On Monday, the US Department of Justice (DOJ) and Google faced each other for the first time in a Virginia federal courtroom to mark the beginning of an incredibly high-stakes antitrust trial that could entirely reshape the online advertising landscape in America.

This trial focuses on Google’s $31 billion ad tech business, based on a recent ruling that deemed Google’s search business a monopoly. The case represents a significant challenge to the tech giant’s dominance in the digital advertising sector and could potentially lead to a breakup of its ad tech empire.

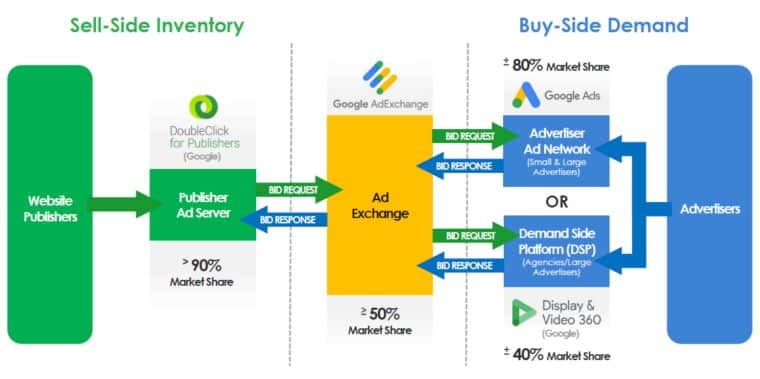

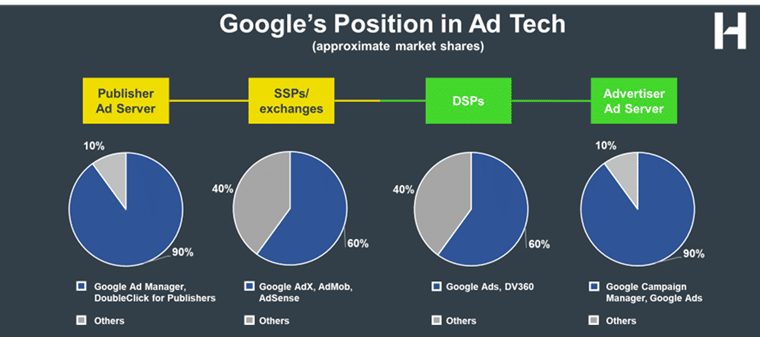

The Department of Justice, joined by 17 states, alleges that Google has illegally monopolized three crucial markets within the ad tech industry: publisher ad servers, ad exchanges, and advertiser ad networks. Julia Tarver Wood, a senior DOJ attorney, opened the trial with a powerful statement: “Control is the defining characteristic of a monopolist.”

She argued that Google’s dominance extends across every step of the online advertising process, from how publishers sell ad space to how advertisers purchase it. According to Wood, this “trifecta of monopolies” has resulted in a system that primarily benefits Google at the expense of publishers, advertisers, and ultimately, consumers.

The government’s case paints a picture of overwhelming market control. In her opening statement, Wood claimed that Google’s market share in these three areas ranges from at least 50% to as high as 91% in some instances.

This level of dominance, the DOJ argues, allows Google (GOOG) to set rules that invariably lead back to its own services, stifling competition and innovation in the process.

Google has denied the allegations over and over again, arguing that the government’s case is based on an outdated understanding of the digital advertising landscape. Karen Dunn, Google’s lead attorney, characterized the DOJ’s lawsuit as “a time capsule, where if you break it open there would be a BlackBerry, an iPod and a Blockbuster Video card.”

This colorful analogy underscores Google’s position that the ad tech market is far more dynamic and competitive than the government portrays.

DOJ Believes Google Exerts Monopolistic Powers Over Digital Ad Market

The DOJ claims that Google has displayed anticompetitive behavior since it launched its advertising business as it immediately started to acquire companies that posed a threat to their dominance.

The Justice Department believes that Google engages in self-dealing and auction manipulation practices to exert control over the entire process. They stress that the company’s advertising process is filled with conflicts of interest between them and publishers.

They also contend that Google has illegally tied its publisher ad server with its ad exchange to maintain its monopoly power. This practice, they argue, has made it virtually impossible for publishers to switch away from Google’s tools without losing significant revenue. Tim Wolfe, a revenue executive at Gannett, provided testimony that highlighted the industry’s dependence on Google.

