Netflix (NYSE: NFLX) released its Q3 2024 earnings yesterday after the close of markets to great fanfare. The stock is trading higher today after the company beat both revenue and EPS estimates while its net subscriber count was in line with estimates.

Here, we will dive into the company’s Q3 earnings in detail and explore what the report means for its stock. We’ll also see how Wall Street analysts reacted to the streaming giant’s earnings.

Netflix Stuns Investors, Attracts 5M Paid Subscribers in Q3

Netflix reported revenues of $9.83 billion in Q3, which is 15% higher YoY and ahead of the $9.77 billion that analysts were expecting. Its EPS also rose 45% YoY to $5.40 and the metric easily surpassed the $5.12 that analysts were expecting.

In Q3, Netflix added over 5 million net subscribers and had 282.7 million paying subscribers at the end of September. While the Q3 subscriber add was below what we have seen in the recent quarters, it was still slightly ahead of estimates. Netflix’s subscriber growth has picked up sharply after the slowdown in 2022.

Netflix $NFLX earnings preview (reporting on Thursday after-hours) 👇

🔹 Revenue: $9.77B (+14%)

🔹 Earnings per share: $5.13 (+37%)Key metrics to watch 👀

🔹Payed membership additions

🔹Total streaming revenue pic.twitter.com/xeTfOihGn5— Investing visuals (@ZeevyInvesting) October 16, 2024

Its subscriber numbers grew exponentially in 2020 and 2021 as streaming demand picked up amid the COVID-19 pandemic. However, it lost subscribers in the first half of 2022 and while the Russia-Ukraine war and the subsequent slowdown in Europe were to blame, rising competition and stellar growth in the preceding two years also put pressure on its subscriber numbers.

Netflix noticed the slump and changed its strategy accordingly. First, it started a lower-priced ad-supported tier and it launched a major campaign to crack down on password sharing. While the password-sharing crackdown was initially quite unpopular among households and many irate customers canceled their subscriptions, it has eventually helped the company increase its subscriber base dramatically.

The ad-supported tier has also helped propel Netflix’s growth and the company said that in Q3, half of its new sign-ups were for the ad-supported plan, in regions where it is available. The company plans to launch the ad-supported plan in more regions.

Currently, advertisements are not a big driver and the company does not expect it to become one until 2026. However, as its ad-supported subscriber base rises and Netflix monetizes them more effectively, ad revenues should become a key driver of NFLX’s revenues.

NFLX Has a Strong Content Slate for Q4

Meanwhile, Netflix expects its subscriber adds to accelerate in Q4 on favorable seasonality and a strong content slate. In Q4, the company will premier the returning series Squid Game S2, Outer Banks S4, and Love is Blind S7. Squid Game’s first season was particularly popular and helped Netflix add millions of new subscribers by itself.

In movies, it will release John Lasseter produced Spellbound, the action thriller Carry-On starring Taron Egerton and Jason Bateman, and The Six Triple Eight, a Tyler Perry-directed war drama starring Kerry Washington in Q4. Netflix will also stream NFL games this Christmas which should also help it attract more subscribers in the quarter.

Notably, Netflix – or for that matter streaming in general – has a promising growth runway. In its biggest markets, Netflix accounts for less than 10% of the total TV time which highlights strong growth potential, especially as streaming continues to snatch market share from linear TV. Netflix has also been able to increase its industry-leading engagement levels and said that an average subscriber watches its content for two hours daily.

Key Opportunities for Netflix

Meanwhile, monetization of its ad-supported subscribers is a key medium-term opportunity for Netflix. The company is rolling out its first-party ad tech platform in Canada next month and then plans to replicate the format in other markets next year.

Digital advertisements are a hugely profitable business for tech companies like Amazon and Apple and if Netflix can effectively monetize its growing user base of subscribers with its ad-supported plan, it should also be able to reap the rewards.

Video games are yet another growth driver for Netflix and should also help the company increase customer engagement and retention. Netflix seems to be handily winning the streaming war as other players, especially Disney, are now focusing on profits rather than growing subscriber numbers at all costs.

