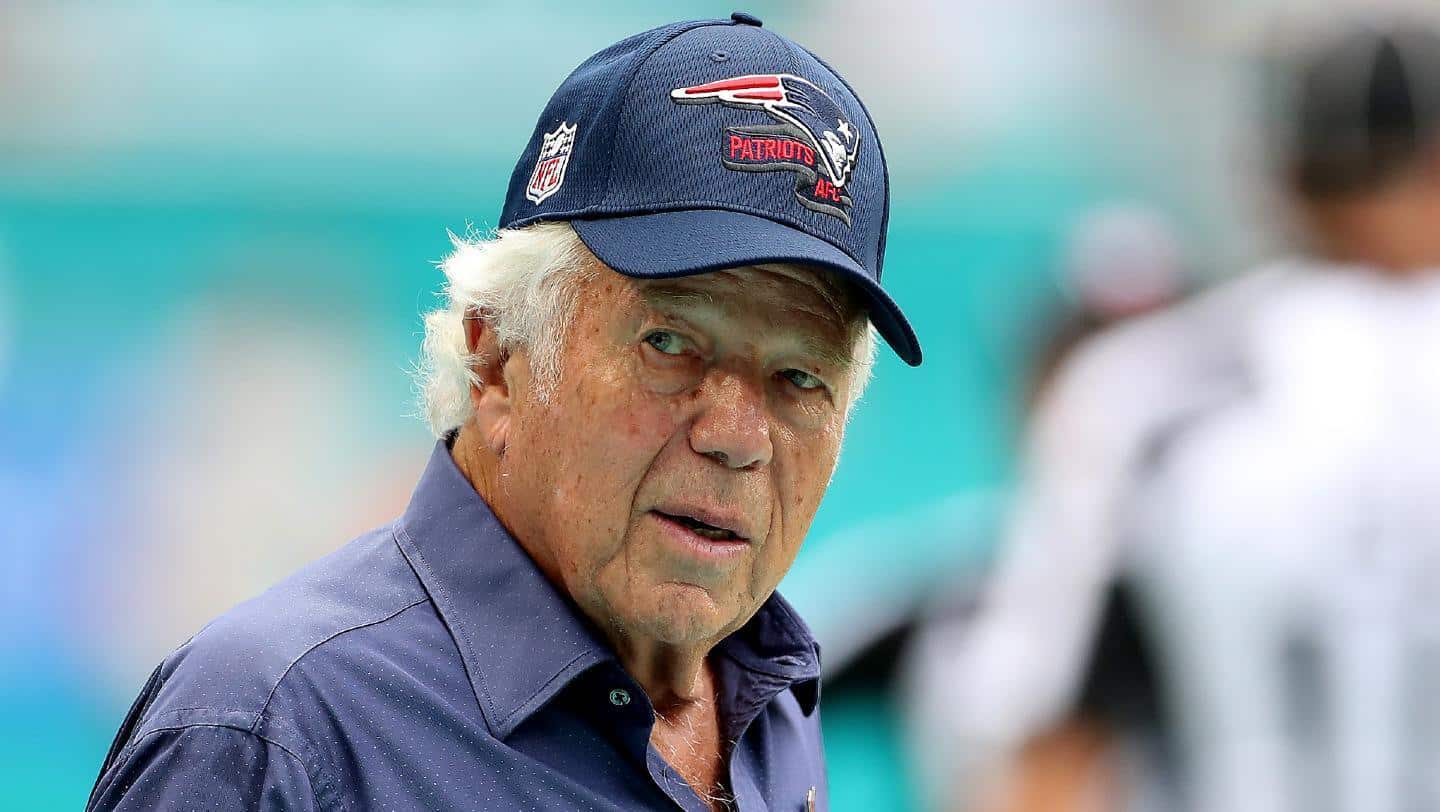

Robert Kraft is best known for owning the New England Patriots NFL team but he is also an incredibly accomplished businessman whose net worth makes him among the richest people in the world.

He is the chairman and CEO of the Kraft Group (different from the food giant Kraft-Heinz), the holding company for his various businesses.

Robert Kraft’s net worth is estimated at around $12.8 billion in 2024.

Let’s check out his career, net worth, and life story to see what insights we can learn from the Massachusetts-born businessman.