He revealed that of the $15 million in fees Gannett pays annually to ad-tech companies, approximately $10 million goes to Google. Wolfe emphasized the difficulty of switching away from Google’s tools, describing it as “a heavy lift” for publishers.

Google Claims That the DOJ’s Definition of the Market is Too Narrow

Meanwhile, Google defends itself by stating that there is only one relevant market that it caters to – a two-sided market made up of content publishers that have online ad spaces and organizations that want to raise brand awareness and advertise their businesses.

They emphasize that digital advertising is a rapidly evolving landscape and that new platforms and technologies have contributed to changing the space for years. They also argue that an integrated ad tech stack helps the business become more efficient and provides more benefits to customers.

They also oppose the notion that they control the majority of the online advertising market and claim that the DOJ’s definition of that market excludes large and relevant players in the space like Amazon (AMZN) and Meta Platforms (META) whose digital ad businesses generate billions every year as well.

Once these large players are included, the company’s market share goes down from 34% to just 17% in the ad exchanges sector. The company maintains that advertisers have a wealth of choices, including using rival tools or shifting ad spending to platforms that don’t involve Google’s ad tech such as Instagram or Netflix.

Long List of High-Profile Witnesses Are Scheduled to Testify in Court This Week

US District Court Judge Leonie Brinkema will be in charge of overseeing the case between the DOJ and Google. She is known for having a no-nonsense and efficient approach and prefers to streamline the legal process as much as possible.

The DOJ initially asked for a 10-week trial but Brinrinkema reduced the period to six weeks to speed up the proceeding. There will be testimonies from a wide range of prominent industry experts and executives including the head of companies like The New York Times and representatives from tech giants like Meta Platforms.

A decent number of Google staff members and YouTube CEO Neal Mohan are expected to appear as well to provide insights into the company’s practices and substantiate the defense’s arguments.

On Monday, executives from Gannett, Index Exchange, Quad, and Kevel testified before the court. The government tried to use their testimonies to prove that publishers have a tough time replacing Google as the preferred advertising network.

The DOJ will focus its efforts on proving that Google has stifled competition and innovation in the ad tech space for decades and will argue that its dominance allows the business to charge higher prices to advertisers and reduce revenues for publishers.

Also read: The Google Class Action Lawsuit Settlement

They estimate that these practices have cost both sides hundreds of millions of dollars since 2019.

“Google is not here because they’re big,” stressed DOJ’s Tarver Wood. “They’re here because they use that size to crush competition.”

Meanwhile, Google will rely on the precedent set by the Supreme Court that the government cannot force a company to treat rivals with kindness.

“Millions of small, medium and large businesses choose Google’s ad tech ecosystem because it works,” the company argued in a public court filing.

The Bigger Picture: Antitrust Proceedings in the Tech Era

This trial comes at a time of increased scrutiny of Big Tech companies by antitrust regulators. Just weeks before this trial began, Google suffered a significant defeat in another antitrust case where a federal judge ruled that its search engine constitutes an illegal monopoly.

US District Judge Amit Mehta probably has the company’s faith in his hands as he is now in the position to force Google to make changes to its organizational structure and business model to remedy the situation.

Google complained about the ruling by stating: “This decision recognizes that Google offers the best search engine, but concludes that we shouldn’t be allowed to make it easily available.”

This recent victory for the DOJ emboldened regulators and set the stage for an even more aggressive pursuit of the ad tech case.

The outcome of this trial could have ripple effects across the tech industry. Other major players like Amazon, Apple (AAPL), and Meta (formerly Facebook) are also facing some degree of antitrust scrutiny. Hence, a decisive victory for the DOJ in this case could potentially pave the way for more aggressive enforcement actions against other tech giants.

The case also brings to light the challenges of applying traditional antitrust law to the rapidly evolving digital economy. The court’s decision will likely set important precedents for how monopoly power is defined and regulated in the age of big data and platform economies.

Looking Ahead: Potential Outcomes and Industry Impact

As the trial unfolds over the coming weeks, several potential outcomes emerge. A complete victory for the DOJ could result in a court-ordered breakup of Google’s ad tech business that would dramatically reshape the online advertising landscape.

A partial victory might find that Google is guilty of just some of these alleged anticompetitive practices, leading to less drastic remedies. Finally, if Google prevails, it could reinforce the company’s position in the ad tech market and potentially set a precedent that makes future antitrust actions against tech giants more challenging.

As the proceedings unfold in the Virginia courtroom, the entire tech industry is watching closely. The repercussions of this trial will likely be felt far beyond Google.