While Meta Platforms’ (formerly Facebook) CEO, Mark Zuckerberg, is almost synonymous with the brand, the company had five co-founders. These include Eduardo Saverin, a former classmate of Zuckerberg’s at Harvard University.

Eduardo Saverin’s net worth is estimated at $30 billion in 2024 and is among the top 100 billionaires on the Forbes List.

Let’s uncover his career, net worth, and life story to see what insights we can learn from the Facebook cofounder who was controversially booted out of the company in 2005 and has since become a venture capitalist.

Key Highlights: How Much is Eduardo Saverin Worth in 2024

- Facebook Co-Founder: Eduardo Saverin’s net worth is around $30 billion, primarily from his 2% stake in Meta Platforms.

- Venture Capital: He co-founded B Capital, a venture capital firm, adding $3 billion to his net worth.

- Real Estate: Saverin owns significant real estate investments in Singapore, worth $300 million.

- Dividend Income: He earns $100 million annually from Meta Platforms’ dividends.

Eduardo Saverin’s Net Worth Breakdown:

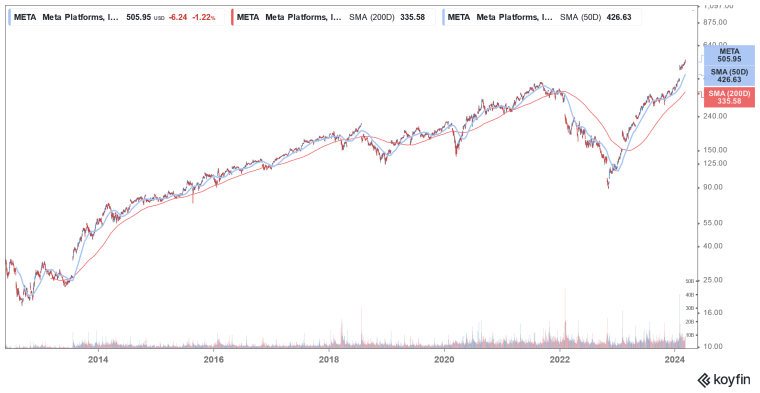

Since most of Eduardo Saverin’s wealth derives from his stake in Meta Platforms – he owns an estimated 2% stake in the company – we can make a strong estimate of his net worth.

Incidentally, during its Q4 2023 earnings call, Meta also initiated a dividend, and while the yield is a paltry 0.4%, it will add a significant amount to Saverin’s income.

Based on the publicly available information about his assets, income, and different business ventures we estimate Eduardo Saverin’s net worth at around $30 billion in 2024.

| Asset or Income Source | Contribution to Net Worth |

| Meta Platforms stake | $25.8 billion |

| Meta Platforms dividend | $100 million |

| B Capital stake | $3 billion |

| Real estate | $300 million |

| Other investments | $900 million |

| Total Net Worth | $30 billion |

5 Fun Facts About Eduardo Saverin

- Early Investor: Saverin invested $15,000 in Facebook while he and Mark Zuckerberg were still students at Harvard. This investment turned into billions as the company grew .

- Venture Capitalist: After leaving Facebook, Saverin co-founded B Capital Group, a venture capital firm focusing on tech startups in India and Southeast Asia .

- Singapore Resident: Saverin renounced his U.S. citizenship in 2012 and moved to Singapore, where he continues his venture capital activities .

- Family Business Background: Saverin comes from a wealthy family with diverse business interests, including real estate and energy .

- Movie Inspiration: Saverin’s role in the early days of Facebook was dramatized in the movie “The Social Network,” where he was portrayed by Andrew Garfield .

Eduardo Saverin Net Worth: Early Life of the Facebook Co-Founder

Eduardo Saverin was born Eduardo Luiz Saverin on March 19, 1982, in Sao Paulo, Brazil, and belonged to a wealthy Jewish-Brazilian family.

His Romanian-born grandfather Eugenio Saverin was the founder of Tip Top, a chain of children’s clothing shops, and went on to earn the title of the Order of Rio Branco which is the highest civilian honor in Brazil.

Saverin has said that his grandparents inspired him to become successful in life.

His father Roberto Saverin was a businessman with interests in shipping, clothing, energy, and real estate while his mother, Sandra, was a psychologist.

The Saverin family moved to Miami, Florida, in 1993 where Eduardo attended Gulliver Preparatory School. Subsequently, he attended Harvard University and graduated with a Bachelor of Arts in economics in 2006.

He was the president of the Harvard Investment Association and made his business acumen known quite early by making a $300,000 profit trading in oil futures.

