Chinese regulators dropped a bombshell on the online gaming industry this Friday with the release of strict draft rules aimed at curbing “irrational” spending and limiting playtime. Shares of industry heavyweights like Tencent and NetEase plunged on fears that the surprise clampdown could severely impact their revenue and profitability.

The proposed guidelines from China’s National Press and Publication Administration (NPPA) impose caps on how much money players can spend in games as well as banning incentives that promote excessive gameplay.

This includes restrictions on daily login rewards, consecutive spending bonuses that reward big spenders, and mandatory player-versus-player battles that compel engagement.

The draft rules also forbid any game content that violates “national security” interests, marking the latest extension of China’s broadening crackdown on internet industries over the past two years.

Blindsiding investors ahead of the long Christmas weekend, Tencent stock sank nearly 12.5% in Hong Kong trading, wiping out over $43 billion in market value. Gaming revenues for Tencent account for at least 30% of the group’s total annual turnover.

Rival NetEase fared even worse, cratering 25% in its biggest single-day drop ever, shedding $14.7 billion of its market value in the blink of an eye. Social platform Bilibili, which generates revenue from gaming, fell by 11% as well.

The tech-heavy Hang Seng index is down 1.7% thus far in the stock trading session, pulled lower by online giants facing an uncertain future if these gaming rules take full effect and end up being more restrictive than initially thought.

Industry Scrambles to Digest Sweeping Ambiguity, Tencent Launches $128M Share Buyback

Gaming executives sought to reassure investors that operations could carry on largely unchanged, though confusion around specifics persists. “These new measures do not fundamentally alter the online gaming business model and operations” Tencent’s VP Vigo Zhang told CNBC this morning.

However, developers and designers flooded WeChat groups questioning whether core monetization strategies must now pivot away from virtual item sales and battle passes – accounting for billions in annual sales. Some decried that the rules are detached from reality. Some voices within the groups shared their outrage that, after years of tight regulation, Chinese gaming remains in authorities’ crosshairs.

The ambiguity even prompted Tencent to announce a $128 million (HK$ 1 billion) share buyback to boost the company’s stock price. While China had resumed gaming license approvals in recent months after last year’s industry freeze, Friday’s surprise reignited fears of an existential threat that analysts thought was fading.

“It caught people off guard, right before the holiday and hitting sentiment hard” said Willer Chen, an analyst from Forsyth Barr Asia. “Better coordination between industry and regulators will benefit everyone in the future”, the financial professional commented.

Previous Curbs Slashed Revenue and Stifled Innovation

Curiously overlapping the gaming rules, China’s media regulator approved 40 new titles for distribution. However, the announcement received little fanfare amid the shocking restrictions.

Chinese regulators almost completely obliterated the education technology industry overnight in 2021, imposing online gaming time limits for minors and freezing all new video game monetization licenses for eight months.

The actions proved to be a one-two punch that hurt revenue and contributed to stalling creative development across gaming leaders like Tencent and NetEase. Foreign investors fled Chinese tech stocks, wiping out billions in equity value that have not been recovered yet, even as some restrictions eased.

Officials blamed games and edtech companies for exacerbating a national crisis that has resulted in worsening youth eyesight, tech addiction, unemployment, and declining birth rates.

That same crackdown prompted hundreds of mobile games to remove references deemed politically dangerous and edited imagery or characters that promoted “incorrect values” like homosexuality. Companies scrambled to ensure compliance with Chinese censors and an online gaming ethics committee was formed.

Friday’s surprising rules can result in similar revenue destruction and innovation obstacles should they finalize fully intact – a big “if” given China’s past walk-backs. However, years of regulatory turbulence are leaving tech giants and investors wary of optimism.

“With these new rules, investors may just leave the market totally, because the policy risk is too high” said Steven Leung of UOB Kay Hian brokerage.

Overseas Operators Also On Notice, China-Exposed Gaming Companies Also Hit

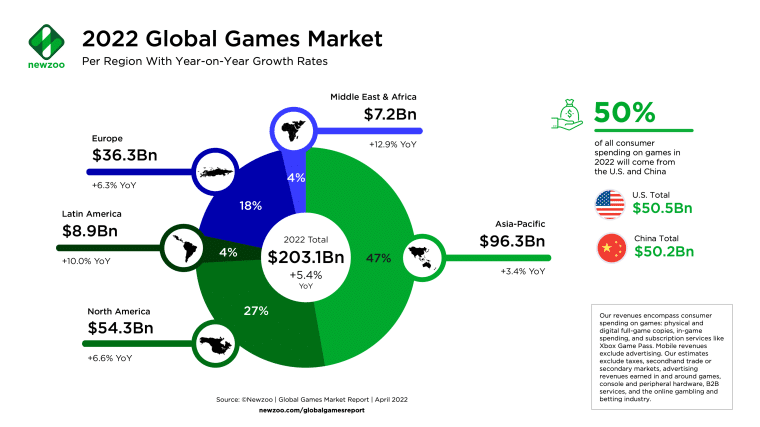

Though China boasts the world’s largest gaming market, it increasingly scrutinizes overseas connections amid a broader decoupling of Chinese and Western internet and cultural ecosystems. The new NPPA’s rules explicitly demand that foreign entities respect Chinese laws and culture while refraining from endangering national security.

Tencent, whose investments include League of Legends developer Riot Games and Fortnite creator Epic Games, must now balance global business interests with placating Chinese regulators. South Korea’s Krafton and Europe’s Prosus, both with substantial China presence, saw their stock dive 14% and 17% respectively reacting to the news.

Also read: Paper Trail Helped Epic Games Beat Google on Court, CEO Says

Some question if Beijing sees gaming as a strategic industry requiring oversight of private enterprises in service of Chinese national interests. If so, the days of unrestrained creativity and revenue may have come to an end for good.

Lightstream Research’s Mio Kato believes that the regulations foreshadow similar government interventions globally against perceived gaming and social media addiction. Thus, while painful to developers, China’s approach could spread to tame an industry that is plagued by excessive and often irrational consumer spending.

Deals Have Dried Up in China Amid Growing Regulatory Pressures

Major industry setbacks have already taken their toll, most evidently in declining Chinese gaming investments and deals. Analysis from GlobalData’s deals database shows massive 2018 spending of $15.7 billion catering to just $2.3 billion a year later after initial measures emerged.

2023 has continued the downward trajectory with the total disclosed value of these deals standing just an inch above $100 million — down over 75% from 2022 and 98% from 2018’s peak.

Friday’s shock announcement ensures substantial market uncertainty in the new year, sending shares plummeting but the long-term impact of the measure is still hazy. Some expect clarification or moderation during the month-long feedback period as backlash builds.

While painful to investors and developers, the latest twist in China’s regulatory saga remains unfinished as both sides vie to shape the world’s leading gaming industry.