If we were to go through the sales numbers of the last 18 months, it is fairly evident that there is an insatiable appetite for voice devices in the global market. The use of these digital voice assistants and conversational AI coupled with the advancements in AI and the overall underlying technology shows that voice first devices are poised to transform commerce and marketing within every industry.

It truly is surprising how technology is so dynamically transforming one sector after another with revolutionary innovations. After the early rattle of IoT (Internet of Things), AR (Augmented Reality), VR (Virtual Reality) and Cloud computing, now we have the digital voice assistant technology to look forward to. However, the concept of voice-based services extends far beyond just personalized assistance to touch the banking sector at large.

People have been using finance apps for personal banking for the long time since it allows them to perform banking related tasks on their mobile devices without having to visit a bank personally. Now, with the prevalence of personal and home assistants mean that banks have a cheaper and better alternative as the technology to support voice-activated banking is already built into smartphones.

So the new ripple in a tech-focused market is the compelling question: Does banking really need a digital voice assistant? Here is the answer:

Imagine the World Without Voice Services

Remember the time when we used to rely on IVR customer services and support to resolve issues related to our computers or mobile services. It was surprising how we used to interact with our mobile devices and manually type on the glass screen to communicate our concerns. However, everything wasn’t really that smooth and functional every time the approach to customer service was made.

The biggest roadblock was that most IVR systems didn’t offer quick problem learning or problem-solving abilities. They didn’t have learning capabilities that today’s virtual voice assistant develops over time. Moreover, typing was neither the most effective, nor the most practical way to interact with a device or a computer for most common problems. It wasn’t that long ago that we had to invest a lot of efforts to fulfill the minor routines.

The world without the voice-driven AI services would seem slow, inefficient and strenuous now that we can think of adopting enlightened virtual assistants. They enable us to take informed decisions and solve a issues in seconds.

Conversational AI in Finance

Imagine being informed of next big step you need to take to make your finance management even better, can you? Also, have you ever thought that you will be presented with an intelligent conversation where all your questions are answered before you utter anything? Now you can.

With the help of voice-powered digital banking chatbots, all your interactions are read, processed and understood properly so that you receive the most comprehensive solutions from the bank. Based on your needs, preferences, transaction patterns and behaviors, the AI-enabled voice assistant can guide and lead you to where exactly you should go – saving you time-consuming by doing away with repeated steps down the road.

Proactive Power of Intelligence

Voice Means Convenience and Luxury

Voice recognition system enhanced with text-to-speech voices creates a world of difference when it comes to the convenience of bank customers. The process is further given a boost by incorporating AI which assists in decoding human emotion and intents through its self-learning abilities.

Nuance was the first pioneer to introduce such system though with limited audio and text capabilities. Apple’s Siri became the first technology to support this interactive algorithm with better potential. However, the success of voice assistive software has now led to fundamentally changing the way customers interact with financial organizations and banking in general.

The reason these technologies are largely integrated into the banking system is that it offers unbelievable convenience and luxury while executing functions like digital transactions, payments, loan process and deposits.

Tech Giants Herald the Era of Intelligent Assistance

Initially, what started as an experimental innovation to make a difference to lifestyle habits, voice-powered chatbots are no longer a technological gimmick. The results gained from integrating voice interactions in conversational commerce is so positive that many tech giants embark on producing high-grade intelligent assistive services.

Leading tech companies have by now launched their software for voice-based conversational AI with some of them being Apple’s Siri, Google Voice, Amazon’s Alexa, Microsoft’s Cortana, Facebook’s M, Amazon’s Echo and Google Home.

With every other software coming into the digital market, various components of interactive assistance are getting fine-tuned to increase the accuracy speech recognition and data analysis. The responses received by these companies are incredible since more and more people are showing interest in trying such voice assistant services to resolve queries, get assistance and save time.

Real-time Examples of Voice Banking

In early months of 2017, American Express made an announcement saying that they will integrate Amazon’s Echo in order to enable customers to check their balance, view offers, make transactions and much more.

According to eMarketer, nearly 35.6 million Americans will rely on a voice-activated digital assistant device like Google Home or Amazon Echo once a month.

Nearly 60 million smartphone users will adopt virtual voice assistant software like Alexa, Siri, Cortana and Google voice in their devices for quick voice-enabled services.

When it comes to voice banking, Garanti Bank and Satander are two financial service providers who have started offering voice-activated banking services.

Real Conversations using Natural Language

Another part where machine learning in voice technology helps with bank customers is that they can interact and share their queries with the system using natural language processing.

If there are more instances of using and interacting with Echo, greater will be the chance for Alexa to learn, process and adapt to your speech patterns, search items, vocabulary and personal preferences. This is quite an essential feature for people who need assistance in their own native language.

The always-on, spontaneous and always-listening nature of Alexa and other voice-enabled banking chatbots will ensure there is an uninterrupted machine learning to read customer behaviour. The result is more accurate search results and precise financial decisions.