How Much Is Robert Kraft Worth in 2024?

Robert Kraft, owner of the New England Patriots and CEO of the Kraft Group, has an estimated net worth of $12.8 billion in 2024.

Key Takeaways

- Net Worth: Estimated at $12.8 billion in 2024.

- Sports Investments: New England Patriots stake valued at $7.6 billion.

- Business Empire: Kraft Group businesses contribute $5 billion.

- Real Estate Portfolio: Worth $100 million.

- Philanthropy: Significant contributions to various causes, including healthcare and COVID-19 relief.

Robert Kraft Net Worth Breakdown

Since Kraft’s business empire is held privately and not through a publicly traded company, calculating his exact net worth is impossible.

However, we were able to collect plenty of public information surrounding his various sources of income, investments, assets, and business ventures to build a holistic estimate, which we break down here for you.

| Asset or Income Source | Contribution to Net Worth |

| New England Patriots stake | $7.6 billion |

| Kraft Group business ownership | $5 billion |

| Real estate | $100 million |

| Cars and other assets | $100 million |

| Total Net Worth | $12.8 billion |

Robert Kraft Net Worth: Early Life of a Paper Mogul

Robert Kraft was born on June 5, 1941, in Brookline, Massachusetts – the same place hedge fund owner Jim Simons was born.

His mother, Sarah Bryna Krafchinsky née Webber, was born in Nova Scotia, Canada, while his father, Harry Kraft, was a dress manufacturer in Boston’s Chinatown and a lay leader at Congregation Kehillath Israel in Brookline.

Robert Kraft went to the Edward Devotion School and Brookline High School. After attending public schools in his childhood, Kraft attended Columbia University on an academic scholarship. After he graduated from the university in 1963, Kraft received a fellowship to attend Harvard Business School.

He earned a master’s degree in business administration from the Harvard Business School in 1965 and began his career with the Rand-Whitney Group, a Worcester-based packaging company run by his father-in-law.

Robert Kraft’s Net Worth: The Journey Started With Packaging Companies

In 1968, Robert Kraft acquired the Rand-Whitney Group in a leveraged buyout and started his packaging operations.

Four years later, he founded International Forest Products (IFP), which laid the groundwork for Kraft Group, and together, both these companies are the largest privately held paper and packaging companies in the US.

This wasn’t Kraft’s first run-in with the paper business. In fact, he started out selling newspapers outside Braves Field in Boston as a child.

Kraft Group Contributes Billions to Robert Kraft’s Net Worth

In 1988, Robert Kraft founded the Kraft Group which became the holding company for all his different business ventures. The group employs over 9.500 people globally and is among the top 100 privately held companies in the US, with Cargill and Koch Industries occupying the top slots.

The Kraft Group is present in six key industries. These include:

- Paper and packaging manufacturing and distribution of forest products: According to the Journal of Commerce, International Forests Products was the fifth largest US exporter in 2017. Overall, Kraft Group is the fifth largest US company in the paper, packaging, and forest product industries.

- Construction and real estate development: The company’s construction arm has built and developed more than $1 billion worth of projects which include medical facilities, office towers, sports stadiums, and mixed-use developments.

- Private equity and venture investing: The company has a private equity vertical that invests in outside companies largely in the technology, healthcare, and life sciences industries. According to CB Insights, the Group has made 49 investments and 15 exits. In 2022, it invested in Stackwell, Evolved By Nature, and Camp4 Therapeutics. Its most recent exit was Delphix which was acquired by Perforce in 2024.

