Amazon Pay, Amazon’s payment processing service used by merchants to take payments from customers, has integrated with buy now pay later firm Affirm, allowing merchants to offer Affirm’s installment payment plans within Amazon Pay’s checkout flow.

The integration brings Affirm’s flexible pay-over-time options to the thousands of merchants that accept payments through Amazon Pay. Eligible U.S. merchants can now easily add Affirm as a checkout option alongside other payment methods like credit cards and bank transfers.

“We know customers want convenient and flexible payment options – whether they’re checking out on Amazon.com or using Amazon Pay,” said Omar Soudodi, director of Amazon Pay. “With Affirm on Amazon Pay, merchants can offer a pay-over-time option to their existing customers and have another way to reach new customers.”

Affirm allows shoppers to split purchases of $50 or more into biweekly or monthly installment payments. Customers are shown the total cost upfront with no confusion about hidden fees. Interest rates vary based on the purchase amount and the buyer’s credit profile, starting at 0% for some customers. There are no late fees or impact on credit scores.

Also read: 90+ PayPal Statistics Updated for May 2023

Merchants Report Positive Results Once They Implement Affirm

Casper, USA Berkey Filters, and UltraSabers are among the merchants already offering Affirm via Amazon Pay. They anticipate increased sales and conversions by reaching new customers who prefer installment payments over lump sums.

In general, merchants using Affirm report 60% higher average order values compared to other payment methods. Customers using Affirm have high purchase repeat rates, with 88% of orders coming from returning customers.

“Digital wallets are an increasingly critical part of the shopping experience and are expected to account for over half of e-commerce transactions worldwide by 2025”, said Libor Michalek, President of Affirm.

Also read: Klarna Cuts Losses & Targets Profitability Later This Year

“By integrating Affirm’s Adaptive Checkout™, thousands of merchants can offer their customers personalized payment options and increased spending power through Amazon Pay’s convenient and secure checkout experience.”

When checking out at a merchant supporting Amazon Pay with Affirm, customers need only click the “Amazon Pay” button and select Affirm as their payment method. They then go through a quick approval process and, upon approval, immediately see their payment schedule before confirming the purchase.

The integration aims to make it easy for merchants to benefit from Affirm’s popular interest-free and low interest installment payment options. Merchants can sign up to offer Affirm via Amazon Pay at pay.amazon.com/business/affirm, and customers can learn more at pay.amazon.com/using-amazon-pay/affirm.

Affirm is Deepening its Ties with Amazon with this New Partnership

This partnership with Amazon is built on top of the first collaboration between the two companies in August 2021 when the e-commerce giant made Affirm its official buy now, pay later partner at checkout on the Amazon.com website.

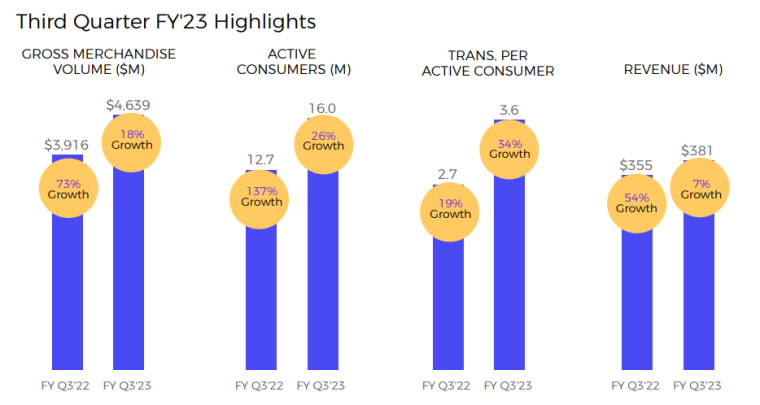

During the third quarter of the 2023 fiscal year, Affirm reported gross merchandise volumes (GMVs) of $4.64 billion resulting in an 18% year-on-year jump. Meanwhile, the company had 16 million consumers who financed their purchases through the platform. This number represents a 16% increase in Affirm’s customer base in just a year.

The company reported that 69% of the financing it has extended bears an interest, meaning that it generates revenue for Affirm. General merchandise is the most active category for the company in GMV terms, accounting for 28% of the total, followed by Fashion & Beauty and Travel & Ticketing which made up for 18% and 16% of GMVs during this third quarter of FY2023.

Also read: Best Crypto Credit & Debit Cards for 2023

During this same period, Affirm processed 14.3 million transactions resulting in a 36% year-on-year jump in this particular metric. The company highlighted that 88% of those transactions came from repeat customers.

Meanwhile, the number of merchants who currently offer Affirm’s financing alternative on their points of sale grew by 19% to 246,000 compared to a year ago with 37% of that total processing over $1 million in gross merchandise volumes in the past 12 months.