The US Department of Justice opened a legal proceeding that could shake up the financial services industry after it filed an antitrust lawsuit against the payment processing giant Visa.

On Tuesday, the agency proceeded to present its case to the US District Court of New York alleging that Visa has a monopoly on the debit card market and claiming that its practices stifle competition and increase costs for businesses and consumers.

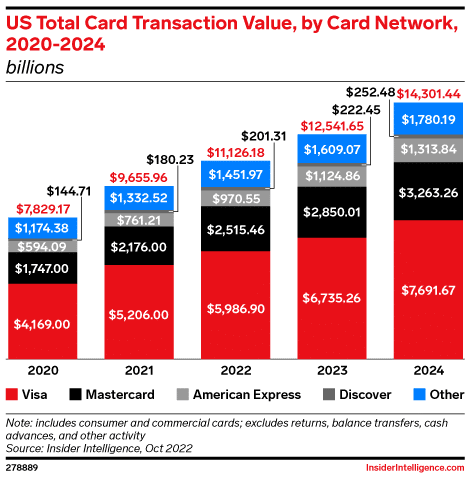

The document filed with the court indicated that Visa controls over 60% of all debit card transactions in the country which results in annual revenues of $7 billion solely from processing fees.

DOJ Claims that Visa Stifles Competition to Charge Higher Fees

Attorney General Merrick B. Garland stated: “We allege that Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market.”

He added: “Merchants and banks pass along those costs to consumers, either by raising prices or reducing quality or service. As a result, Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.”

The DOJ found several indications that Visa has monopolistic powers over the market as it imposes volume commitments to merchants and forces financial institutions to use their platform or otherwise require them to pay “disloyalty penalties.”

Moreover, Visa allegedly negotiated agreements with potential rivals that aim to discourage them from pursuing ventures that endanger their monopoly, which effectively reduces competition in this particular market.

By doing this, they may also be taming down innovation in the sector as Visa spends hundreds of millions every year to avoid the development of “new technologies that could advance the industry but would otherwise threaten Visa’s monopoly profits.”

Visa Will Defend its Case Vigorously

Rottenberg emphasized that Visa is proud of the payments network it has built, the innovation it advances, and the economic opportunity it enables. The company maintains that it faces growing competition, particularly in the online space.

Visa rapidly dismissed the DOJ’s claims and deemed them “meritless”. The company will defend its case vigorously according to a statement from its general counsel, Julie Rottenberg, who said: “Today’s lawsuit ignores the reality that Visa is just one of many competitors in a debit space that is growing, with entrants who are thriving.”

She added: “Anyone who has bought something online, or checked out at a store, knows there is an ever-expanding universe of companies offering new ways to pay for goods and services.”

Naturally, Visa seems to be trying to downplay its monolithic role in the industry. During the second quarter of 2024, Visa processed more than $3 trillion worth of transactions through its network. The company’s market capitalization currently stands at $531.8 billion including today’s 1.4% drop in its stock price and yesterday’s 5.5% decline that took place shortly after the news hit.

A Case Against Visa Could Last Years

The DOJ’s lawsuit argues that Visa’s alleged monopolistic practices have significant consequences for both consumers and businesses.

The complaint suggests that merchants and banks pass along Visa’s inflated fees to consumers, either by raising prices or reducing quality or service. The DOJ also argues that Visa’s practices limit the choices available to both merchants and consumers when it comes to payment processing options.

Retailers, who have long complained about excessive costs for processing both debit and credit card payments, have welcomed the DOJ’s action. Stephanie Martz, chief administrative officer and general counsel for the National Retail Federation, stated: “You can mandate competition. But if what’s happening behind the point-of-sale is inhibiting that, then you don’t actually have competition.”

“There’s no question that it affects consumers as well. You’re paying for these cards in the form of higher prices,” she added.

The outcome of the lawsuit could have far-reaching implications for the entire sector as Visa’s rivals – i.e. Mastercard and American Express – could be judged by the same standards as their peer.

The lawsuit challenges core aspects of Visa’s business model, potentially forcing the company to restructure its relationships with merchants, banks, and technology partners.

However, experts suggest that the trial could last a few years as a deep-pocketed corporation like Visa has all the resources it needs at its disposal to fight the DOJ all the way to the Supreme Court.

Biden Administration Have Targeted Multiple Large Corporations Like Google and Apple

In 2020, the DOJ moved to block Visa’s acquisition of Plaid – a transaction that was valued at $5.3 billion back then. The takeover was considered an “insurance policy” at the time that prevented the target company from expanding its network and threatening Visa’s lucrative debit card business. The deal collapsed as a result of the DOJ’s involvement.

The Biden administration has been on a crusade against businesses and models that have gained monopolistic powers over time across various industries. Notable cases include RealPage, a real estate software firm for algorithmic price fixing, Ticketmaster, Microsoft (MSFT), Google, and Apple.

Attorney General Garland highlighted the less visible but equally harmful effects of Visa’s alleged conduct compared to other antitrust cases: “In some of the Justice Department’s antitrust enforcement actions, the harm caused by the alleged illegal conduct is more visible: higher prices for air travel, for concert tickets, for smartphones. The harmful effects of Visa’s alleged anticompetitive conduct is less visible, but they are no less harmful.”

Consumers Could Benefit From More Competition in the Payments Sector

While the lawsuit is still in its early stages, there are several potential outcomes and implications to consider. If the DOJ prevails, Visa could be forced to alter its agreements with merchants, banks, and partners, which could effectively open up the market to additional competition.

In addition to changes in its business practices, Visa could face significant financial penalties if the DOJ proves that it has violated antitrust laws.

The outcome of this case could set precedents that affect other players in the payments industry and could reshape the competitive landscape. Meanwhile, if the lawsuit leads to increased competition in the debit card market, consumers could potentially benefit from lower fees and more innovative payment options. The case may also inspire additional regulatory scrutiny toward large players in this sector like PayPal and Block.

While Visa has vowed to defend itself vigorously, the lawsuit underscores the Biden administration’s commitment to enforce antitrust laws across various sectors of the economy.