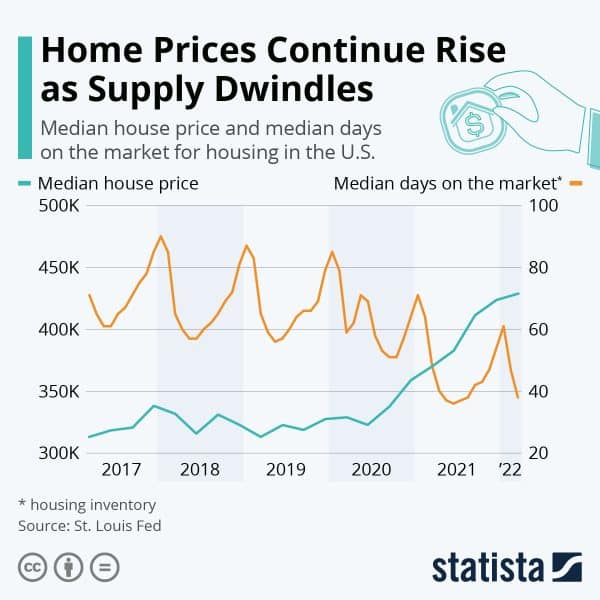

Property prices in the US housing market showed no signs of cooling in April 2024, even as stubbornly high mortgage rates kept squeezing affordability for prospective homebuyers.

While a gradual increase in inventory offered a glimmer of hope, record-high prices and financing costs kept the market firmly tilted in favor of sellers.

Home prices soared to new heights last month and set a record as strong demand has kept outpacing the limited supply of homes listed for sale. According to data compiled by the National Association of Realtors (NAR), the median existing home price jumped 5.7% from a year earlier to $407,600.

This marked the fourth consecutive monthly increase and is considered a sobering statistic for buyers. Meanwhile, just 14 months ago, in March 2023, the median home price in the United States stood at $430,700 for a new home while it now sits at $438,900. This catastrophic trend started accelerated in 2020 and it hasn’t slowed down yet.

“Home prices reaching a record high for the month of April is very good news for homeowners,” said Lawrence Yun, Chief Economist for NAR. However, he added: “It is still a very frustrating market out there” for buyers who are confronted with the reality that there are not enough properties for them to choose from as inventories keep sitting at historically low levels.

The S&P CoreLogic Case-Shiller Home Price Index similarly showcased accelerating annual price growth, with property values in major markets like San Diego, Chicago, and Detroit rising at the fastest pace within the country.

Mortgage Rates Remain High and Raise Financing Costs for Buyers

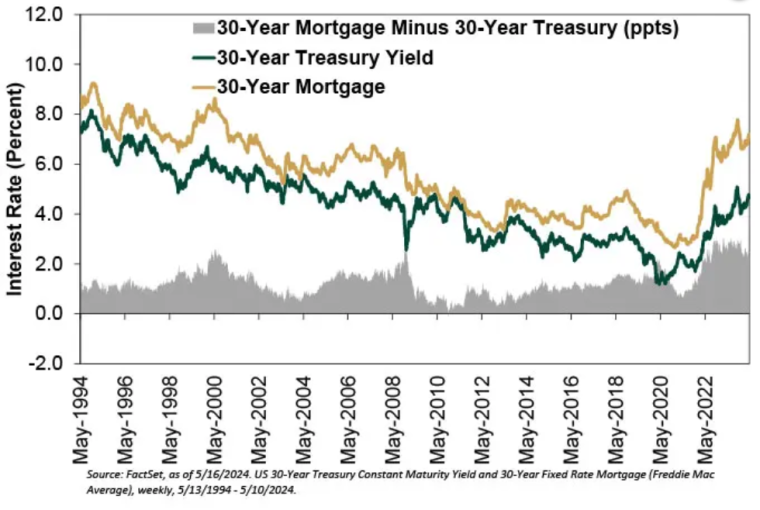

Rising mortgage rates are adding fuel to buyers’ current discomfort as they surged past 7% in April for the benchmark 30-year fixed loan. Freddie Mac data shows that the average rate on a 30-year mortgage hit 6.94% by the end of this past week, up from just 6.24% in March and 6.6% in December last year.

Although mortgage rates have dropped compared to last year’s high of 7.8% in October, they are still sitting at high levels and result in significant borrowing costs for prospective buyers.

The combination of elevated home prices and markedly high borrowing costs results in a colossal affordability crunch. By NAR’s calculations, an American family needed an income over $100,000 to afford a $420,000 home in most parts of the country as of last month. This amount is well above the median US household income of around $75,000. When considering taxes and rising living expenses (not to mention exploding debt), it’s quickly becoming impossible for most Americans to become homeowners.

Housing affordability considers the impact of various variables including prices, household incomes, and mortgage rates. When considering taxes and rising living expenses (not to mention exploding debt), it’s quickly becoming impossible for most Americans to become homeowners.

“Home prices are at record highs, mortgage rates are high and a lack of inventory to some degree looks like it is hindering sales,” NAR’s Yun further commented.

