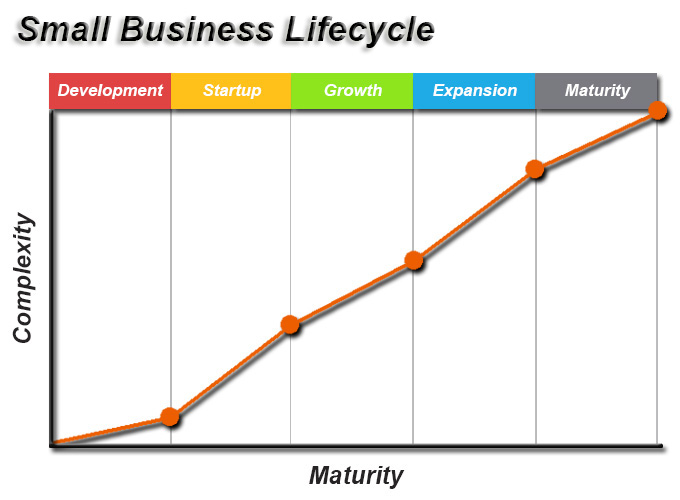

During the growth of a small business, a company will go through the stages of the business life cycle and encounter different challenges that require different financing sources.

For example, the business will require a different strategy when it comes to market penetration, business development, and retaining market share.

As the business matures, operations and priorities will change therefore requiring business financing to also change as well.

A business will go through the stages of a business lifecycle similar to a tree’s lifecycle.

As a seedling that sprouts and matures, the tree will require different amounts of resources through the stages of its lifecycle.

Understanding the different stages of the business lifecycle will help you prepare for the obstacles that your business will need to conquer to succeed.

Key Takeaways: Understanding Business Life Cycle Stages (In Order)

- Development / Seed Stage: This foundational stage is all about turning your business idea into a reality, conducting market research, and determining the idea’s feasibility.

- Startup Stage: Legal establishment of the business, development, and initial marketing of the product or service. It involves tweaking the business model based on feedback and ensuring it meets market demand.

- Growth / Survival Stage: The business consistently generates revenue and gains new customers. It’s a period for fine-tuning the business model and strategies for efficient operations amid growing competition.

- Expansion / Rapid Growth Stage: With a solid market presence, the business seeks to expand into new markets and distribution channels to capture a larger market share, leveraging its established sales, marketing, and operations models.

- Maturity Stage: The business reaches its peak with a dominant market presence. Decisions here involve sustaining growth through new strategies or considering exit strategies.

Each stage presents unique challenges, from establishing a customer base and managing cash reserves to dealing with competition and exploring expansion opportunities.

Adjusting your business plan and operations to address these challenges is crucial for navigating the business life cycle successfully.

Let’s explore!

1. Development / Seed Stage

The development or seed stage is the beginning of the business lifecycle.

This is when your brilliant idea is merely just a thought and will require a round of testing in its initial stage.

In testing your business idea, you may conduct research regarding the industry, gather feedbacks from your friends, family, colleagues, or other industry specialists.

This is when you are determining whether the business idea that you had is worth pursuing and if so it will be the birth of your new business.

Challenges

- Business Idea Profitability

- Market Acceptance

- Establishing Business Structure

- Accounting Management

2. Startup Stage

You’ve decided that your business idea is worth pursuing and have made your business official. At this point, you’ve completed the development of your products or services and will start marketing and selling them. During this phase, you will refine your offerings based on feedback from your first paying customers and market demand. You will need to learn and adapt your business model to ensure it is profitable and meets your customers’ needs. By adjusting your business model, you’ll be able to put your business on the right path.

Challenges

- Managing Cash Reserves

- Managing Sales Expectations

- Accounting Management

- Establishing Customer Base

- Establishing Market Presence

3. Growth / Survival Stage

Your business has endured through the initial stages of the business lifecycle and is currently in its growth or survival stage. T

he business is consistently generating revenue and adding new customers.

This recurring revenue will help pay for your operating expenses and open up new business opportunities. Currently, your business could be operating at a net loss or maintaining a healthy profit, but there could be some competition.

This is also when you need to fine-tune your business model and implement proven methodologies, sales model, marketing model, and operations model before expanding your venture for the mass market.

Challenges

- Dealing with Increasing Revenue

- Dealing with Increasing Customers

- Accounting Management

- Effective Management

- Market Competition

4. Expansion / Rapid Growth Stage

Your business has been a thriving company and established its presence in the industry.

You have now reached the stage in which your business will expand and spread its roots into new markets and distribution channels. In order to start capitalizing on the success of your business, you will need to capture a larger market share and find new revenue.

Therefore your business will experience a rapid growth in revenue and cash flow.

The rapid growth stage takes advantage from the proven sales model, marketing model, and operations model set forth from your growth/survival stage.

Challenges

- Increasing Market Competition

- Accounting Management

- Moving into New Markets

- Adding New Products/Services

- Expanding Existing Business

5. Maturity Stage

After a successful expansion, your business is on top of its industry and has matured.

At the final stage of the business lifecycle, your business has a dominating presence in its market. Your business could still be growing but not at the substantial rate as you’ve previous experienced.

Your current option is to decide to take a step back towards the expansion stage or to think of a possible exit strategy.

Challenges

- Increasing Market Competition

- Accounting Management

- Moving into New Markets

- Adding New Products/Services

- Expanding Existing Business

- Exit Strategy

Every stage of the business lifecycle brings new or pre-existing challenges. Solutions that may have worked for one stage may not work in another stage, which is why you should always adjust your business plan and operations accordingly.

Wrapping Up: Mastering the Business Life Cycle Stages in Order

At each stage, your business will rely on a financial source to help overcome the challenges your business faces. This is especially important to have an accounting management software in place so that you will have an accurate reflection of your current business finances.

Having an accounting software in place will help you understand where your business is on the current business lifecycle and the details will allow you foresee upcoming challenges and to make better business decisions.

This article originally appeared on Servora Blog and has been republished with permission.