In its shareholder letter, Netflix took potshots at its streaming rivals by pointing to its strong content slate and said, “streaming services which lack our breadth of content are increasingly looking to bundle their offerings.” While the company did not name any rival, it was a veiled reference to Disney which has bundled its Disney+ streaming platform with Hulu and ESPN+.

How Wall Street Analysts Reacted to NFLX’s Earnings

Netflix’s Q3 earnings were generally received well by analysts. JPMorgan, analyst Doug Anmuth said that Netflix remains a top pick for him and raised the stock’s target price by $100 to $850. “We believe NFLX’s global scale, strong engagement (~2 hours/day), & diversified content will push NFLX toward becoming the default choice for how users consume TV, film, & other long-form Content,” said Anmuth in his note.

UBS also maintained its buy rating on NFLX and raised the stock’s target price from $750 to $825 as the brokerage was impressed with the company’s commentary on double-digit revenue growth in 2025.

Morgan Stanley analyst Benjamin Swinburne termed Netflix’s Q3 earnings a “success” and raised the stock’s target price by $10 to $830. “Its ability to grow earnings 20-30% annually over time stems from layering on additional growth levers – paid sharing, ads, live, games – while increasing its return on content spend,” said Swinburne in his note.

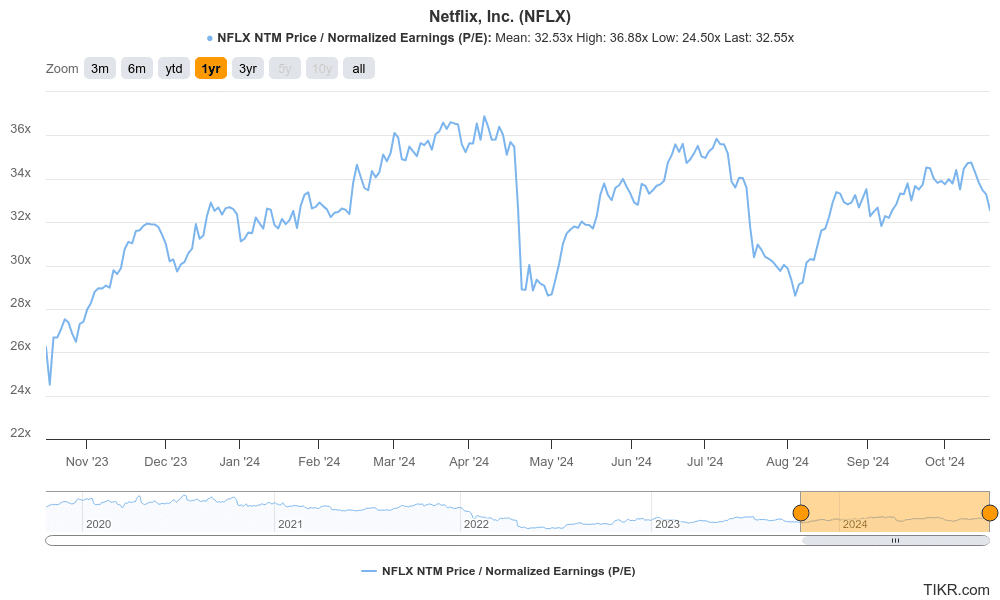

However, a section of the market is apprehensive about Netflix’s valuation as it trades at a next 12 months price-to-earnings multiple of 32x which many find stretched. Wolfe is in the bearish camp and believes that to justify its current valuations Netflix would need to deliver double-digit revenue growth for many years – something it is doubtful about.

All said, bulls seem to be having an upper hand and Netflix stock is sharply higher today, extending its 2024 rally. With a strong content slate that acts as a moat, profitable operations, growth drivers like sports streaming and video games, and untapped potential in advertisements, bulls have plenty of reasons to be bullish on the streaming giant and the Q3 earnings have validated the bullish thesis.