Meanwhile, prospective homeowners are disgusted with the situation and emphasize their frustration when they turn to the marketplace to look for properties that they can afford with their current salaries.

“It’s like I’m playing a game that you can’t win,” a 32-year-old man interviewed by BBC commented.

“The fact that we’re being priced out just makes me want to throw up.”

Meanwhile, 30-year-old Braiden Dogherty from Florida complained that the government is not doing anything to relieve first-time home buyers from being left out of the market.

“I don’t see any platform that purposely looks out for somebody like first-time homebuyers, wanting to ease their pain,” he told the BBC last week.

Inventory Grows but Not Enough to Justify a Significant Price Drop

One of the few bright spots of this year’s reports was a steady improvement in housing inventory over the past few months. This provides prospective buyers more options for those who are able to stomach the high prices and financing costs. Thanks to simple supply and demand, increasing inventory should help lower prices.

The inventory of available houses rose by 9% last month compared to the past month and 16.3% compared to the year before to 1.21 million units according to NAR data. This is the fourth consecutive month in which the market has experienced an inventory increase and could be signaling a potential upcoming decline in home prices at a future date.

Still, NAR’s Yun highlighted that inventories are still tight despite these increases.

Keith Gumbinger from the online mortgage company HSH.com, echoed similar comments. “For the best possible outcome, we’d first need to see inventories of homes for sale turn considerably higher,” he told Forbes last week.

According to Gumbinger, higher inventories “would ease the upward pressure on home prices” and could help property values drop from the “peak levels or near-peak levels” seen recently.

These inventory gains helped fuel a mild increase in the share of consumers who qualified as first-time buyers in April. The metric increased to 33% – up 1% compared to the previous month.

Yun questioned how these homebuyers managed to afford properties at these prices and cautioned that they may have received some help from family members or other sources to raise the money for the down payment, hinting that this trend could be unsustainable in the medium term.

Meanwhile, Rick Sharga, the CEO of CJ Patrick Company, a market intelligence firm, commented: “I don’t expect to see a meaningful increase in the supply of existing homes for sale until mortgage rates are back down in the low 5% range, so probably not in 2024.”

Sales Activity Cools as Spring Buying Slows

With home prices still at record levels and persistently high financing costs, home sales keep slowing down despite a recent uptick in early 2024.

NAR reported a 1.9% monthly decline in sales during April with most US regions experiencing a drop in their respective figures as higher mortgage rates keep taking a toll. Annualized seasonally-adjusted sales ended April at 4.14 million units, which also resulted in a 4.22% decline compared to April 2023.

The North-East region was the most heavily affected as sales of existing properties retreated by 4% compared to the previous year at an annual rate of 480,000 units.

Meanwhile, the South – the largest region in terms of units – experienced a 3.1% retreat compared to 2023 in April despite median prices sitting at relatively low levels compared to the country’s median at $366,200. Prices in this area, however, experienced a 3.7% uptick compared to last year.

The US Housing Market’s Outlook Depends Highly on the Fed’s Next Steps

Looking ahead, few experts anticipate that the trajectory of the US housing market will shift dramatically in the near term.

Factors including limited supply, the Federal Reserve’s reluctance to slash interest rates, and the upcoming Presidential election, which moves into the freezer any initiative to cool down the market, suggest that both high prices and mortgage rates could persist for what remains of the year (and probably longer).

Some buyers may find temporary reprieves if the pace of home price appreciation starts decelerating or if the Fed pivots toward cutting interest rates later in the year. But reliably improved affordability likely remains a 2025 story based on most economic forecasts.

If the Fed ultimately caves to ease financing conditions by lowering interest rates, buyers could find some relief to afford a home somewhere in 2025.

For now, homeowners are still the clear winners in this market due to rapidly escalating equity positions that offset affordability strains. For now, many prospective buyers may have to further improve their budgets, lower their expectations, or simply stay priced out of the housing market until the situation brightens.

A Few Recommendations from Experts to Navigate Today’s Housing Market

In this challenging environment, both buyers and sellers need to make careful, informed decisions because they will impact you for years and years. Make sure to speak to a financial expert to ensure that you are making the right decision. Here are a few important tips for both buyers and sellers that you should pay attention to.

Tips for Buyers:

- Focus on finding affordable monthly payments instead of fixating on home prices.

- Stay flexible in terms of size, location, and condition to expand the range of options.

- Stick to the budget, even if it delays homeownership. Entering a disadvantageous property or arrangement is typically not a good idea and it can cause undue stress for years and years.

- Rely on your realtor’s expertise to monitor inventory and quickly identify good deals that pop up or short-term improvements in the overall state of the market.

Tips for Sellers:

- Price competitively based on up-to-date comparable sales data.

- Ensure that the home shows exceptionally well to maximize its market value.

- Work closely with experienced local agents to maximize marketing exposure.

- Perform any required pre-listing repairs or renovations to minimize customers’ objections.

Industry experts consistently advocate for pragmatism and preparation as keys to success in an increasingly competitive real estate landscape. With US housing likely to remain a seller’s market for the foreseeable future, protecting one’s interests by being prudent could be the best defense against an upcoming price shock.