For years, cryptocurrency has been making headlines. As one of the fastest growing industries out there, the mystery surrounding it is just as tempting as the potential rewards; and many people are seeing dollar signs.

Bitconnect is a new cryptocurrency exchange platform similar to Bitcoin and Ethereum. It promised big returns on investments and grew to a multi-billion dollar market value. For many investors, even experienced ones, this was enough to overlook the warning signs of a bad business. At its core, Bitconnect was just a basic pyramid scheme.

Bitconnect was a scam that couldn’t last, depending on the money from new members to pay returns to earlier investors. This setup meant that for every two new people brought in, the investment of one earlier investor was covered. The multi-level scheme gave the illusion of real profits, but in truth, most of the returns came from new members instead of actual investments.

Following the unceremonious shut down of Bitconnect has many investors shocked and frightened to try their hand at cryptocurrency. After all, it’s a highly unregulated and volatile industry with largely unpredictable highs and lows; that being enough to keep investors at arms length. But the recent events of Bitconnect are acting as a wakeup call for not just investors but for industry regulations.

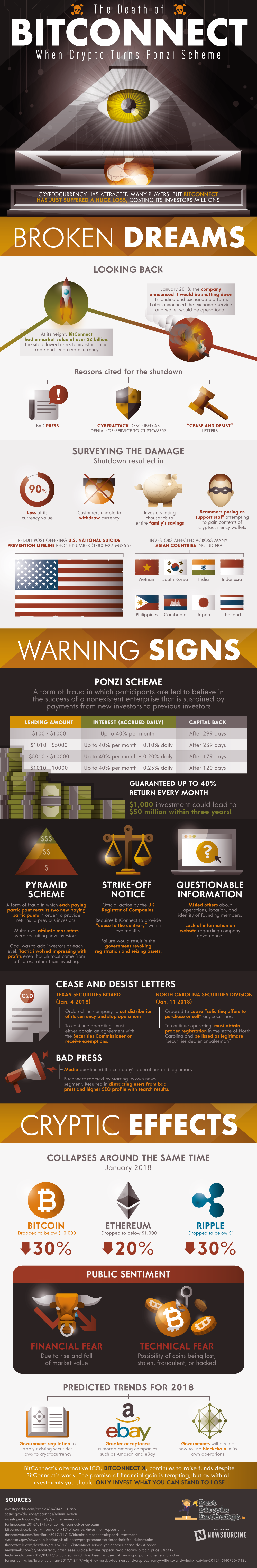

Whether the crash of Bitconnect was from bad press and cease and desist letters or if it was actually a Ponzi scheme makes no difference to the defrauded investors. At its height Bitconnect boasted a market value of over $2 billion and was pulling in hundreds of new users every day. Today, it’s a cautionary tale for bad investments. Take a look at this infographic for more on the rise and fall of Bitconnect, and what its demise means for the future of cryptocurrency.

Infographic Source: Best Bitcoin Exchange