Prepare for a pricier Netflix bill soon as the streaming company continues to ruthlessly push for more revenue by pushing greater costs on subscribers and selling ads. Netflix executives are warning subscribers to brace for another round of price hikes soon even though it reported strong fourth-quarter earnings results this week.

The streaming leader isn’t taking its position for granted and is pushing to boost revenue through various initiatives as competition intensifies in the saturated streaming market.

Ad-Based Subscriptions Are Too Popular and Profitable, Dooming Basic Plans

In a letter to its shareholders, Netflix (NFLX) noted the rapid expansion of the new ad-supported subscription tier, which saw customer sign-ups jump 70% compared to the previous quarter.

The low-priced membership supported by commercial breaks has already captured an impressive market share, accounting for 40% of sign-ups in the markets where it is available.

This early success with the ad tier led Netflix to confirm its plans to retire the legacy Basic subscription plan. The $9.99 monthly tier without ads will be discontinued for all members, starting with the UK and Canada in Q2 2023 before expanding globally. New members have been barred from selecting this entry-level tier since last July. Soon, no one will have access to it anymore.

The elimination of Netflix’s cheapest ad-free option aims to push price-sensitive subscribers toward the ad-supported plan or higher premium tiers. When asked about this pricing strategy on the earnings call, Co-CEO Greg Peters responded: “we’re able to resume our standard approach towards price increases”.

This declaration should warm subscribers to prepare for another annual increase in membership fees across the board. Multiple Netflix tiers increased in cost last October, but previous individual hikes have run as high as $2 per month. While another bump could help satiate investors’ appetite for higher earnings, some analysts warn that subscriber losses may soon outweigh revenue gains.

Executives Boast the Success of Their Password-Sharing Crackdown

Peters and his fellow executives spent much of the call touting what they deemed the successful implementation of its password-sharing crackdown. After subscriber rolls declined sharply last year, Netflix took aggressive actions to limit multi-household password sharing in an effort to capture revenue from nearly 100 million non-paying viewers.

The “Profile Transfer” system facilitates the conversion of extended family and friend network members into paying subscribers. So far the plan has been tremendously successful and other streaming platforms including Disney Plus are already starting to follow suit. Netflix claims that “many millions” have opted to open new accounts after their access was revoked, contributing heavily to better-than-expected Q4 gains.

It seems that users have been accepting the access restrictions thus far and the proposed alternatives that Netflix put on the table to incorporate them as paying users. This includes the Basic with Ads plan, which alleviates the pain of adding a new subscription service to the budget at the cost of regular advertisements. However, the plan to now eliminate the Basic tier while hiking rates across the board may put users’ willingness to stay with the service to the test again during challenging economic times.

Netflix to Provide More Value With Live Sports: Signs $5 Billion Deal with WWE

Although Netflix is planning on increasing prices and cutting out the basic tier, that doesn’t mean that it isn’t actively looking for ways to bring more value to subscribers.

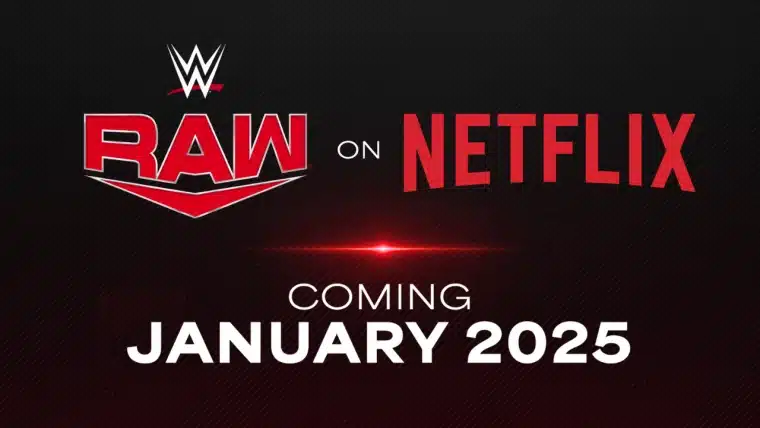

Alongside their focus on extracting more revenue from existing pipelines, Netflix also continues to pour cash into premium original content to attract new subscribers. A splashy new deal locked up exclusive streaming rights for WWE’s iconic Monday Night Raw program, spanning over 500 annual hours of action-packed spectacle.

The $5 billion deal spanning 10 years, which includes an option to extend the agreement for another ten years or terminate it after five, brings highly coveted live sports programming into the Netflix grid for the first time.

Executives promised that live offerings would remain carefully targeted rather than trying to compete with mainstream sports broadcasting packages. The WWE deal, however, does signal the company’s intent to increasingly diversify its programming genres and formats.

Buoyed by surging Q4 growth amid these key strategic shifts, Netflix’s leadership sent some optimistic remarks to investors about what’s ahead. Over the next year, additional password-sharing constraints and selective price hikes should help overcome the muted subscriber gains projected for 2024.

The leadership team remains bullish on long-term international penetration as well for the streaming pioneer. While robust competition has emerged from deep-pocketed rivals like Disney, Apple (AAPL), and Amazon, Netflix feels confident that its broad range of localized content can be considered a durable competitive advantage to its service.

However, given all of these budget-hurting profit-seeking maneuvers, how many loyal subscribers could feel disenfranchised? The answer depends partly on how artfully Netflix balances its pricing changes with significant enhancements and expansions of its content library that justify the additional money.