Recent studies have shown that two-thirds of customers want to call to speak to a financial services agent in order to make a purchase decision. This statistic makes intuitive sense — financial decisions like investments, loans, and mortgages are often highly considered and require a live agent to field the numerous questions and concerns prospects will voice. Additionally, having a live agent provides a certain peace of mind that sensitive financial data is being processed with care.

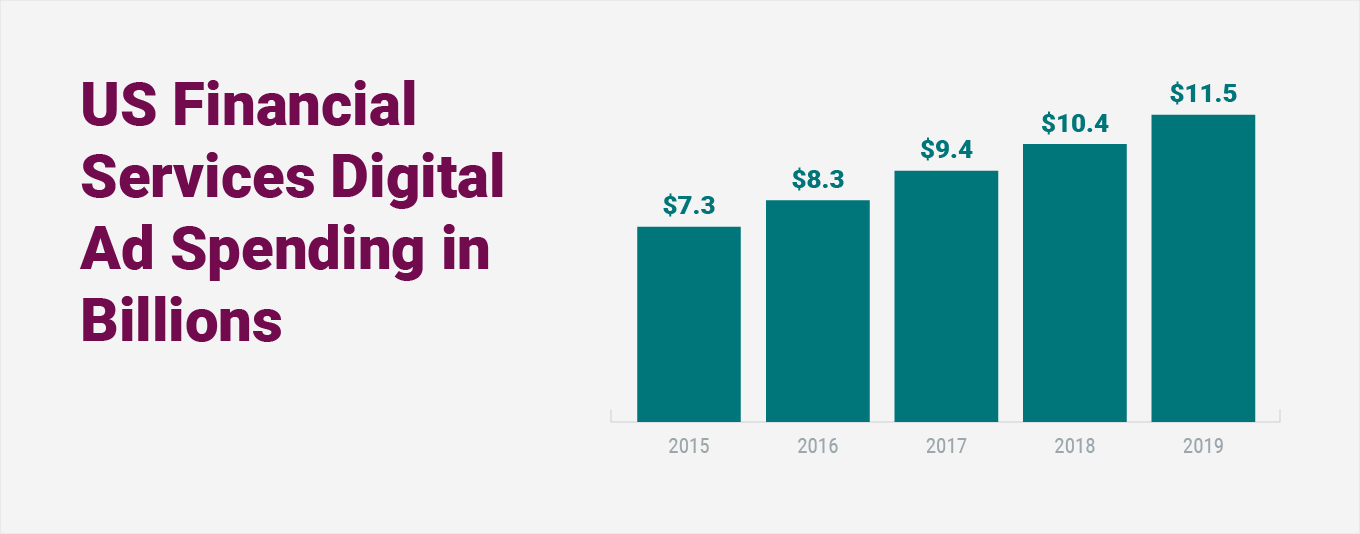

Despite spending a total of $9.4 billion on digital advertising in 2017, US investment firms, banks, credit card and insurance companies, and other financial service firms rank measuring ROI as their biggest marketing challenge. A major part of this challenge is tying marketing attribution to inbound phone calls which, on average, convert to ten times more revenue than online form fills.

Source: eMarketer

By understanding the marketing channels that are driving the highest revenue — including revenue from inbound calls — financial marketing teams can fully optimize their campaigns. See our 3 tips below.

1. Track Each Caller’s Journey from Marketing Source to Customer

In order to prove their ROI and optimize their budgeting, financial marketers need to start by tying together the full customer experience. Digital marketing campaigns that only focus on what happens online provide an incomplete, fractured view of the customer journey. You can see clicks, impressions, and online conversions; however, you can’t see how many calls your efforts drove. Collecting this data is crucial, since calls are often the most valuable conversions for financial marketers.

There is a wealth of valuable data on inbound calls that financial marketing teams can capture, in order to flesh out the customer journey. In addition to collecting basic caller data, such as name, phone number, geographic location, and whether they’re a new or repeat caller, you can capture the marketing source that drove the call, down to the specific digital ad, search keyword, or website page. You can also collect data from the call experience, including where the call was routed, whether or not the call was answered, who said what during the conversation, and how long the call lasted. This data enables you to not only measure the true ROI of your marketing channels, but optimize spend for drives the most customers at the lowest costs.

2. Use Call Analytics to Create a Personalized Call Experience

Today’s consumer expects businesses to anticipate their needs and provide a frictionless experience. According to a recent Salesforce study, 59% of customers say tailored engagement based on past interactions is very important to winning their business. Therefore, it’s essential that you personalize the caller experience to make your potential customers feel valued and known.

When a consumer calls, they expect to promptly speak to the relevant sales agent or department that can handle their needs. You can easily ensure your callers are routed correctly by integrating the data we mentioned in the previous section. You can route callers based on the marketing source — for instance, if they called from the “mutual funds” page of your website, you can seamlessly route them to a knowledgeable fund manager. You can also route callers by their location, ensuring they reach a representative from their local branch. And if an existing customer calls, you can immediately route them to a support agent, rather than a salesperson.

As an additional layer of personalization, you can arm your agents with information on each caller and the marketing source that drove the call (channel, keyword, ad, webpage) so they can tailor the experience accordingly. Before your salespeople begins the conversation, they’ll be able to view the caller’s online activity and anticipate their needs, tailoring the conversation to win the sale.

3. Analyze Conversations to Measure Financial Marketing and Sales Performance

In addition to tracking the quantity of calls your financial marketing campaigns are driving, you should also analyze conversations to determine the sales quality of these calls. To illustrate the importance of call quality for marketers, let’s say your paid search ads are driving 500 calls per month, whereas your display ads are driving 300 calls. With this intelligence, you would probably decide to allocate more budget to paid search. However, if you analyzed the quality of these conversations, you could determine that, though your paid search ads are driving more calls, only 10% of these calls actually resulted in sales. By contrast, 55% of your display ads resulted in customers. What’s more, the conversions from your display ads were, on average, $300 more valuable than those from your paid search ads. Without these insights, you risk making the wrong optimizations and losing customers.

It’s also important to analyze conversations on calls in order to measure and help optimize the performance of your sales teams and brick-and-mortar locations. You should monitor what percentage of calls are going to voicemail and which sales agents and locations have the best closing rates. For example, your conversation data may uncover that one of your loan officers is performing far above average this quarter. When you search his call transcripts, you discover that he’s added some flourishes to your original sales script. In order to improve the performance of your team or locations overall, you decide to update your sales scripts to include lines from his high-performing pitch, resulting in increased sales across the board.

Ultimately, by utilizing the actionable insights from conversation analytics, you can ensure your company is running like a well-oiled machine — your financial marketing team is driving quality calls and your sales agents are closing them at a high rate.

To learn more financial services marketing best practices, download our eBook, The Secret to Financial Services ROI: Inbound Calls.