The payment processing company MySchoolBucks has been facing intense scrutiny from parents due to extremely high fees and business practices.

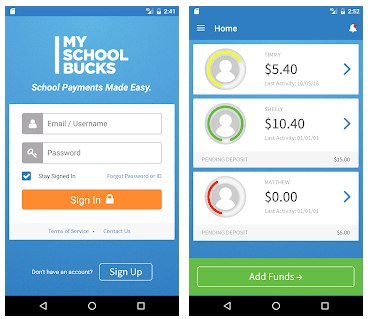

The website is a subsidiary of a large payment processing company called Global Payments. The site allows parents to load up money into an online account to cover for their children’s school meals.

Cafeterias and stores within schools adopt the firm’s point-of-sale technology to process payments made by children. It should supposedly make things easier for parents but the service is quite expensive.

Also read: AI in Education – Everything You Need to Know in 2024

Federal regulators indicate that MySchoolBucks has a 40% share in the K-12 market with partnerships and contracts with over 30,000 educational facilities nationwide and serving more than 2 million families.

Global Payments recently announced that they signed a contract with the Los Angeles Unified School District – one of the three largest districts in the US.

Global Payments Charges Hefty Transaction Fees to Parents

At the heart of the controversy surrounding MySchoolBucks are the fees it charges parents for loading money into their children’s accounts. These fees, often labeled “program fees”, have been criticized as excessively high and burdensome, particularly for low-income families.

Emily Krieger, a mother in Bozeman, Montana, noticed that the fee for loading money onto her children’s meal accounts had increased to $3.25 per transaction. This fee was larger than the cost of an entire school meal at her children’s elementary school, where lunch costs $2.25 plus $1 for milk. This may not seem horrible at the surface but these fees add up quickly and many families struggling to put their kids through school simply can’t afford them.

According to a July report by the Consumer Financial Protection Bureau (CFPB), MySchoolBucks charges the highest fees among its competitors. The company’s average transaction fee is $2.55. However, in many places like Bozeman, the fee has been increased to over $3. While these fees may seem small at first glance, they can add up significantly over time.

The CFPB estimates that families pay an average of $42 per school year in fees. However, some parents pay much more depending on the number of children they have and the frequency with which they make deposits.

For low-income families who can’t afford to load large sums at once, the burden is even greater. Regulators found that vulnerable families may pay as much as $0.60 in fees for every $1 they spend on lunch.

Adam Rust, director of financial services at the Consumer Federation of America, described the fees as “a hidden cost of just living” stating that the system was designed to “nickel-and-dime hundreds of thousands of people once every other week.” Unfortunately, these kinds of hidden fees are becoming more and more common as companies figure out new ways to extract more money out of the pockets of consumers.

MySchoolBucks Competes with Just Another Two Companies in the US

One of the primary reasons MySchoolBucks has been able to maintain its fee structure is its dominant position in the market. The K-12 payments market is controlled by three companies primarily: MySchoolBucks (owned by Global Payments), SchoolCafé (owned by Cybersoft Technologies), and LINQ Connect.

This market concentration has created what critics describe as a captive market. Parents often have no choice but to use the payment platform selected by their school district. They can’t just pick a different provider with lower fees, essentially allowing MySchoolBucks to charge whatever it wants.

Christine Chen Zinner, senior policy counsel at Americans for Financial Reform, characterized this situation as an example of corporate monopoly, where a company can “exert a certain price — really, any price that they want — and the parents are at the corporations’ mercy to pay that price.”

The lack of alternatives is exacerbated by the fact that schools may not always prioritize service costs when negotiating contracts with these companies. Districts might choose MySchoolBucks for its backend services without fully considering the impact that its fee structure has on families’ budgets.

Parents Join Forces to Fight MySchoolBucks in Court

In 2019, a group of parents decided to join forces and take legal action against the company. They alleged that MySchoolBucks committed consumer fraud as it misled users about the destination of the fees it collected.

The lawsuit claims that the fees were going to the school district and were reinvested into its educational facilities while they were treated as ordinary business revenue.

“Parents behave differently when they think that the money is going to their child’s school than when they think the largest payment processor in the world is stealing their money,” Janey Varnell, one of the attorneys who led the case, commented.

She emphasized that the case is unique as no one had attempted previously to sue a payment processing company in the K-12 market on these charges.

The lawsuit has faced significant pushback from Global Payments. Shortly after the suit was filed, MySchoolBucks attempted to deposit $40,000 into the bank account of Max Story – the case’s plaintiff – to nullify his claim.

Story refused the money to keep fighting the case in court. The company also introduced a new terms of service agreement requiring users to waive their rights to participate in class-action lawsuits against the company.

Despite these obstacles, the case may soon be certified as a class-action lawsuit. At a hearing on July 17, US District Judge Timothy Corrigan indicated that he was leaning towards certifying the case, which would allow attorneys to pursue claims on behalf of MySchoolBucks users nationwide.

Global Payments is Not Backing Down from Its Efforts to Corner the Market

Global Payments, the parent company of MySchoolBucks, has not directly responded to requests for comment on these allegations. However, their actions in response to the lawsuit reveal their beliefs.

The company’s attempt to deposit money into Story’s account suggests a desire to settle the issue quickly and quietly. Meanwhile, the new terms of service explicitly mention the Story v. Heartland Payment Systems case and require users to waive their right to participate in it. This indicates a proactive approach to limiting their legal exposure.

Also read: Inside Google and Meta’s Secret Ad Campaign to Target Kids Despite Concerns

Moreover, the company’s continued growth and expansion into new school districts suggest that it views its business model as sustainable and defensible.

In 2016, Global Payments acquired a company called Heartland Payment Systems for $4.3 billion. Executives have touted the “school solutions” division, which includes MySchoolBucks, as a driver of “double-digit growth” in earnings calls with investors.

MySchoolBucks is Now at Regulators’ Crosshairs

The practices of MySchoolBucks and similar companies have not gone unnoticed by regulators. The Consumer Financial Protection Bureau has taken a particular interest in the K-12 payments industry.

In a report released in July, the CFPB conducted an in-depth study of companies profiting from school lunch fees.

The report found that these fees were “burdensome” and had a disproportionate impact on low-income families. This follows an earlier report in which the CFPB warned a handful of unnamed K-12 payment companies that their practices “may not comply with consumer financial protection laws.”

The CFPB’s focus on this issue suggests that they could soon take action to regulate the sector. The bureau highlighted that school lunch programs are not supposed to charge additional fees beyond the cost of a meal, according to longstanding policy from the US Department of Agriculture.

Americans for Financial Reform’s Zinner praised the CFPB’s approach, saying, “I think the [CFPB] has the right idea. They’re doing everything that they can to make sure these payment processing companies are in full compliance with the law.”

However, any attempts at reform will likely face significant resistance from Global Payments, a company with annual revenues exceeding $9 billion and substantial lobbying power in Washington.

The controversy surrounding MySchoolBucks emerges at a point when significant efforts are being made to make school lunches more accessible to all students. Some states have implemented universal free breakfast and lunch programs.

However, even in these cases, MySchoolBucks often maintains a presence, allowing students to pay for additional items or milk.

As legal proceedings continue to advance, MySchoolBucks is still making millions off parents. A class-action lawsuit could have far-reaching implications on the company’s business model but it may still be a while until that happens as the court needs to first certify the lawsuit.