Uber is one of those companies that always seems to be embroiled in one or the other controversy. From consumer complaints of price gouging to drivers protesting over falling earnings, Uber has been inundated by negative publicity for a while now. The company has also been at loggerheads with several regulators over its categorization of drivers, imperiling its bottom line.

In a more recent and bizarre case, Gary Leff the co-founder of frequent flyer community InsideFlyer.com and named one of the “World’s Top Travel Experts” by Conde Nast Traveler, has alleged that Uber showed him a higher price for a ride when he had a $15 American Express Uber credit in his account.

Leff discovered that the price that was shown to him was higher than what Lyft offered for the same ride. Interestingly, he found the pricing to be normal when he tried using these credits on Uber Eats.

Uber Caught Overcharging? How Having Credits in Your Account Might Be Costing You – View from the Wing https://t.co/8rIDsVEqMy

— gary leff (@garyleff) September 22, 2024

Does Uber Overcharge If You Use Credit Balance

His report also quoted the example of another user who bought Uber gift cards from Costco at a 20% discount on their face value. The user who’s named Charles said that while things were normal when he loaded up his account with a $50 card, they got weird when he loaded up a $200 gift card.

Charles discovered that Uber wouldn’t let him use the payment method for rides booked in advance. Also, like Leff, he observed the price for his usual rides go up even as Lyft still showed him the normal price.

He experimented and checked the price for the ride on someone else’s phone only to find that the app showed the usual $20 price instead of the $30 that it showed him with a gift card as the payment method.

While the issue would need further investigation, if it is true then it could be considered illegal price gouging as those with credit balances or gift cards would prefer Uber.

Notably, accusations of ride-hailing companies gouging prices are not new. Earlier this year, Senator Sherrod Brown (D-OH), who chairs the Senate Committee on Banking, Housing, and Urban Affairs wrote a letter to CEOs of both Uber and Lyft over their “opaque pricing.” Brown said, “More recent research has shown that Uber’s prices increase when a device has low battery – suggesting that Uber preys upon the perceived desperation of their customers. Instead of enabling consumers to make informed decisions, aggressive companies – like Uber – exploit technology and consumer data to manipulate consumers, extracting every last cent possible from them.”

Drivers Have Also Complained of Discriminative Wages

While some users have complained of being overcharged, many drivers have said that Uber offered them a lower amount for the same trip compared to other drivers on the platform. Research done by More Perfect Union shows that both Uber and Lyft offered different amounts for the exact same ride to different drivers.

While Uber says that the surge and by extension the price that it offers drivers depends on several aspects including a driver’s location, in its experiment More Perfect Union kept the drivers’ phones in the same place.

The different prices offered by ride-hailing companies are due to the secretive algorithms that help ride-hailing companies maximize their profits even as it apparently comes at the cost of drivers and riders. You can learn more about the explosive experiment in the above video.

Notably, algorithmic wage discrimination is a burning issue and research done by Veena Dubal, Professor of Law at the University of California, Irvine School of Law found rampant wage discrimination at leading companies.

Algorithmic Wage Discrimination Is Quite Prevelant

While Dubal said that the prices are determined by algorithm, she added, “But based on what we know about price discrimination in the consumer context, we can postulate that these wage manipulators are personalized based on what Uber’s machine learning systems knows about the habits, practices, and income targets of individual workers.”

Uber has used “innovative” ways to cut driver earnings and it has been accused of working around New York City regulations that were meant to increase driver earnings.

To get around the regulations, Uber has been locking out drivers during periods when the demand is low so that it doesn’t need to pay the drivers for that time. These lockouts have been quite unpredictable and at times lasting for as much as an hour. Because of the lockouts drivers have been facing troubles in planning their work shifts and some say their earnings have fallen dramatically because of this change.

Ride-hailing Companies Lobby Hard to Keep Drivers Classified as Contractors

The business model of ride-hailing companies revolves around charging competitive rates to customers that are invariably lower than what traditional taxis charge. When you add it all up, drivers get to keep only about 75% of the fare with the remaining going to the ride-hailing companies.

