Michael Saylor, the founder and former CEO of MicroStrategy, is a well-known figure in investing, recognized for his strong support of Bitcoin. From the highs of the dot-com boom to the current ups and downs of the crypto market, his net worth has fluctuated greatly over the years. In 2024, Michael Saylor’s net worth is estimated to be $7.4 billion.

In 2022, Saylor resigned as the CEO of his company after holding the position for 33 years. At that time, his net worth had dropped by billions due to the Bitcoin crash, which also led to a decline in Microstrategy’s stock. Now that Bitcoin has bounced back from the tough bear market, Saylor is once again a very wealthy man with billions to his name, primarily due to the cryptocurrency.

Let’s see how Michael Saylor accumulated his billions in the first place.

Michael Saylor’s Net Worth Breakdown:

While Saylor doesn’t reveal his net worth, as expected, the available information indicates that his wealth has grown tremendously in the past few years and especially 2024. This is primarily driven by his stake in Microstrategy and his substantial holdings in Bitcoin. Saylor holds at least the same quantity of BTC coins that he did in 2020 but Bitcoin is now worth much more.

Although the specifics of other investments remain undisclosed, we have a pretty good idea of what makes Saylor’s wealth worth billions. Here’s how it breaks down.

| Asset or Income Source | Contribution to Net Worth |

| Stake in Microstrategy | ~12% worth $3.8 billion |

| 2022 SEC settlement | -$8.3 million |

| Microstrategy CEO salary | Unknown |

| Personal Bitcoin holdings | 17,732 BTC worth $3.6 billion |

| Yachts | $100+ million |

| Total Net Worth | $7.4 billion |

Michael Saylor Net Worth: Early Life and Education

Michael Saylor was born on February 4, 1965, in Lincoln, Nebraska. With his father being an Air Force chief master sergeant, Michael spent most of his childhood on Air Force bases.

When he was 11 years old, his family moved to Fairborn, Ohio, since this was conveniently near the Wright-Patterson Air Force Base. Following the move, Saylor enrolled at the Massachusetts Institute of Technology (MIT) with an Air Force scholarship (ROTC).

At MIT, Saylor was a member of the Theta Delta Chi fraternity, where he made friends with his MIT fraternity brother Sanju Bansal, the future partner with whom he would develop MicroStrategy.

In 1987, Saylor graduated from MIT with a double major in aeronautics and astronautics, science, technology, and society.

However, while Michael Saylor’s journey began with his wish to become a pilot, he had a medical condition, a benign heart murmur, which prevented him from becoming one. Disappointed by the situation, he decided to search for other work opportunities, and eventually landed a gig in a consulting firm in 1987, called The Federal Group.

Michael Saylor Net Worth: Building a Microstrategy

While it initially seemed like Saylor settled for a job he didn’t like or wasn’t trained for, his choice of a career eventually led him to MicroStrategy, the business that turned him into a billionaire!

Let’s see how his career progressed over the years.

Career after University

Michael Saylor remained in The Federal Group doing computer simulation modeling for a software integration firm for around a year. When he left, he became an internal consultant at DuPont, where he developed computer models that anticipated changes in markets. His models predicted that the major DuPont markets would suffer a recession in 1990. Management was hesitant to believe him but he would soon be proven right as the market fell.

A year after working at DuPont, Michael Saylor decided to take a major leap and start his own company that he named Microstrategy.

Microstrategy

In 1989, Michael Saylor, Sanju Bansal, and Thomas Spahr co-founded Microstrategy, a firm that developed software for data mining and focused on mobile software and cloud-based services. Not long after, the company pivoted its focus to software for business intelligence services.

The business thrived under Saylor’s leadership. He was the CEO of the company from the very beginning and led the business into the fields of distributed analytics, mobile identity, web analytics, and more. In 1992, Microstrategy landed its first big client, McDonald’s, with a whopping $10 million contract.

In 1997, Michael Saylor formed a subsidiary of the same business named Angel, one of the first home automation and security companies. It was eventually sold for $110 million to Genesys.

Following this and several other major contracts, the partners took the company public in 1998. The initial stock offering was 4 million shares priced at $12 a piece, but the price doubled on the first trading day.

By 2000, Michael Saylor was the wealthiest man in Washington DC, according to the Washingtonian.

Microstrategy’s Struggles and Legal Issues

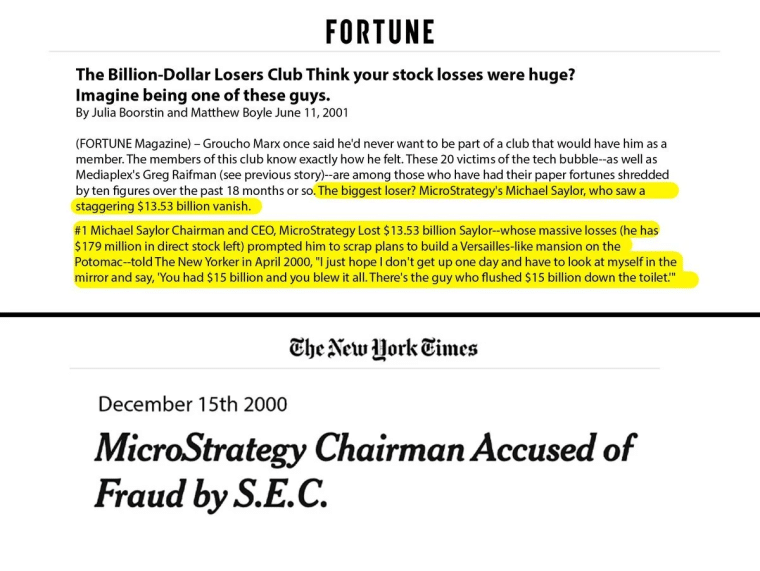

Not everything was smooth sailing for the American entrepreneur, though. In 2000, Saylor was charged with fraudulently reporting financial results for the company for two years. He ultimately settled with the SEC and paid $350,000 in penalties and $8.3 million in personal disgorgement.

His fortunes really took a sharp turn this same year since the Microstrategy stock fell $140 in a single day due to the dot-com bubble burst. This caused Saylor to lose $6 million before he was even charged by the SEC.

In 2020, he sparked more controversy for the company when he sent the employees a long memo decrying the safety protocols during COVID-19 and refused to close the offices unless it was legally required.

Later that same year, Saylor disclosed that MicroStrategy would be buying Bitcoin instead of holding cash. It invested hundreds of millions of dollars into the digital currency so far and has made a massive (unrealized) profit.

In October 2020, Saylor shared that he personally held 17,732 Bitcoin with an average purchase price of $9.882. His company, Microstrategy, on the other hand, accumulated 121,044 Bitcoin by 2021. The company most likely has around 193,000 BTC today worth more than $12 billion.

Saylor’s Resignation

On August 8, 2022, Michael Saylor announced that he would be stepping down as CEO of MicroStrategy and was replaced by the new CEO Phong Le, the company’s former president. He decided to take on the role of executive chairman of Microstrategy instead and stated in a press release:

“As Executive Chairman I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations.”

His resignation followed the company’s major loss of $900 million in Bitcoin when the coin’s value dropped.

Today, he owns around 12% of the company’s shares (or 2,401,858 shares) and has 64.7% of the voting power. With the recent Bitcoin rise, his estimated net worth has grown tremendously in the last months, and the company once again invested in Bitcoin, now owning more than 1% of all the Bitcoin that exists.

Michael Saylor Net Worth: Awards & Philanthropy

Awards and Honorable Mentions

As a prominent businessman, Saylor has won many awards and honorable mentions over the years, including:

- 1996: Named KPMG Washington High-Tech Entrepreneur of the Year

- 1997: Ernst & Young named him Software Entrepreneur of the Year

- 1998: Red Herring Magazine listed him as one of the Top 10 Entrepreneurs of 1998

- 1999: Featured in the MIT Technology Review as “Innovator Under 35”

- 2003: Horatio Alger Award

Philanthropy and Corporate Giving

In 1999, Saylor established the Saylor Foundation, which was later renamed Saylor Academy. This is a non-profit organization that offers free education in the form of online courses led by world-renowned institutions such as the Massachusetts Institute of Technology, his alma mater, and Carnegie Mellon University.

The Saylor Academy offers online degrees in addition to the assembly of online courses. He is the sole trustee of the foundation.

In 2008, he launched Saylor.org, a site that provides college content and courses at no cost whatsoever.

Michael Saylor Net Worth: Bitcoin Holdings & Other Investments

Saylor maintains quite a significant portion of his business, and most of his net worth comes from this stake alongside his Bitcoin holdings. However, he has a handful of other sources of income that add to his wealth. The businessman also earns money from book proceeds and has major investments in real estate.

Not only that, but Saylor has been granted over 30 patents.

Bitcoin Holdings

Saylor’s foray into the cryptocurrency space, specifically Bitcoin, has earned him harsh criticism over the years. It even caused him to step down from CEO when Bitcoin was struggling in a painful bear market. However, this also propelled him to quite a fame and he became the crypto community’s darling, given the nickname ‘permabull’ for his fierce stance on the currency.

While some have praised him for his accurate predictions (so far) that Bitcoin would continue to move up in cycles, he has given some poor advice in the past. He suggested that viewers should mortgage their houses or family businesses just to buy Bitcoin. He made this video at around the time when Bitcoin reached its previous all-time high, attracting a deluge of criticism after it subsequently crashed. Nevertheless, he was at least somewhat vindicated when Bitcoin reached a new all-time high in 2024.

Unlike some crypto influencers and figures, you can’t say that Saylor doesn’t put his money where his mouth is. In addition to his Bitcoin Microstrategy investments, Saylor has invested a massive portion of his personal net worth into this currency. His personal Bitcoin holdings in combination with his stake in MicroStrategy and their holdings, made his wealth grow by over $700 million as the coin increased in value.

He actually predicted a rise in Bitcoin last year, saying that the market will one day reach $100 trillion. Part of his reasoning is that the demand for Bitcoin outstrips the supply by 10x because of the supply and demand dynamics of the coin.

Authorship

As a leader in the world of business intelligence and investments, Michael Saylor is a trusted entrepreneur. He is the author of best-selling books including:

- The Mobile Wave: How Mobile Intelligence Will Change Everything

- What Is Money? – co-authored with Robert Breedlove

His first book appeared on the New York Times Bestseller List in 2012 and was ranked #5 in hardcover business books on the Wall Street Journal’s list.

Real Estate

At one point, Saylor lived in a luxury villa called Villa Vecchia in Miami Beach, Florida, which was built in 1928 and had 13 bedrooms and 12 bathrooms. He also has a home in Mclean, Virginia, where he lives today.

Other Assets

Saylor reportedly owns two luxury yachts, a Feadship Harle and an Usher, worth over $100 million.

What Can We Learn from Michael Saylor’s Story?

Michael Saylor’s journey from a budding entrepreneur to a billionaire Bitcoin bull offers many valuable lessons for aspiring investors and business leaders. As the co-founder of Microstrategy, Saylor demonstrated excellent entrepreneurial vision and strategic foresight. His work in mobile technology and business intelligence software paved the way for the company’s success and solidified his reputation as a successful entrepreneur.

Despite facing numerous challenges throughout his career, including financial setbacks and legal issues, Saylor remained resilient and persevered. He was often criticized for his investment choices, but his ability to navigate turbulent waters and adapt to changing markets has been truly inspiring. It teaches us that resilience is key to achieving long-term success.

Saylor’s bold embrace of cryptocurrency and Bitcoin as strategic investments reflects his willingness to embrace innovation. He recognized the potential of blockchain technology and pushed his company to incredible heights.

Beyond his business endeavors, Saylor’s philanthropic efforts and commitment to society teach us the importance of giving back to the community and using one’s wealth to make a positive change.

Michael Saylor’s net worth of $7.4 billion is a testament to the power of resilience, innovation, and strategic vision in achieving success and creating lasting impact.