The consulting powerhouse McKinsey & Company is now in the crosshairs of the US Department of Justice (DOJ), which has launched a high-stakes criminal investigation into the firm’s controversial role in advising major pharmaceutical manufacturers on turbocharging the sale of prescription opioid painkillers.

The federal probe emerges as another major legal headache and existential threat for the elite advisory firm that has already paid nearly $1 billion to escape ballooning civil litigation over the nationwide addiction crisis.

Key Takeaways: McKinsey & The Opioid Crisis

- Federal Investigation: The DOJ has launched a criminal investigation into McKinsey’s role in advising pharmaceutical companies on opioid sales strategies that exacerbated the crisis.

- Previous Settlements: McKinsey has already paid nearly $1 billion in legal settlements to states, tribes, and local governments, without admitting wrongdoing.

- Accusations: Prosecutors are investigating whether McKinsey's recommendations to aggressively market opioids, despite addiction risks, violated the law.

- Reputational Risks: The investigation could further damage McKinsey’s reputation, particularly among prospective talent and clients prioritizing corporate ethics .

- Latest Updates: As of October 2024, McKinsey faces mounting legal scrutiny with the DOJ’s criminal probe, which could lead to further financial penalties and impair the firm’s ability to secure government contracts.

What is the Story behind the McKinsey Scandal

According to the Wall Street Journal, federal prosecutors have assembled a grand jury in Virginia tasked with scrutinizing if McKinsey's consulting work improperly exacerbated the rampant over-prescription of highly addictive opioids like OxyContin.

Of particular focus is McKinsey's advice to Purdue Pharma, the maker of OxyContin, including recommendations allegedly made to sales reps that prompted them to intensify their marketing efforts to doctors who were prescribing the highest volumes of opioids.

Prosecutors are also investigating if McKinsey obstructed justice by withholding or destroying internal records pertaining to its opioid advisory work, sources told the Journal. Two US Attorney's Offices – the Western District of Virginia and the District of Massachusetts – are spearheading the high-profile criminal inquiry.

Also read: Sackler Family Net Worth: Racking Up $13 Billion But At What Cost?

McKinsey declined to comment on the DOJ investigation. However, the firm previously stated that while it "deeply regrets" failing to foresee tragic addiction consequences, its intent was supporting legitimate medical needs – denying culpability for directly fueling the nationwide crisis. Why it thought anyone would believe that it legitimately wanted to help people and not just make money at any cost is a bit baffling but it may be hard to prove in a court.

Nearly $1 Billion Have Been Spent in Legal Settlements by McKinsey Since 2021

The DOJ's criminal case marks a dramatic escalation in McKinsey's legal jeopardy stemming from its entanglement with pharmaceutical companies accused of deceptively marketing the prescription opioid painkillers that fueled the public health crisis.

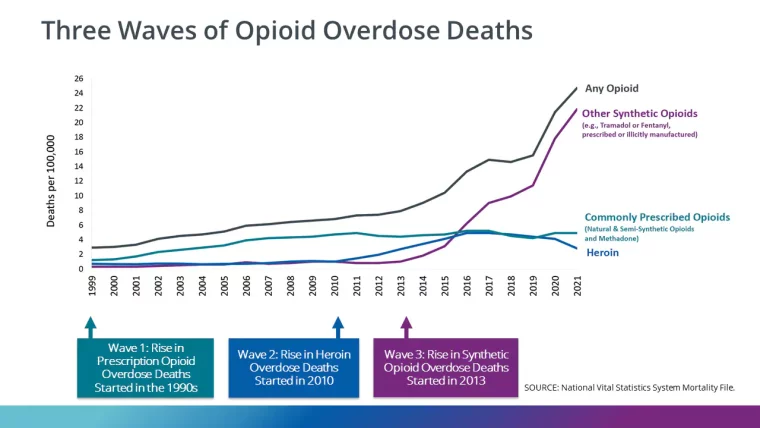

According to the Centers for Disease Control and Prevention (CDC), nearly 645,000 Americans died from opioid overdoses between 1999 and 2021 as the addiction epidemic ravaged communities nationwide.

The epidemic's devastation fueled a blizzard of litigation from state attorneys general, local governments, Native American tribes, and other organizations. Their lawsuits alleged that McKinsey improperly advised drug makers like Purdue Pharma on implementing aggressive sales practices, downplayed addiction risks, and prioritized profits over public welfare.

McKinsey aimed to resolve the matter by reaching a $641.5 million settlement in 2021 with 49 states, territories, and the District of Columbia. That payout, described at the time as the first by a company that was directly associated with the opioid crisis, sought to "achieve finality and avoid the inherent cost and risk of litigating in venues across the country" according to the firm’s official statement back then.

However, the legal onslaught persisted. Last year, McKinsey agreed to pay $347 million more to settle claims from additional plaintiffs like Native American tribes, school districts, local municipalities, and health insurers seeking compensation for the expenses caused by opioid addiction and overdose cases.

