The pharmaceutical industry has witnessed the beginning of a new era with the introduction of effective weight-loss drugs around 7 years ago.

These treatments, which include Novo Nordisk’s Wegovy and others like Zepbound and Mounjaro, have experienced steadily rising demand from consumers who have now found an FDA-approved alternative to treat obesity.

At the same time, these drugs have made their manufacturers quite reach, generating billions of dollars in revenue for them and making Novo Nordisk the most valuable company in Europe at some point last year.

The Wegovy Phenomenon: A Weight-Loss Game-Changer

The weight-loss market has been taken by storm by drugs like Wegovy. The drug is categorized as a GLP-1 agonist, which is a type of treatment originally intended to treat diabetes and heart diseases.

According to a recent survey, around one in eight individuals in the United States have taken these weight-loss drugs. The majority of these consumers suffered from diabetes or heart disease. The popularity of these treatments has created supply imbalances that have resulted in temporary shortages in the United States.

Also read: 10 Biggest Pharmaceutical Companies in the World by Market Capitalization

In the specific case of Wegovy, its popularity rose after the drug became the first to be approved by the United States Food and Drugs Administration (FDA) as a weight-loss treatment.

How Effective is Wegovy?

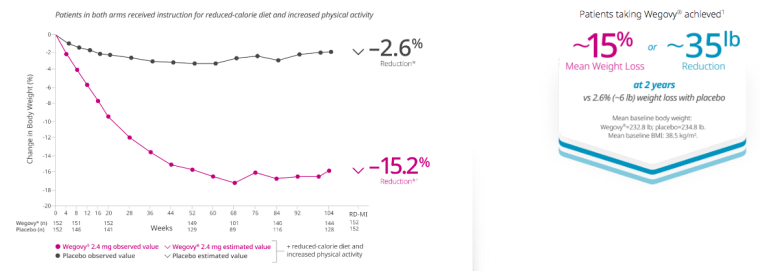

A study from Nature Medicine recently provided interesting insights into the effectiveness of Wegovy. According to the researchers, the drug generates results for patients during the first four years at least. During this period, those who take it both lose and maintain their lost weight. These results doubled the initial estimates and highlighted the power of Wegovy.

The study included 17,000 adults who were overweight or obese. Their conditions were not caused by diabetes. On average, the patients who took Wegovy lost an average of 10.2% of their initial body weight and saw their waist circumference reduced by 7.7 centimeters.

Dr. Cheng-Han Chen, Medical Director of the Structural Heart Program at the MemorialCare Heart & Vascular Institute, explained: “When people start taking the semaglutide-type drugs such as Wegovy or Ozempic, the majority of their weight loss occurs within the first year, or the first year and a half. And then after that, you don’t lose more weight, you just keep it off.”

Aside from weight loss, GLP-1 agonists reportedly generate other benefits to patients including an improvement in their heart condition and diabetes management.

“There is a school of thought that these drugs as a class may bind to GLP-1 receptors directly on the heart or arteries, or perhaps bind to some other critical target reducing inflammation or impacting cardiac function in some other positive way,” commented Jayne Morgan, a cardiologist in charge of Health and Community Education for the Piedmont Healthcare Corporation.

A Billion-Dollar Market in the Making

The market for weight-loss drugs is expected to grow to $100 billion by 2030 and some analysts are even suggesting that this could be a conservative estimate.

Novo Nordisk and Eli Lilly are the most prominent players in the space. Novo is the manufacturer of both Ozempic and Wegovy while Eli Lilly makes a drug named Zepbound that competes directly with the former.

Also read: DOJ Cracks Down on HealthCare Fraud Schemes That Stole $2.75 Billion

To meet the significant demand that its drugs have been experiencing lately, Novo Nordisk announced this month a $4.1 billion investment into expanding its manufacturing capacity in the United States.

A new facility in Clayton, North Carolina will be built while 1.4 million square feet will be added to the company’s production space as well. The company said that it will be investing around $6.8 billion in total this year – a 74% increase compared to 2023.

Novo Nordisk Outpaces TV Advertisers with New Wegovy Campaign

Novo Nordisk also launched this month an aggressive advertising campaign named “The Power of Wegovy”.

A new ad titled “Discover the Power” has been aired thousands of times on national TV in the United States and the campaign has reportedly cost around $42 million – the highest amount spent by any TV advertiser on a single ad.