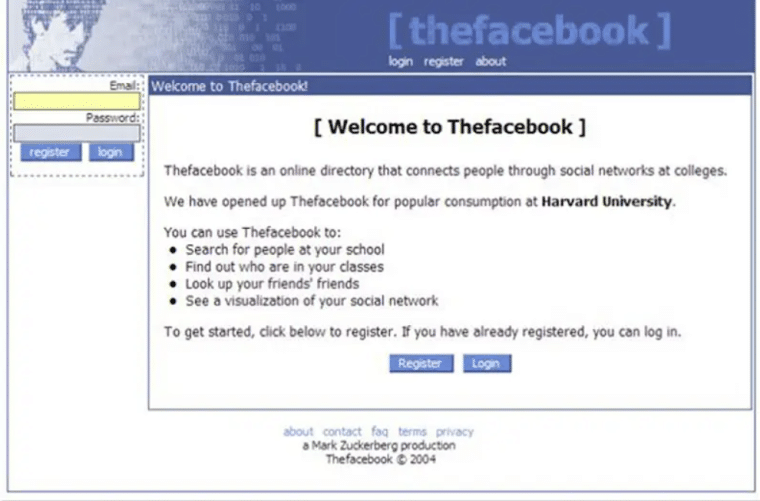

At Harvard University, Saverin met Mark Zuckerberg who was then a sophomore student. In 2004, Saverin invested $15,000 in Zuckerberg’s business venture, dubbed TheFacebook.com, with the money going to buy servers and paying for other startup costs. It was a risky bet but it turned out to be an absurdly lucrative investment for Saverin as the value of his initial investment has since risen astronomically.

As a 21-year-old college student, I made the first seed investment into Facebook with the majority of my life savings.

Saverin went on to say, “I am thankful and humbled to have played a part in Facebook’s remarkable transition from a then one-college-specific social network to the most ubiquitous social utility in the world today.”

Eduardo Saverin Net Worth: The Early Days At Facebook

Initially, Saverin held the positions of chief financial officer and business manager at Facebook and owned a 34% stake in the company.

For context, a 34% stake in Meta Platforms at current prices is worth around $450 billion, thanks to the stellar rally in Meta shares in over a decade since it went public in a mega IPO in 2012.

At the time, Facebook was the biggest US IPO, although it has since been surpassed by electric vehicle startup Rivian with its IPO in 2021.

TheFacebook.com – the previous moniker of the now popular social network – was an instant hit among Harvard students.

In 2004, Zuckerberg and Saverin formed TheFacebook as a limited liability company (LLC) under Delaware law, along with another Harvard classmate Dustin Moskovitz.

What started as a site for college students has since grown to become the most popular social media company globally and Facebook had over 3 billion monthly active users at the end of 2023.

Eduardo Saverin Net Worth: Relationships Sour Within Facebook

The relationship between Saverin and Zuckerberg soon started to sour, despite the company’s success.

While Zuckerberg and Moskovitz moved to Palo Alto, California, to work on TheFacebook.com, Saverin instead opted for an internship at Lehman Brothers in New York.

Instant messages from that period show that Zuckerberg wanted Saverin “to set up the company, get funding, and make a business model”. However, Saverin wasn’t readily available for these tasks and so the cultural and distance divide between them led to the relationship going south.

The relations between the two co-founders went even further downhill when Saverin started to run ads for a job board site called Joboozle – was his own startup – on Facebook.

In an email, Zuckerberg told Saverin, “You developed Joboozle knowing that at some point Facebook would probably want to do something with jobs. This was pretty surprising to us, because you basically made something on the side that will end up competing with Facebook and that’s pretty bad by itself. But putting ads up on Facebook to advertise it, especially for free, is just mean.”

The breaking point in the relationship came when TheFacebook.com needed funding. Zuckerberg wasn’t able to get Saverin to fly to Palo Alto to sign for the transformation of the company under Delaware law. Incidentally, while Tesla CEO Elon Musk recently called upon companies to not incorporate in Delaware, it is often the first choice for startups because of low taxes and lax business laws.

In an instant message with Dustin Moskovitz, another Facebook co-founder, Zuckerberg said, “He was supposed to set up the company, get funding, and make a business model. He failed at all three… Now that I’m not going back to Harvard I don’t need to worry about getting beaten by Brazilian thugs.”

Zuckerberg and Moskovitz soon met Sean Parker who had cofounded Napster and tasked him with securing funding for the company – which was one of Saverin’s initial tasks. Parker also joined the company as a cofounder which took the total number of co-founders to five. Chris Hughes was also a cofounder but left the company in 2007.

Finally, TheFacebook.com was incorporated in Delaware on Jul 29, 2004, and acquired the old company that had been incorporated in Florida. In September of the same year, Peter Thiel acquired a 9% stake in the company through convertible bonds worth $500,000. This would turn out to be one of the best investments of all time and would be worth over $110 billion if it was held until the current day.

Eduardo Saverin’s Net Worth: Becoming a Billionaire With Facebook

After the transaction, Saverin’s stake in the company fell from 30% to 24%. Next month, a shareholder agreement allotted Saverin 3 million shares in the new company. As part of the deal, Saverin agreed to hand over his voting rights to Zuckerberg and also surrendered his intellectual property rights in exchange for additional Facebook shares.

Saverin’s stake in the company fell below 10% in January 2005 when Facebook issued 9 million common shares of which, 3.3 million went to Zuckerberg, 2 million to Markovitz, and 2 million to Sean Parker.

Apparently, the Brazilian native got to know about the massive dilution of his stake in the company only in April 2005 when TheFacebook.com sent him a letter seeking his approval for its second round of funding.