Both Uber and Lyft have vociferously opposed attempts to characterize their drivers (who are contractors) as employees as it would mean higher pay (and payroll taxes) coupled with benefits like medical insurance for them. Most recently, both companies threatened to exit Minneapolis altogether after a proposal to increase driver pay to match minimum pay.

During the hearing, Uber and Lyft drivers testified that they're struggling as rideshare companies take an even bigger piece of the pie.

One driver said he recently drove a woman to the airport for $45 and made just $8.

"They're taking advantage of us." pic.twitter.com/CQqf8MzhfY

— More Perfect Union (@MorePerfectUS) May 7, 2024

Many Companies Have Been Using Algorithms for Pricing

To be sure, ride-hailing companies are not the only ones using secret algorithms to arrive at pricing and earlier this year the US FTC began an investigation into surveillance pricing by grocery stores and retail companies.

“The study is aimed at helping the FTC better understand how surveillance pricing is affecting consumers, especially when the pricing is based on surveillance of an individual’s personal characteristics and behavior,” said the FTC in its release.

FTC chair Lina Khan said, “Americans deserve to know whether businesses are using detailed consumer data to deploy surveillance pricing, and the FTC’s inquiry will shed light on this shadowy ecosystem of pricing middlemen.”

Separately, Wendy’s faced a lot of flak earlier this year over its plan to try out “dynamic pricing”, similar to surge pricing, but quickly abandoned the idea thanks to the backlash.

Uber has Turned Profitable: Is It Because of Efficiency or Price Gouging?

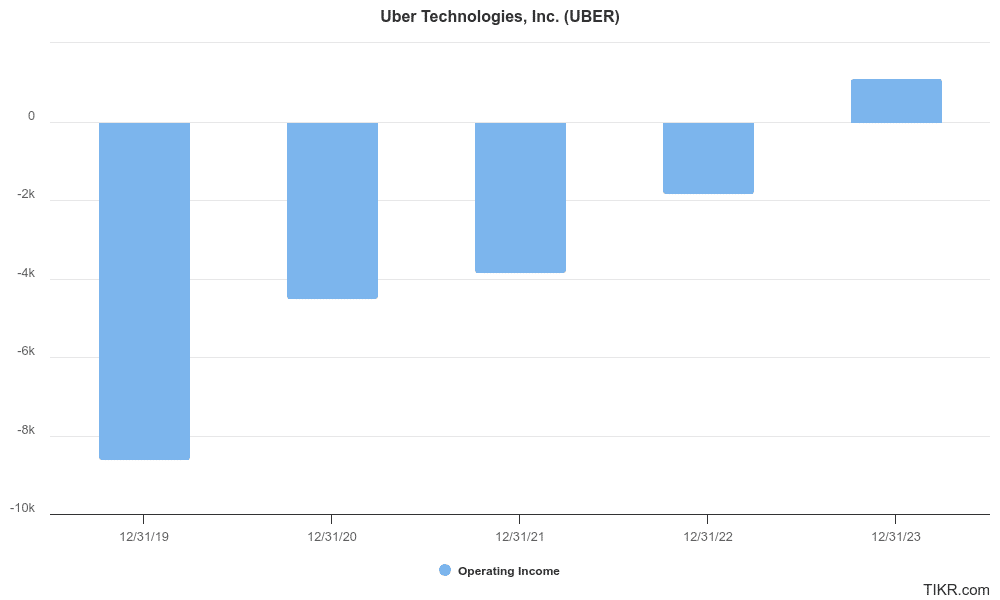

As for Uber, the company has turned profitable and posted an operating profit of $1.1 billion last year as compared to an operating loss of $1.8 billion in 2022. Stock markets have also rewarded Uber for the significant improvement in its financials and the stock is up 64% over the last year.

Uber CEO Dara Khosrowshahi attributed the profits to “the growth flywheel we built, coupled with rigorous cost discipline, enabling us to generate strong leverage to exit the year with tremendous momentum and reliable execution.”

However, critics believe that the profitability has been driven by overcharging users and underpaying drivers. But then, this take rate is what Uber’s business is built around.