The campaign targets a wide audience and shows testimonials from individuals who have lost weight thanks to the drug. The ad’s diversity aims to present Wegovy as an option for many different types of patients ranging from those that have been diagnosed with diabetes to overweight individuals.

“Diverse representation in healthcare campaigns can play a significant role in patients feeling seen, heard and understood, especially in a stigmatized space like obesity, which we’ve been engaged in for more than two decades,” commented Tejal Vishalpura, Senior Vice President of Commercial Strategy and Marketing at Novo Nordisk.

It’s a bit surprising that Denmark-based company needs to spend money on advertising to keep consumers interested in its drug, though recent supply shortages may be setting the drug back.

In April this year, the FDA informed consumers that 1.7 milligram doses of Wegovy were once again available in the United States. Meanwhile, for rival drugs like Zepbound, shortages are expected to persist until mid-year.

“They need to advertise, and advertise a lot, because there have been a lot of people who’ve been prescribed it who haven’t been able to get it,” said Leigh O’Donnell, from the research and consulting firm Kantar.

Novo Nordisk Gains Approval of Wegovy in China

Shortages are not stopping Novo Nordisk from expanding the reach of its successful weight-loss drugs. In late June, the company obtained approval from Chinese authorities to market Wegovy in the country. According to statistics, at least half of China’s 1.4 billion population is either overweight or obese.

Also read: Ozempic-Maker’s Sneaky Drug Marketing Sparks Wave of Copycats

The company will likely invest heavily in advertising its product in the Asian country as a patent on the drug’s active ingredient, semaglutide, is set to expire in 2026 and approximately 15 generic drugs are already in the pipeline of many domestic pharmaceutical companies and will be released right after.

The approval of Wegovy comes on the heels of the success of Ozempic in the country, whose sales have already doubled compared to last year.

Drugmakers Deal with Supply Shortages and Patent Expiration

The enormous demand that these products have experienced has put to the test the complex and sophisticated supply chains of both Novo Nordisk and Eli Lilly. Most of the presentations of their flagship drugs have been listed by the FDA as having “limited availability”.

Although the companies are investing heavily in expanding their manufacturing capacities, these expansion projects will take a while to come online. During that time, other producers may come up with similar drugs.

Meanwhile, in the United States, data from the National Library of Medicine (NIH) indicates that both Ozempic and Wegovy will see their patents expire in March 2026, meaning that generic drugs will flood the market in less than 2 years.

Insurance Coverage and Affordability Issues

In addition to supply shortages, the cost of these drugs is also a roadblock for many patients. For example, the cost of taking Wegovy for a month is $1,349. Although many insurers in the United States have agreed to partially cover the cost of this drug, public health programs like Medicare (and some other health insurance plans) do not cover weight-loss treatments.

However, insurance companies and health programs could benefit in the long term from administering these drugs to their customers as they reduce the risk of heart disease and may even lead to a reversal in a diabetes diagnosis.

“If the patients get to a healthier weight, they’re no longer diabetic, they don’t need high blood pressure medication. It’s a slow process, and as long as there’s continued data to show that these medications save costs in the long run, then I think eventually the insurance companies will come around. But it takes a long time,” Dr. Mir Ali, a surgeon at the Memorial Care Surgical Weight Loss Center told Medical News Today.

GLP-1 Drugs Could Be Used to Treat Multiple Other Diseases

While the effectiveness of GLP-1 drugs is clear, experts emphasize the importance of combining medication with lifestyle changes. A Danish study published in February found that combining these medications with exercise allows people to stay in shape after the lost weight by using these drugs.

As research continues, there is potential for these drugs to be approved for additional uses beyond weight loss and diabetes management. Studies are ongoing to explore their effectiveness in treating conditions such as sleep apnea, addiction, anxiety, Parkinson’s, kidney disease, and fatty liver disease. There is a real possibility that drugs like Wegovy could be real miracle drugs, helping to eliminate obesity and other serious conditions across millions of patients.

In addition, use cases for Wegovy and other similar drugs appear to extend beyond diabetes and heart disease treatment, with possible indications for conditions including apnea, Parkinson’s, and fatty liver disease.

The success of Wegovy and similar drugs has attracted attention from other pharmaceutical companies. With patents set to expire in the coming years, the market will likely see increased competition from generic versions and new entrants. However, experts believe that Novo Nordisk and Eli Lilly could their dominance in the near future due to their well-established manufacturing capabilities and ongoing research and development efforts.