Despite the nearly $1 billion spent in total settlement costs, McKinsey admitted no wrongdoing over its advisory work. The strategy, aimed at swiftly resolving civil matters through settlement, now appears to have backfired, fueling a criminal investigation that is capable of inflicting far graver reputational and financial damage to the consulting giant.

McKinsey Denies Wrongdoing but Evidence Mounts

Prosecutors appear to be focused on whether McKinsey's consulting recommendations for pharmaceutical companies like Purdue and Endo crossed legal boundaries by recklessly advising on over-prescription despite the apparent risks.

In 2019, a cache of documents was publicly released through Purdue's bankruptcy proceedings, detailing McKinsey's advice and how it may have exacerbated the addiction epidemic. One August 2013 presentation sent to Purdue executives is seen as a central piece of evidence.

Also read: 10 Biggest Pharmaceutical Companies in the World by Market Capitalization

According to the presentation's contents, reported by multiple media outlets, McKinsey consultants advised Purdue that it had a "significant opportunity" to redirect sales representatives away from doctors writing the fewest OxyContin prescriptions.

Instead, the recommendations focused squarely on intensifying marketing to doctors identified as the highest-volume prescribers of the potent and addictive opioid.

The presentation claimed that this strategic reallocation of Purdue's sales force could increase OxyContin's revenues by over $100 million annually. It stated that doctors who were already prescribing high doses of OxyContin could boost their recipe quantities by 25 times on average compared to their peers.

Other documents showed that McKinsey advised Purdue and Endo Pharmaceuticals on tactics to boost painkiller sales to the US Department of Veterans Affairs – even as McKinsey served as a consultant to the VA itself during that period. McKinsey asserted that those two roles were unrelated.

McKinsey has maintained that its work aimed to support the legitimate use of opioids by patients with medical needs requiring pain treatment. The firm further contends that it ceased advising pharmaceutical companies on opioid-specific business matters in 2019.

However, federal investigators appear unconvinced and seem determined to explore the possibility of further potential wrongdoing further.

Government Contracts at Risk if McKinsey is Criminally Convicted

The escalation to a federal criminal probe exposes McKinsey to devastating financial penalties and reputational damage should prosecutors secure convictions over the elite consultancy's opioid advisory activities.

Also read: Best Biotech Stocks to Watch in 2024

Financial analysts speculate that a criminal conviction could expose McKinsey to further 9 figure (or more) fines due to its involvement in a crisis that has cost the federal government and the general public billions of dollars.

There is also the risk that former clients could file lawsuits to claim compensation for damages related to prestigious talent departing their organizations due to their association with an entity that has been accused and found guilty of criminal wrongdoing.

Perhaps the most severe consequence would be that a criminal indictment can impair McKinsey's ability to secure future government consulting contracts. This has been a vital advisory pipeline that has historically accounted for a significant portion of the firm’s revenues, particularly from agencies like the Department of Defense (DoD) and the Department of Veterans Affairs (DVA). McKinsey brought in about $142 million from the US government in 2018, though the number has since fallen to a local low of $54.9 million in the fiscal year ending on September 30th, 2023.

This dire scenario of diminished business prospects and tarnished brand value can hit McKinsey's prestige and profitability. Founded in 1926, the closely held partnership has cultivated a reputation for its elite analytical expertise coveted by its work with the world's most prominent corporations across a wide range of industries.

Scrutiny over McKinsey's involvement with opioid manufacturers has already forced internal reforms, including new client screening protocols and nearly $700 million invested since 2018 to upgrade risk management teams and compliance processes based on the firm's statements.

Court of Public Opinion May Have Found McKinsey Guilty Way Before the DOJ

Irrespective of whether DOJ prosecutors secure criminal convictions against McKinsey, the high-stakes federal investigation carries outsized reputational risks in the court of public opinion.

Marketing experts warn that McKinsey may face long-lasting damage to its brand equity and recruitment prospects due to the sting of intensifying legal scrutiny. This could be particularly true among prospective millennial and Gen Z consultants prioritizing corporate ethics and civic responsibility.

"McKinsey's efforts worked", said North Carolina Attorney General Josh Stein upon announcing his state's portion of the 2021 civil settlement. "The number of pills prescribed, Purdue's profits and McKinsey's fees all skyrocketed. But so did the number of overdoses."

McKinsey’s status as a private company prevents analysts, investors, and the general public from scrutinizing its finances and the impact that these legal settlements have had on its practices and policies.

However, public opinion is already tilted against the business for its proven role in the opioid crisis as indicated by the settlements. As this latest investigation unfolds, proof of further involvement could further tarnish the company’s reputation and affect its ability to keep growing its businesses in critical segments of the economy that may see too many risks in working with a firm with this kind of track record.