A legal battle soon followed where Saverin alleged that Zuckerberg spent TheFacebook’s money – essentially Saverin’s money – for his personal expenses. Eventually, Saverin and Zuckerberg settled out of the court under undisclosed terms.

Saverin signed a non-disclosure agreement as part of the deal and is said to have gotten between a 4%-5% stake in the company post-settlement. Currently, Saverin holds around a 2% stake in Meta Platforms after selling off much of his shares.

While Saverin and Zuckerberg did not really enjoy friendly relations, the former maintains that the on-screen rant between them as displayed in the hit movie “The Social Network” is also exaggerated.

Saverin said of his portrayal in the movie where his character is played by Andrew Garfield:

That’s Hollywood fantasy, not a documentary. Facebook wasn’t built out of a Harvard dorm window. And I would never throw a laptop at someone, like it appears in the movie. Not even at Mark.

In 2009, Saverin moved to Singapore and renounced his US citizenship in 2012. While Saverin claimed that he moved to Singapore as he wanted to work in a company there, moving before Facebook’s IPO helped Saverin avoid $700 million in capital gains taxes and estate taxes as per Wall Street Journal’s estimates.

After leaving Facebook, Saverin co-founded Aporta an online donation portal for charity. However, his major business breakthrough came with B Capital.

Eduardo Saverin Net Worth: Becoming a VC

In 2015, Saverin started the B Capital Group with Raj Ganguly. On his LinkedIn page, Saverin says “B Capital Group backs brash entrepreneurs building the next generation of groundbreaking technology companies.”

“With offices in Los Angeles, San Francisco, and Singapore, B Capital Group focuses on pioneering start-ups that are ready to scale across the global stage. Partnering with Boston Consulting Group, and its incubation arm BCG Digital Ventures, B Capital delivers unparalleled access to top corporations to match cutting-edge start-ups with the world’s most powerful CEOs, platforms, and brands.”

In 2022, B Capital raised $250 million for its Early Stage VC Fund. The venture capital company has invested in several companies and early-stage startups, predominantly in India and Southeast Asia. These include.

- Byju’s, an Indian edtech company, previously the country’s most valuable startup

- Dailyhunt, an Indian news aggregator

- Ninja Van, Southeast Asia’s leading logistics provider

- Xingyun Group, a global B2B ecommerce service platform.

Eduardo Saverin Net Worth: Other Investments

Not much is known publicly about Saverin’s personal investments in stocks and bonds. He is, however, said to own several properties in Singapore. These include:

- A GCB (Good Class Bungalow) along Nassim Road with a full-sized tennis court and swimming pool. It was the most expensive property to be transacted in the city-state.

- A 10,300 sqft duplex penthouse in Sculptura Ardmore, a high-rise condominium.

- A 5,000 sqft penthouse at Orchard Residences.

While we don’t know whether Saverin invested his money into cryptocurrencies or other digital assets, he backed an Indian crypto exchange called CoinDCX. Notably, India’s crypto regulations are quite vague and while the country hasn’t banned cryptocurrencies altogether like its neighbor China has, its policies are not exactly conducive to the development of the cryptocurrency ecosystem in the country.

Saverin invested in Antler in 2020. The company is an early-stage venture capital fund and startup accelerator founded by Magnus Grimeland, Saverin’s Harvard classmate.

He has also invested in Anideo, a company led by his long-time friend Andrew Solimine.

The company developed the Denso video-streaming application. In addition, Saverin invested in a price-comparison mobile application named Shopsavvy, and Jumio – is an online portal that protects customers from fraud and identity theft.

Meanwhile, as is the case with most venture capitalists, some of his investments have been unsuccessful, these include Qwiki, a multimedia video website.

Eduardo Saverin’s Life Outside of the Business World

Eduardo Saverin married Elaine Andriejanssen, a Chinese Indonesian in 2015 in the French Riviera. Andriejanssen’s family has multiple businesses in Indonesia and she has worked as a quantitative research analyst at Franklin Templeton Investments.

The couple have a child and live in Singapore.

He has maintained a rather low profile and is not as active on social media as some of his contemporary billionaires. In response to a question as to why he maintains a low profile on his Facebook page, Saverin responded, “I don’t like showing my privacy online.”

What Can We Learn From Eduardo Saverin’s Life

There are countless lessons that we can learn from Eduardo Saverin’s life. For instance, he gives amazing advice for budding entrepreneurs.

“Entrepreneurship involves mistakes and failures. But ultimately, if you have that intellectual capital and intimate understanding behind your project, you have a chance to succeed,” said Saverin.

Another aspect worth learning from his life is to not dwell on the past. In the startup space, there are bound to be differences among founders but despite his previous acrimonious relationship with Mark Zuckerberg, Saverin has moved on.

While Saverin’s story is not a rags-to-riches tale like many other billionaires like Zara’s founder Amancio Ortega Gaona, he has had his share of setbacks, especially when he was forced to leave Facebook.

However, he bounced back and continued his entrepreneurial journey. We see similar determination in most billionaires who face and overcome multiple challenges to become successful in their lives.