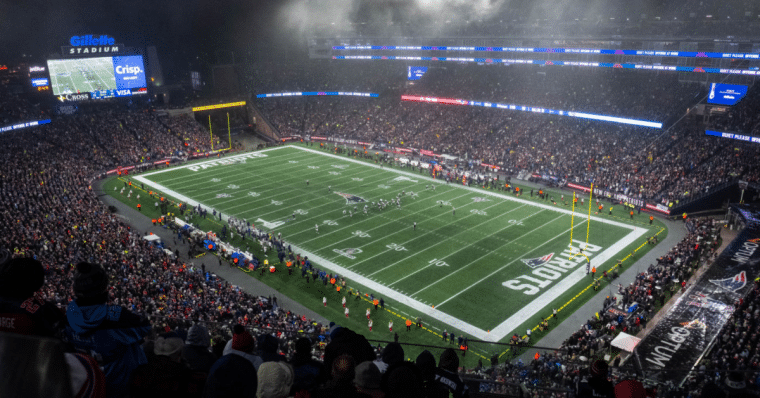

- Sports, entertainment, and event management: Robert Kraft and the Kraft Group are perhaps best known for their association with sports. The Group owns several companies in this vertical which include Kraft Analytics Group (KAGR), Kraft Sports + Entertainment (Gillette Stadium, the New England Patriots, New England Revolution), and Patriot Place. In 2021, JPMorgan Chase’s asset and wealth management division took a stake in KAGR.

In addition, the Group places a lot of focus on sustainability and philanthropy. Notably, the company employs sustainable business processes across its different organizations.

Sustainable investing and investing in green energy companies have gained a lot of traction over the last few years as the global economy transitions to a cleaner future.

Robert Kraft Net Worth: Making Sports a Lucrative Business

Robert Kraft’s journey to acquire sports teams began as far back as 1974 when he, along with other investors, bought the Boston Lobsters of World TeamTennis.

Kraft had been looking to buy the New England Patriots, one of the greatest NFL teams of all time, for years before he finally acquired the franchise. He purchased a 10-year option on the Foxboro Raceway in 1985 which was a horse track adjacent to the stadium.

The agreement barred the stadium from holding non-Patriots events when races were being held at Kraft’s raceway.

The clause added to the financial troubles of the Patriots franchise and the stadium filed for bankruptcy protection in 1988. Subsequently, Kraft outbid others to buy the stadium out of bankruptcy court for $22 million.

Patriots’ then-owner Billy Sullivan sold the controlling stake in the Patriots franchise in 1988. Kraft was interested in buying the team but this time he was outbid by Victor Kiam.

The Kraft Group was among the founders of Major League Soccer (MLS) in 1996. It founded the New England Revolution as one of the league’s 10 charter clubs.

Robert Kraft Net Worth: Making Billions With the Patriots

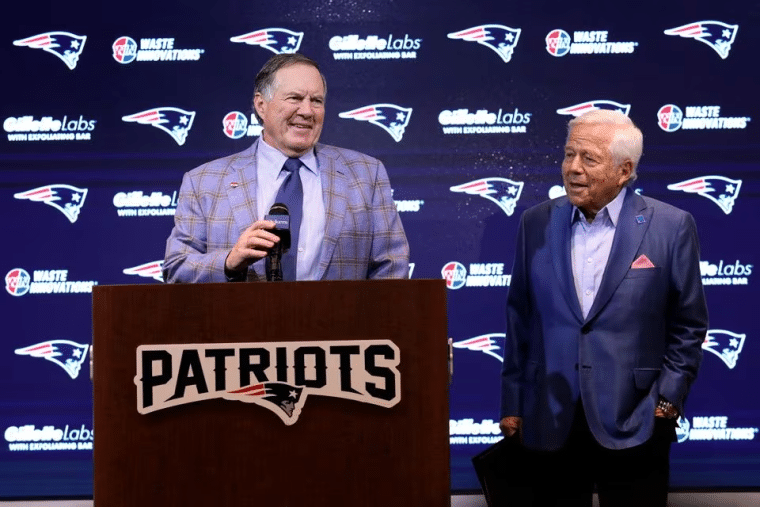

Robert Kraft purchased the New England Patriots in 1994 from then-owner James Orthwein for $172 million which made it the most costly NFL franchise deal until then.

However, the deal turned out to be quite profitable for Kraft, and the franchise is now valued at $6.7 billion according to Sportico, making it the second most valuable NFL franchise.

The Dallas Cowboys, owned by Jerry Jones, is the most valuable NFL franchise.

The performance of New England Patriots has also been ludicrously good under Kraft’s ownership. It has won more games than any other NFL franchise in the last 20 years. This, along with its six Super Bowl titles, makes the team one of the most successful sports teams (not just NFL teams) of all time.

Kraft, who had been a season ticket holder since 1971, said that he observed the team from the stands of the old Foxboro Stadium.

And then when they came here, I sat in the stands here and dreamt about one day trying to buy this team and own it and run it the way I wanted. I said, if I could ever get this team, I just dream of having home playoff games and going to the Super Bowl and winning it.

