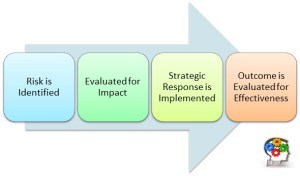

Risk management in any environment represents sound strategy. This typically involves a scanning of the environment, identification of risks, evaluating their impact on corporate operations and goals, and selection of

An unhealthy attitude towards risk often includes two scenarios:

- A completely lackadaisical attitude that fails to respond to the risks and the corporation is completely undermined as a result.

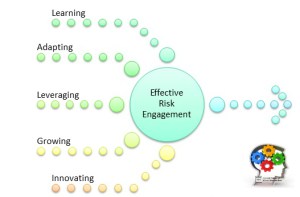

- An ‘absolute risk aversion’ that undermines corporation’s ability to learn, leverage, or innovate. This scenario appears less devastating than the first scenario (a ‘quick death’) but can lead to a loss of effectiveness, achievement of the company’s mission, and customer satisfaction (a ‘slow death’).

The ultimate challenge facing corporations is to balance their attitude, and thus response, to risk in an effort to

When each ‘unit of misalignment‘ the corporate drift towards self-destruction increases. What this requires is an ability to gather relevant performance data, evaluate it, and translate it into meaningful lessons to drive improvements throughout the corporate environment (both internal and external).

What is perceived as an unacceptable risk to one company may very well be embraced as an acceptable risk by the next. What differentiates these two is not necessarily their attitude towards risk (since the environment, product/service offerings, and business models for each may call for their different attitudes towards risk) but how they respond to it.

The line differentiating an effective leveraging of risk will depend on the company’s operating environment, industry, competencies, and resources. These can be changed over time but whether to take that first step will depend on the company’s attitude towards risk. An absolute risk aversion is hard to confirm and even harder to change. This is because the line between ‘managing appearances’ and ‘risk aversion’ is often blurred with one often preceding the other. Company culture often reinforce the behaviours that are interfering with accurate reporting and the development of innovation competencies. Consider the following questions:

- Metrics: Does your company culture support the use of metrics and accurate reporting?

- Definition of Success: Is project success reported accurately?

- Barriers: Are barriers acknowledged that impact this definition?

- Evaluating Performance: How is success evaluated? Are requirement/scope/schedule changes (+/-), that impact how success is evaluated, accurately reported?

- Stable Definitions: Does lagging performance change how success is evaluated & reported or is the original definition maintained? Is success ‘spun’ so that favourable perspectives are maintained regardless performance?

- Response: Does your company ‘stay the course’ when facing risk and unease or change its goals and the strategies/ process to reach them?

- Technology: How often does your company experiment with new technology? Processes? Or strategies?

- Quality: Does your company control the quality of its inputs and outputs? Or does the quality of these control what your company is able to achieve and dream?

- Compromises: How does your company evaluate compromises? Are they seen as virtuous are indications that more work needs to be done to pursue excellence?

Innovation cannot occur without a proper understanding of the project, product/service, and company constraints. Accepting diminished project performance in order to avoid risk is not the answer. The executive team needs to have a clear understanding of how the project is performing. Spinning the story of success regardless the project’s real performance will limit the company’s ability to develop the needed competencies for improvement.

How is your company turning risk into opportunity? Responding to the leadership team’s risk aversion? Overcoming the tendency to disguise lagging performance and leveraging it an opportunity to be innovative? Share your comments below.

Read more: