In 2024, the agriculture industry finds itself at the intersection of tradition and innovation. As we grapple with feeding an ever-growing global population, we rely on the biggest agriculture companies to bridge the gap between current demands and future sustainability.

In this curated list from Business2Community, you can learn all about the world’s largest agriculture and agribusiness companies, ranked by market cap, and the products and services they provide to help bring food to your table each day.

The World’s Biggest Agriculture Companies

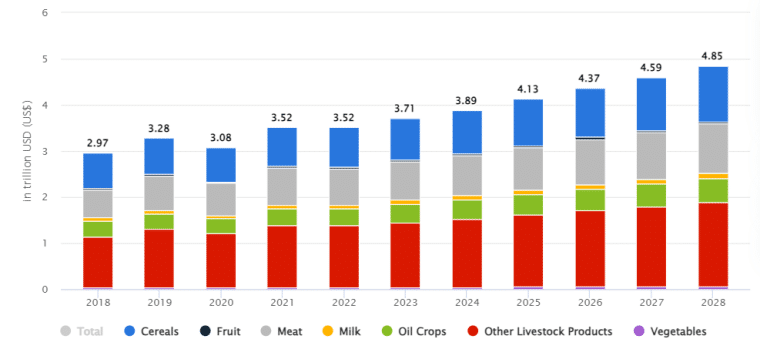

The global agriculture industry is predicted to have a gross production value of $3.89 trillion in 2024, according to data published by Statista. A CAGR of 5.66% will bring this value to $4.85 trillion in 2028.

The combined market cap of the 10 top agriculture companies in the world is $416 billion, so let’s take a look at who they are and how they became so successful.

1. Deere & Company – $114.90 Billion

Founded in the heartland of America in 1837, Deere & Company, commonly known as John Deere, has grown from a humble blacksmith shop to a global leader in agricultural machinery.

With a market cap of $114.9 billion, the largest agricultural company is best known for its green and yellow tractors that dot rural landscapes in over 100 countries across the world.

John Deere employs 83,000 people globally, and 33,800 of these are based in the USA and Canada.

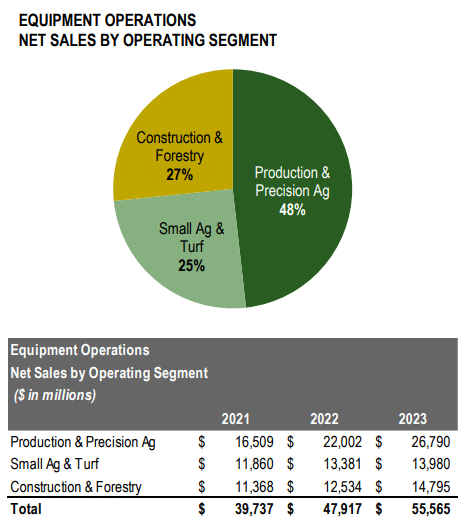

The company generated revenue of $61.25 billion in FY23, the majority of which ($55.57 billion) came from equipment sales.

However, it’s not only about heavy equipment; Deere & Company leads in agricultural technology, using digital tools such as GPS navigation, yield mapping software, and smart spraying to improve the accuracy and sustainability of farming. The company has a network of 650,000 connected machines that can be monitored from a distance, providing early diagnostic alerts to reduce downtime.

This extensive control over its machines can be great but it comes with a major downside for farmers: poor repairability. John Deere is often criticized for making it incredibly difficult for farmers to fix the equipment they buy from the company themselves (or with a 3rd party). This way they are often forced to send the problematic machine to John Deere be fixed which isn’t cheap.

| Company Name | Deere & Company (DE) |

| Founded | 1837 |

| Headquarters | Illinois, USA |

| Market Capitalization | $114.90 billion |

2. Cargill, Incorporated – $50-75 Billion (est)

Cargill is a private company, but according to an estimate by Bloomberg, it could be worth around $50 to $75 billion, placing it second among the biggest agriculture companies in the world.

Its revenue of $177 billion in 2023 also made it the largest privately held company in the USA.

With its roots tracing back to 1865, Cargill now operates in over 70 countries and employs more than 160,000 people. The company works with over 5,000 brands in five key areas:

- Agricultural Supply Chain

- Protein & Salt

- Animal Nutrition & Health

- Food & Bioindustrial

- Financial Services & Metals

Its operations span the entire process, from working with farmers on crop production and sourcing commodities to producing industrial products and branded foods and distributing them around the world.