Meanwhile, Kraft is passionate about the franchise and said, “Never in my lifetime will we sell this team,” while adding that he hopes his children won’t sell the team either.

The Group has capitalized on the popularity of the Patriots and in November 2007 it opened the Patriot Place as an extension of Gillette Stadium.

It is a mixed-used entertainment complex providing guests with dining, entertainment, retail, hospitality, and health care around the year.

Robert Kraft also has exposure to esports and bought the Boston Uprising, an Overwatch League team, in 2017 which merged with Oxygen Esports in 2022. He also holds a stake in Draftkings but monetized some of the stake in 2020 amid a stellar rally in the stock.

Robert Kraft Net Worth: Other Business Ventures and Investments

We don’t have much public information about Robert Kraft’s investments in stocks, bonds, or cryptocurrencies. However, he was an investor in FTX which catastrophically failed and went bankrupt.

Along with Kraft, leading fund manager Paul Tudor Jones also invested in the crypto exchange founded by Sam Bankman-Fried.

Notably, while FTX had to wind up operations, rival crypto exchange Binance, founded by Changpeng Zhao, who is commonly known by his initials CZ, has thrived despite the controversies.

In addition, Kraft forayed into the media industry and has invested in New England Television Corp. He became its director and chairman in 1984 but sold his stake in the company in 1991. He also invested in several Boston radio stations continuing his bet on the entertainment industry.

Robert Kraft’s Philanthropic Activities

Like fellow billionaires, Robert Kraft has been associated with several philanthropic causes and the Kraft Group places a lot of emphasis on giving. Here are some of the social activities that Robert Kraft and his Kraft Group have been associated with:

- An endowed fellowship fund of $24 million at the Harvard Business School

- A cumulative $20 million to Partners Healthcare (now known as Mass General Brigham)

- The Kraft Family Blood Lab at the Dana-Farber Cancer Institute

The Kraft family supported the fight against the COVID-19 pandemic in multiple ways like offering the Gillette Stadium as a hub for relief programs including vaccinations.

He donated AirKraft which was one of two Boeing 767-300ERs of the Patriots to transport N95 masks from China to the US.

Of late, Kraft has been speaking against acts of antisemitism and last year pledged $100 million to combat the social issue.

Robert Kraft Net Worth: Real Estate Investments & Car Collection

Robert Kraft has a flair for real estate, and in 2022, he bought a penthouse in Palm Beach for $23.75 million.

The deal grabbed headlines as it was the most expensive deal in the south Florida town and the property is among the few oceanfront condominiums in Palm Beach.

The New England Patriots owner has a penchant for oceanfront properties and, in 2021, bought a 7,000-square-foot oceanfront mansion in Southampton, New York, for a massive $43 million.

He also owns a large estate in the Boston suburb of Chestnut Hill.

Kraft has a good collection of cars, but the blue Bentley Continental GT Speed convertible, which was gifted to him by rappers Meek Mill and Jay-Z (who is among the richest rappers with a net worth of 43 billion) on his 80th birthday, is among the most loved ones.

The car is valued at around $240,000.

What Can We Learn from Robert Kraft’s Life?

We can learn a lot from Robert Kraft, whose family, by his own admission, had “modest financial means.”

He said that the only arguments in his family growing up were about money, but that’s no longer a problem for them whatsoever because of Kraft’s business acumen and determination.

“At a young age, that sort of said to me, if I could find a way to be financially independent, it really planted seeds with me to want to do that,” said Kraft.

His story is not one of instant success but of hard work, resilience, and impeccable business acumen which saw him buy out the NFL franchise which he admired. His rags-to-riches story is not much different from Jacksonville Jaguars owner Shahid Khan who landed in the US with a mere $500 in 1965 and built a $13 billion fortune – making him an embodiment of the “American Dream,” just like Kraft.

Aspiring entrepreneurs can also learn from Kraft’s experience who says that his life’s best decisions have been based on instincts.

“They don’t teach it in Harvard Business School. When something feels right to you, even if other people can’t understand it, if it feels right for you, you go with it and lead with it and stay with it,” said Kraft.

He identified opportunities early including his initial foray into physical paper commodities. In a world that’s getting hyper-competitive, early mover advantage can help businesses gain an edge over those who enter later.