recent job reports revealed troubling data with the US economy creating fewer jobs than expected while the unemployment rate is steadily rising.

Globally, the picture is equally concerning. Europe is still facing economic stagnation with the Eurozone posting lackluster GDP growth. On the other hand, Japan is facing mounting inflationary pressures while attempting to unwind decades of ultra-loose monetary policy.

Meanwhile, China’s economy continues to falter and has seen a slowdown in factory output, consumption, and rising unemployment that is threatening its growth engine.

Hayes believes that we are witnessing the end of the era dominated by central banks.

“I 100% agree with that prognosis. The era of central banks is over. The politicians are going to take over and tell banks to create liquidity in specific sectors of the economy,” he stated.

He sees this as a positive development for the crypto market, adding: “So you’re going to see soft and hard capital controls in different locations, which means that crypto is the only asset that you can own that’s globally portable and gets you out of that system.”

Potential Winners in a Low-Interest Rate Environment

Investors seeking yield may turn to alternatives in the decentralized finance (DeFi) market like the Pendle or Ethena, both of which offer staking opportunities that can generate annual returns ranging from 4% to 45% APY.

These products will likely see increased demand in the short term and so will their native tokens.

On the flip side, Hayes noted that demand for tokenized Treasuries, an interest-rate-sensitive product, could weaken in a low-interest rate environment.

While rate cuts have been historically positive for hard assets like Bitcoin, the speed and size of the cut indicate that the Fed is not content with how the economy is faring at the moment or they are overly confident that inflation won’t spiral out of control again.

In the long run, as central banks constantly intervene in financial markets, Bitcoin’s fundamentals may continue to strengthen. In a world where fiat-based economies are facing growing pressures from mismanagement and politicization, BTC and other cryptocurrencies may continue to offer a compelling decentralized alternative.

Investors may face volatility in the near term but those with enough conviction in crypto’s role as a sound monetary system may see today’s rate cut as another step toward validating its long-term value proposition.