Cargill has ambitions to develop the most sustainable food supply chains in the world; its goals include reducing carbon emissions by 30% and becoming deforestation-free by 2030.

| Company Name | Cargill, Incorporated |

| Founded | 1865 |

| Headquarters | Minnesota, USA |

| Market Capitalization | $50-75 Billion (est) |

3. BASF SE – $47.98 Billion (€44.30 Billion)

BASF SE is one of the largest chemical companies in the world. Founded in 1865 in Germany, it began by manufacturing the chemicals needed for dyes before branching out into other sectors.

In 1925, BASF and five other companies merged to form IG Farben. This company supported the Nazi Party during World War II, relied on concentration camp labor, and was responsible for the deaths of over 1 million people during the holocaust with its poison gas, Zyklon B.

In 1951, IG Farben was split back into its constituent companies and BASF continued its operations. Its plant in Ludwigshafen, Germany covers 10km², has 2,850km of pipeline, and accommodates over 30,000 employees.

BASF reported revenue of $68.9 billion in 2023, down from $87.3 billion in 2022. This was spread across its six sectors as follows:

- Chemicals: $10.4 billion

- Materials: $14.1 billion

- Industrial Solutions: $8.0 billion

- Surface Technologies: $16.2 billion

- Nutrition & Care: $6.8 billion

- Agricultural Solutions: $10.1 billion

- Other: $3.2 billion

Its agricultural chemicals include crop protection products such as fungicides, insecticides, and herbicides, plus seed treatments to increase crop yield and quality.

| Company Name | BASF SE (BAS.DE) |

| Founded | 1865 |

| Headquarters | Ludwigshafen, Germany |

| Market Capitalization | $47.98 Billion (€44.30 Billion) |

4. Corteva, Inc. – $40.11 Billion

Corteva, Inc., also known as Corteva Agriscience, was formed in 2019, making it the youngest of the top agriculture companies on this list. Before this, Corteva was the agricultural unit of DowDuPont, which itself was formed in 2017 as a merger of Dow Chemical Company and DuPont.

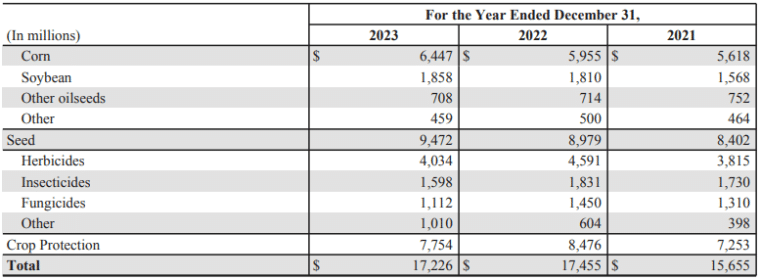

As a company completely dedicated to the agricultural industry, Corteva focuses on producing seeds and crop protection products. In 2023, the company reported net sales of $17.23 billion with an operating EBITDA of $3.38 billion.

Within the seeds category, 68% of Corteva’s revenue comes from corn, and 20% from soybeans. Its crop protection revenue comes from herbicides (52%), insecticides (20%), and fungicides (14%).

Corteva is also developing digital tools to make farming more sustainable and profitable. On its I-FARM, an 80-acre test-bed site in Urbana, Illinois, a fleet of AI robots sows crops, collects seed samples, and delicately clears weeds that are growing among new crops. The robots are being trained to assess plant qualities and make informed decisions based on environmental data points, just as a human farmer would.

| Company Name | Corteva, Inc. (CTVA) |

| Founded | 2019 |

| Headquarters | Indiana, USA |

| Market Capitalization | $40.11 Billion |

5. Archer-Daniels-Midland Company – $30.97 Billion

Archer-Daniels-Midland Company, known as ADM, is a giant US-based agribusiness company that processes food for humans and animals and trades agricultural commodities such as corn, soybeans, and oilseeds.

ADM ranked 35 in the 2023 Fortune 500 list. It has 42,000 employees globally and 327 processing plants, the majority of which are in North America.

The company reported $93.9 billion in revenue in 2023, down from $101.6 billion in 2022, with $6.2 billion operating profit, down from $6.6 billion in 2022.

Advances in probiotics, plant-based proteins, and sugar alternatives are helping keep ADM on the cutting edge of food trends and consumer preferences. In 2023, ADM raised its quarterly dividend by 11%; its 51st year of consecutive dividend increases for shareholders.

| Company Name | Archer-Daniels-Midland Company (ADM) |

| Founded | 1902 |

| Headquarters | Illinois, USA |

| Market Capitalization | $30.97 Billion |

6. Bayer AG – $30.41 Billion (€28.08 Billion)

Bayer is another German agriculture company that is also one of the world’s largest pharmaceutical and biomedical companies. Like BASF, it was part of the IG Farben merger in Nazi Germany. Bayer employees were involved with conducting medical experiments on concentration camp prisoners to test new drugs.

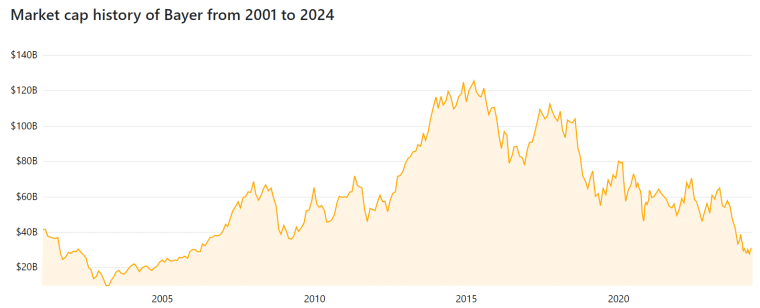

More recently, Bayer has found itself in a dire financial position, largely because of its purchase of Monsanto in 2018 and the subsequent litigation relating to Monsanto’s Roundup weedkiller and claims it caused cancer. There have been around 170,000 claims made to date and the company has paid out over $12 billion in settlements, with more likely to come.

Poor performance in 2023 led to a proposal to reduce Bayer’s dividends from $2.40 per share to $0.11; the legally required minimum.

Looking to the future, Bayer’s current innovations include new seed varieties for corn, soybeans, cotton, and vegetables – these new varieties offer greater crop efficiency and resilience against pests and diseases. The company is also developing new crop protection solutions and digital applications for agricultural technology.

| Company Name | Bayer AG (BAYN.DE) |

| Founded | 1863 |

| Headquarters | Leverkusen, Germany |

| Market Capitalization | $30.41 Billion (€28.08 Billion) |

7. Nutrien Ltd. – $28.44 Billion

Canadian company Nutrien is a leading global provider of crop inputs and services. It is a relatively young brand, having been formed in 2018 through the merger of PotashCorp and Agrium, which were founded in 1975 and 1931, respectively.

Nutrien’s main business is producing potash, nitrogen, and phosphate fertilizers. These contributed $3.8 billion, $3.8 billion, and $1.7 billion, respectively, to its $19.5 billion in sales in 2023. Other key revenue streams for the company are crop protection, seed, and merchandise.

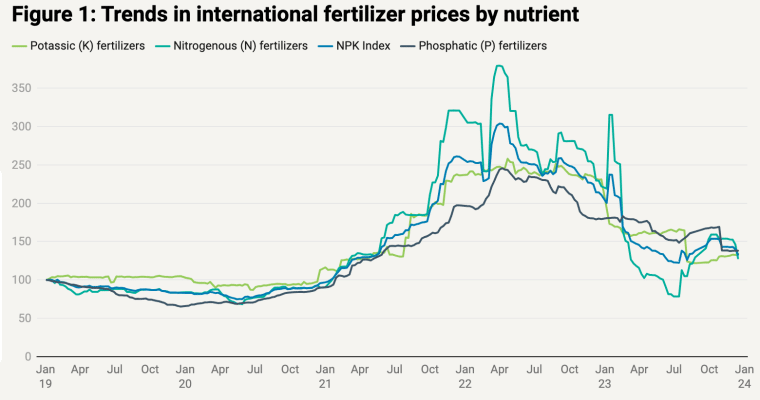

Fertilizer prices rose in 2021 and 2022 from supply chain disruptions caused by the pandemic and later the Russian invasion of Ukraine. Nutrien’s market cap followed this trend, exceeding $62 billion in April 2022, but it has fallen again along with fertilizer prices.

| Company Name | Nutrien Ltd. (NTR) |

| Founded | 2018 |

| Headquarters | Saskatoon, Canada |

| Market Capitalization | $28.44 Billion |

8. Tyson Foods, Inc. – $21.24 Billion

Tyson Foods, Inc. produces around 20% of the pork, beef, and chicken in the USA. From pizza toppings to deli meats, Tyson Foods sells a variety of food products under a variety of popular brands like Ball Park, Jimmy Dean, and Hillshire Farm. It’s also a leading provider of protein to American restaurant chains.

In 2023, the company recorded an operating loss of $395 million on its total sales of $52.9 billion. Only its Prepared Foods segment was profitable, with Beef, Pork, and Chicken all making a loss. This loss was attributed to “unfavorable market conditions, including higher fed cattle costs.”

Key areas of innovation for Tyson include emerging proteins to keep up with sustaining a growing population, and artificial intelligence and machine learning to create a more agile food supply chain. In 2023, Tyson announced a partnership with Protix, a leader in the global insect ingredient industry.

| Company Name | Tyson Foods, Inc. (TSN) |

| Founded | 1935 |

| Headquarters | Arkansas, USA |

| Market Capitalization | $21.24 Billion |

9. Bunge Global SA – $15.17 Billion

Bunge is one of the world’s leading agribusiness companies, incorporated in Switzerland and headquartered in the USA. At over 200 years old, it’s also the oldest agriculture company in the top 10.

