Boeing stock fell over 4% yesterday which was much worse than the drawdown in broader markets after the company announced that it is halting the trials of its 777X after finding a crack in its structure.

Boeing said, “During scheduled maintenance, we identified a component that did not perform as designed.” It added, “Our team is replacing the part and capturing any learnings from the component and will resume flight testing when ready.”

Boeing Halts 777X Test Flights After Finding a Faulty Component

Reportedly, Boeing found that a component called “thrust link” which is part of the structure connecting the engine with the airplane, failed after a test flight. It then conducted follow-up inspections to find the part cracked on two other planes.

Boeing has notified its customers as well as federal regulators about the issue. Meanwhile, the good thing this time around is that Boeing detected the issue early and is acting proactively to address the flaw. All test rides of 777X are on hold until the problem is solved.

However, the incident raises even more eyebrows on the build quality of Boeing’s planes. Boeing seems to be falling apart, both literally and figuratively. Earlier this year, the door panel of a 737 Max jet blew off during an Alaska Airlines flight. Later in April, the engine cover on a Southwest Airlines Boeing 737-800 fell off during takeoff last month.

In his explosive testimony last month, whistleblower Sam Salehpour reiterated Boeing was very much in the know about the safety issues but not only ignored them but also retaliated against him when he brought these to the notice.

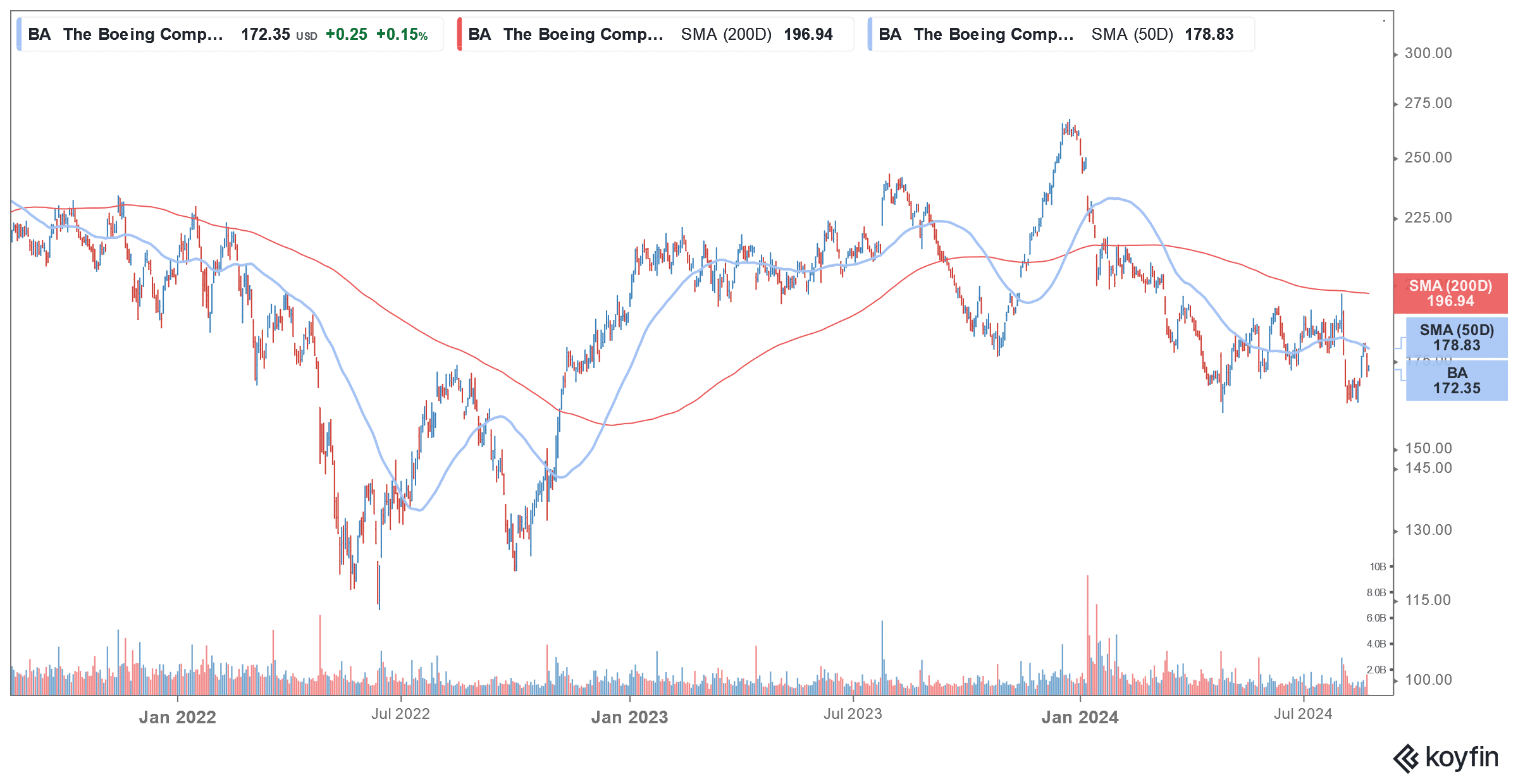

BA is the Second Worst Performing Dow Jones Stock in 2024

Not much has gone right for Boeing in 2024 which is the second-worst performing Dow Jones stock of 2024 with a YTD loss of almost 34%. The aircraft maker could well have been the worst-performing constituent of the 30-share index if not for Intel’s disastrous Q2 2024 earnings, post which it fell to a decade low.

Boeing’s price action is not surprising considering the financial impact of the crisis as well as the disastrous PR. Earlier this year, the Federal Aviation Administration (FAA) halted the production expansion of the Boeing 737 Max which is the company’s best-selling model. Just when things were looking on the right track, the halting of 777X trials has come as a dampener for markets.

Today, Kelly Ortberg officially joins Boeing as President and CEO.

Read his message to employees here: https://t.co/tQZbDXqFFI pic.twitter.com/4pNkwpt9TD

— The Boeing Company (@Boeing) August 8, 2024

Boeing Got a New CEO Earlier This Month

Earlier this month, Kelly Ortberg who has been in the aerospace industry for over 3 decades and was leading Rockwell Collins between 2013 to 2021, took over the baton as Boeing’s CEO. He replaced Dave Calhoun after Boeing stock sagged and underperformed markets by a wide margin during his leadership.

Incidentally, Calhoun became the CEO in early 2020 shortly after two new 737 Max jets crashed in quick succession, just a few months apart, between 2018 and 2019, in Indonesia and Ethiopia.

Under his tenure, Boeing’s reputation in terms of safety deteriorated even further and several of its aircraft were involved in safety-related incidents with the management widely seen to be hushing up rather than addressing the structural issues that cause such repeated incidents.

Meanwhile, Ortberg has a tough job at hand as there looks no easy fix for Boeing as is illustrated by the pausing of 777X trials. Leadership guru Bill George said Boeing has to “think differently because they’ve been on the wrong track for 20 years” and believes that it would need a decade for things to turn around.

Analysts on BA Stock

Earlier this month, Bernstein reiterated its overweight rating on Boeing stock even as it cut the target price from $222 to $207. “In assessing where Boeing currently stands, there are two competing factors. First is the deepening hole of cash, with more defense charges, rising inventories, slowing advances, and higher debt. On the other side is an outlook for improving deliveries, including the 737 production ramp, 787 production recovery, 777X certification progress, and restart of deliveries to China,” it said in its note.

Meanwhile, the 777X certification progress has now taken a back seat after Boeing halted test flights.

The Pause on 777X Is a Setback for BA Investors

The 777 has been one of best best-selling aircraft for Boeing ever since it started offering them in 1995 and the 777X was expected to be the next growth driver as the 777-300ER is now aging even as its sales are still strong.

The halting of 777X’s test flights is a setback for Boeing as the FAA only started testing it in July. In fact, during the Q2 2024 earnings call, Calhoun was quite upbeat on the model. “Our team has put the 777-9 test fleet through more than 1,200 flights, 3,500 flight hours across a wide range of regions and climate condition. And the certification of flight testing will continue validating the airplane safety, reliability and performance,” he said during the earnings call.

Notably, the 777-9 is the first plane in the 777X line. Boeing operated its first 777-9 flight way back in January 2020. It optimistically suggested that deliveries would begin in 2022 but they were hit with multiple major delays due to recurring issues, including those related to the supply chain during the COVID-19 pandemic. Prior to the halt of testing, Boeing had said that it would commence the model’s deliveries in 2025.

Boeing stock has left a big hole in the pockets of long-term investors also as the stock has lost over half of its market cap over the last five years even as the S&P 500 index (with dividends) has nearly doubled over the period.

The Aircraft Manufacturing Industry Is a Duopoly

The aircraft manufacturing industry is effectively a duopoly which is making some analysts see Boeing in a more positive light, despite its many troubles. Analysts rate Boeing a “Moderate Buy”, despite its seemingly unending woes. Boeing’s order intake trailed rival Airbus by a wide margin in 2024 as airline companies seemed wary of ordering fresh planes from the troubled company.

In July, Boeing’s order intake was ahead of Airbus as its woes receded. However, the halting of 777X trials shows that the troubled aircraft maker still has a long way to go before it fully regains the market’s confidence.

Notably, Chinese state-owned plane maker COMAC is also trying to expand internationally. While COMAC is arguably an untested player for global airlines, Boeing’s problems are so severe that it may not be able to stay on top for very long.