Erica: The Beginning of Voice-First Attitude in Banking

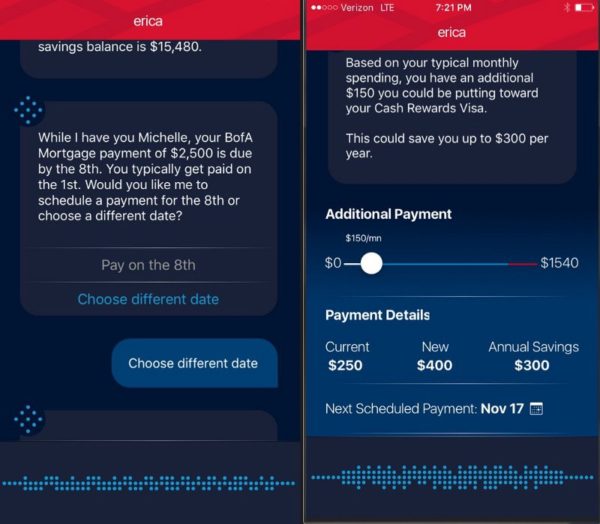

At the time of the launch of Amazon’s Alexa, many tech analysts formed the commonplace opinion that Alexa was just the new talk of the town. However, things came out differently. When Bank of America’s introduced Erica in 2016, the technology hit another milestone. Forbes depicted how Erica of Bank of America can change the usual interactions that happen between a customer and their bank.

Erica unleashed unforeseen promises

With the help of the Artificial Intelligence used by Bank of America, they could see the millions of customers using their mobile banking app to interact with their bank account and perform transactions. Using its smart machine learning inputs, Bank of America had a clear idea about how to program the algorithm of Erica for offering voice banking aid.

Erica has much more to offer than what a person at first look would gather. Closely observing the customers transactions and analysing their financial pattern, Erica not only makes statements about account balance like a typical ATM machine but it also keeps the customers updated about their credit score, debt management, savings, future investment plans etc.

Erica is a proactive voice assistant

When a customer interacts with a bank, he leaves behind a footprint of financial data that Erica over time reads and digests to offer useful advice to the customer. It will scan user’s financial state and favour them by offering real-time opportunities to control and optimize their spending.

Being a proactive voice assistant, Erica can monitor customers’ vital banking functions and recommend taking fair steps to improve their market reputation and low credit score. She can even surprise you by telling you to reduce interest on your existing credit card by making somewhat higher payment on an outstanding balance.

Erica is here to erase the gap between human and machine

It was not that long ago that people used to foster the misconception of how machines may not give as much of a competitive advantage, profitability or interactive finesse as their human counterparts. A few years ago, the possibility of having an AI-powered voice assistant was a wild dream. However, Erica of Bank of America has pretty much debunked the myth.

What Erica is programmed to do can erase the gap that existed between a human and a machine. Erica’s machine learning system aligns perfectly with digital advancements made to improve banking experience. It is meant to revolutionize the way banking is approached as it peeks a little deeper into the financial aspect (which is perhaps the most crucial of all) of our lives.

The voice chatbot of Erica synchronizes all banking decisions and information of a customer to enable a different level of banking commerce and redefine personal banking using digital technology.

The Enlightened Assistant Drives Sophisticated Banking

Brian Roemmele, the founder at Payfinders.com states, “The more a personal assistant knows about a consumer and daily life patterns, the better it can interact with millions of financial (and non-financial) options at any given moment.”

This statement can be extended to mean a lot in terms of the impact of having personal banking assistant in real life. It is true that having an enlightened voice assistant who is listening to your activities 24/7 is a boon when it comes to your finance-related decisions. In today’s world, when people are busy organizing every aspect of their lives, they have little time left to manage and focus on their daily finance.

Hence, it is really nice to have someone who recognizes your voice, follows you closely and understands your life like no other. At any given moment, all you need to do is to ask your digital voice-enabled finance guide to initiate intelligent communication that involves questions and solutions.

Moreover, the vision of sophisticated banking necessarily involves the idea of proactive banking where a person is reminded of their accurate financial status and actionable recommendations to diminish the risk factor.

Is Conventional Banking About To Disappear?

This is the most critical question thousands of tech enthusiasts and finance experts are asking. Definitely, it is undeniable that the rise of Fintech startup companies and their development promises have fortified the vision of entrenching voice banking infrastructure in the world.

Despite achieving considerable success, the question is still there: Will traditional banking completely disappear? We can say there is a possibility of everything in today’s world.

KMPG report says that certain major components of conventional banking may disappear and will be replaced by virtual voice assistant like Eva. Most banks may think of digitizing their customer call centers, branches, sales teams, financial advisers, marketers, etc. Data will be the hero in the whole digital AI setting and so will be their generous technology partnerships.

Conclusion

The discussion on whether or not banking needs digital voice assistant can conclude with many possibilities, one of which is ‘probably yes’. This is because it is impossible to avert from the shift that leading tech giants have promised in the banking sector through voice-enabled devices, AI-driven technology and data processing capabilities. The invisible banking bot system is still at its thoughtful stage with some of its components becoming true as Artificial Intelligence is combined with voice. Despite the digital progress, the banking sector is still not perfectly prepared to dive into absolute voice-enabled AI-driven services. The complete transformation, albeit a couple years away, is bound to happen and round the corner.