Bunge’s integrated operations reach from farmer to consumer and involve:

- Processing oilseed and grain

- Producing vegetable oils and protein meals

- Selling packaged plant-based oils worldwide

- Selling wheat flours, corn-based products and bakery mixes in North and South America

- Producing sugar and ethanol in Brazil through a joint venture with BP (BP Bunge Bioenergia)

After a record financial year in 2022, net sales dropped from $67.2 billion to $59.5 billion in 2023. However, net profit rose from $3.7 billion to $4.8 billion in 2023.

In June 2023, Bunge announced plans to merge with Canadian grain-handling business Viterra in a deal worth $8.2 billion. Concerns raised by Canada’s Competition Bureau have delayed completion of the merger, but the two companies are working to obtain the necessary regulatory approval.

| Company Name | Bunge Global SA (BG) |

| Founded | 1818 |

| Headquarters | Missouri, USA (incorporated in Geneva, Switzerland) |

| Market Capitalization | $15.17 Billion |

10. CNH Industrial N.V. – $14.80 Billion

CNH Industrial manufactures farming machinery and agricultural and construction equipment, supplying over 170 countries. The company is incorporated in the Netherlands with headquarters in the UK.

CNH has over 40,000 employees across 42 manufacturing plants and 49 research & development centers. It supplies its commercial vehicles and machinery under brands including Case IH, Steyr, and Raven, all designed to boost efficiency and productivity on farms worldwide.

The company achieved total revenues of $24.69 billion in 2023, up 4.8% from 2022, with a net income of $2.38 billion, up 17% from 2022.

74% of its revenue came from the agriculture sector, with a further 16% from construction and 10% from financial services.

| Company Name | CNH Industrial N.V. (CNHI) |

| Founded | 1842 |

| Headquarters | Basildon, UK (incorporated in Amsterdam, Netherlands) |

| Market Capitalization | $14.80 Billion |

Top 10 Agriculture Companies in the USA

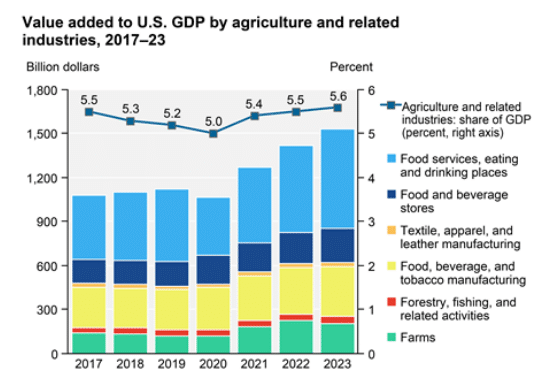

Agriculture, food, and related industries contributed over $1.5 trillion to the US economy in 2023, representing 5.6% of GDP, according to the US Department of Agriculture.

Since some of the largest agriculture companies in the USA are privately owned, we have ranked them according to their 2023 revenue to make it easier to compare like-for-like.

- Cargill, Incorporated – $177 billion – Largest privately held company in the US

- Archer-Daniels-Midland Company – $93.9 billion – Fortune 500 #35

- Deere & Company – $61.25 billion – Largest agricultural company by market cap

- Tyson Foods, Inc. – $52.9 billion – Produces 20% of US beef, pork & chicken

- Dairy Farmers of America Inc. – $24.5 billion (latest results) – Private, farmer-owned cooperative with 14,500+ members

- Pilgrim’s Pride Corporation – $17.4 billion – 133 million servings of protein each day

- Corteva, Inc. – $17.23 billion – Has an 80-acre AI farm in Illinois

- Land O’Lakes, Inc. – $16.8 billion – Farmer-owned cooperative with 2,700+ members

- AGCO Corporation (AGCO) – $14.4 billion – Manufactures agriculture machinery, HQ in Georgia

- The Mosaic Company – $13.7 billion – Mines phosphate and potash for fertilizers

Learning From the Biggest Agriculture Companies in the World

These agricultural companies play a critical role in serving the diverse needs of our growing population. We have seen how they are innovating in areas such as vertical farming, alternative proteins, and insect ingredients to make the supply chain more efficient and sustainable while continuing to produce higher yields.

7 out of 10 of the companies featured here have been helping to feed consumers for over 100 years, but with digital agriculture changing how the industry works and growing demands for big companies to promote sustainability, perhaps we will see a shakeup in the next generation of the agricultural industry.

FAQs

What is the world’s largest agriculture company?

What are the big 4 in agriculture?

Is Bayer a monopoly?