Robinhood Markets, the pioneer of the commission-free trading movement, is making an ambitious push into the credit card arena with the launch of its brand-new Robinhood Gold Card. The fintech disruptor revealed details of the premium rewards card on Tuesday evening during its first-ever keynote product event in New York City.

The Robinhood Gold Card enters an increasingly competitive credit card market with an unrivaled value proposition – offering an industry-leading 3% cash back on all purchases with no annual fee. Most premium rewards cards cap these earnings at 2% (at most) for non-categorized spending.

“There’s always been special perks and opportunities reserved for the wealthy that make them even richer. It’s why we started Robinhood and gave our customers access to commission-free trading and the 24 hour market,” said Robinhood co-founder and CEO Vlad Tenev.

“Today’s announcements at Robinhood Presents: The New Gold Standard bring us one step closer to the goal of giving everyone better access to the financial system”, Tenev added.

Fight for the check. Spring for the upgrade. That 3% cash back is yours. Claim your spot on the waitlist for the Robinhood Gold Card. Terms apply.https://t.co/iQ03uMuWiH pic.twitter.com/5YqSGcGwd7

— Robinhood (@RobinhoodApp) March 26, 2024

An Unparalleled Cash Back Earning Rate

The headline feature of the Robinhood Gold Card is its generous 3% cash back earning rate across all purchases. Cash back is earned in the form of points that can be redeemed for cash, deposited into a Robinhood brokerage account to invest, or redeemed for gift cards, or shopping and travel benefits.

While premium travel rewards cards often offer 3x points or more on travel and dining, their earning rates on general purchases rarely exceed 2%. The Robinhood Gold Card’s 3% cash back applies to all non-category purchases ranging from groceries and gas to online shopping and streaming services.

Also read: Robinhood Attempts to Enter UK Again: Third Time is the Charm?

Additionally, cardholders will earn an even higher 5% cash back rate when booking travel through Robinhood’s new dedicated travel portal.

“Our goal is to enter this market in a big way”, Tenev said in an interview. “We don’t want to just roll out a credit card that our customers will adopt. We want to roll out a product that can lead the industry and move it forward.”

No-Fee Card Built for Robinhood’s Gold Members

The lucrative cash back rewards come with no annual fee, though the Robinhood Gold Card requires enrollment in Robinhood’s $5 per month Gold subscription. The company’s Gold membership also provides benefits like:

- 5% APY on uninvested cash balances.

- Up to $2.25 million FDIC insurance from partner banks.

- 3% match on Robinhood retirement IRA contributions.

- Lower margin rates for eligible members.

- Instant deposits up to $50,000 per day.

- Access to professional investment research materials.

Gold members will also receive a new 1% unlimited deposit boost starting in May on all incoming transfers to their Robinhood brokerage accounts.

“The goal is for all of our customers to hold all of their assets in Robinhood, and for all of their transactions to go through it”, Tenev stated.

Premium Benefits & Consumer Protections

Beyond its unbeatable cash back earnings, the Robinhood Gold Card provides valuable travel protections and purchase coverages that rival premium travel cards:

- Trip interruption/cancellation reimbursement.

- Auto rental collision damage coverage.

- Purchase security and extended warranty.

- Return protection.

- Zero fraud liability.

- Travel and emergency assistance.

- Roadside dispatch.

- Visa Signature Concierge access.

Also read: Best Crypto Credit & Debit Cards for 2024

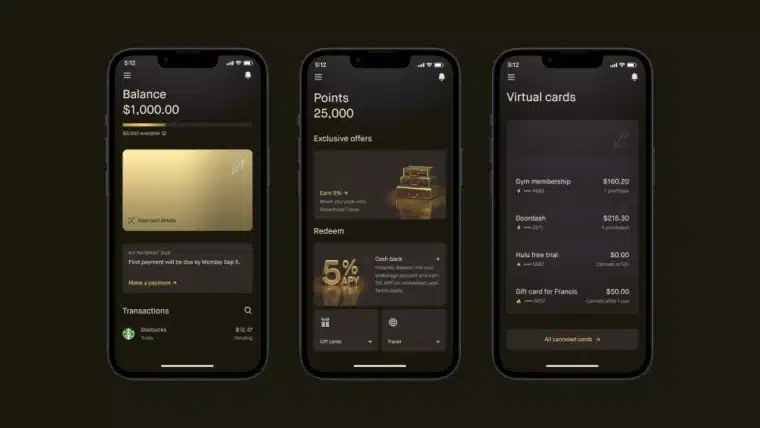

The card also enables advanced virtual card capabilities for enhanced privacy and security. Users can create disposable virtual card numbers for one-time use or to seamlessly end free trials and subscriptions. If the physical card is misplaced, cardholders can instantly request a replacement via the app.

Family-Friendly Features Include Issuance of Up to 5 Authorized Cards

In a first for Robinhood, the Gold Card introduces valuable family-sharing tools designed to help build credit for dependents while providing oversight for the primary account holder.

Cardholders can add up to five authorized users of any age to their account. Each user receives their own physical card, and the primary account holder can set custom spending limits, review purchases in real-time, and lock cards instantly if they are lost or damaged. This feature is a major bonus for families with a bunch of young adults starting to make their way into the financial world.

A big vision for Robinhood appears to include becoming a financial cross-generational institution for the whole family.

Robinhood Launches New Standalone Mobile App Experience for the Gold Card

The Robinhood Gold Card will be serviced through a new standalone mobile app designed to simplify spending management with key features like:

- Real-time purchase notifications and spend tracking by category.

- Automated payment setup for recurring bills.

- Smart budget and savings tools.

- Contactless mobile wallet functionality.

- Virtual card management.

While separate from Robinhood’s trading app, the new credit card app will provide a seamless experience by integrating with the same user credentials.

Moreover, in an eye-catching promotional gambit, Robinhood will offer the first 5,000 customers who refer 10 new Gold members a 10-karat solid gold version of the physical Robinhood Gold Card. The exclusive 36-gram golden card will surely become a conversation starter.

Robinhood’s Ambitious Fintech Expansion

The Robinhood Gold Card represents the latest aggressive move by the California-based fintech company to expand beyond its brokerage business to ultimately become a financial services super app.

Last year, Robinhood launched retirement accounts with the unique perk of matching contributions of up to 3% on IRA deposits for Gold members. Customer adoption has been brisk, with $3 billion in assets accumulated across 500,000 retirement accounts as of February.

Also read: Coinbase vs Robinhood – Which is the Best Crypto Exchange?

The fintech unicorn also acquired credit card startup X1 for $95 million in June 2022, bringing aboard X1’s founder, Deepak Rao, to spearhead Robinhood’s foray into card lending products.

Robinhood’s strategy aims to make the platform a primary financial hub offering a full suite of banking, investing, lending, and money management tools for its 22 million customers.

Stock Price Soars Following Product Launch

Wall Street is giving an early vote of approval to Robinhood’s aggressive consumer finance expansion plans. The company’s stock price spiked 8% in early trading on Wednesday following the Gold Card announcement.

The surge builds on a remarkable 2023 rally that has seen Robinhood’s shares more than double in the past 12 months, vastly outpacing the S&P 500’s 31% gain during that the same period.

Robinhood appears to have regained its mojo with investors who are enthusiastic about the fintech’s growing suite of products and services.

With bold moves like the Robinhood Gold Card now grabbing headlines, it appears the fintech pioneer’s growth plans are hitting their stride as it evolves into a comprehensive money super-app.