Shares of Coinbase took a hit on Thursday after the company published dome disappointing financial results corresponding to the third quarter of its 2024 fiscal year.

The crypto exchange saw its share price plummet by 15.3% by the end of the session as the market reacted negatively to how its profits fared during the period. The dramatic decline pushed the stock price to $179.25 and severely impacted the shares’ year-to-date performance, with yearly gains now standing at a meager 3%.

During the three months ended on September 30, Coinbase’s net income was $75 million. This figure was nearly 35% below analysts’ estimations for the period. Meanwhile, the company’s revenues stood at $1.2 billion or $60 million below the consensus estimate from analysts as compiled by Bloomberg.

Coinbase’s dramatic drop extended to other publicly traded exchanges like Robinhood, whose shares experienced a 16% decline shortly after publishing weak results as well while crypto mining companies like Riot Platforms and Mara Holdings also took big hits as they saw their share price plummet by 8% and 11% respectively.

Trading Volumes Drop Sharply Compared to First Quarter of 2024

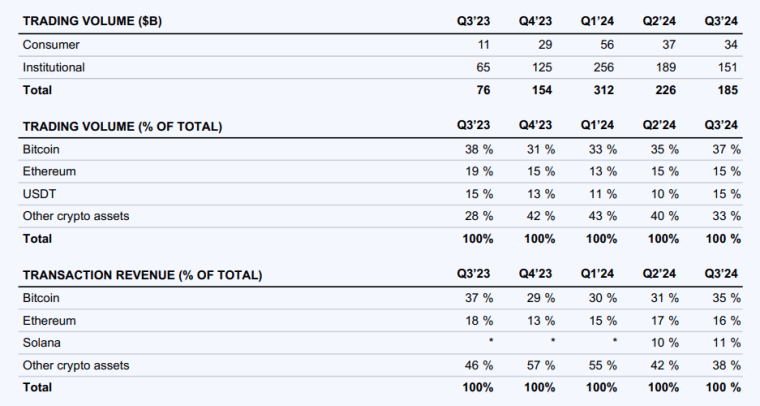

A closer look at Coinbase’s quarterly performance reveals some concerning trends associated with its trading activity primarily. During these three months, trading volumes declined sharply to $185 billion. This is the second consecutive quarterly decline that the platform has experienced. During the first quarter of the year, Coinbase reported trading volumes of $312 billion and then, the next quarter, volumes dropped to $226 billion.

CEO Brian Armstrong addressed these challenges during the shareholder call, emphasizing the company’s strategic efforts to reduce dependence on volatile transaction fee revenue. “We’ve made a big effort to diversify our revenue over the years away from transaction fee revenue, which is more volatile. It’s not as predictable. It’s more market-dependent,” he explained.

Also read: Robinhood Launches New Betting Product for US Presidential Election

Despite these quarterly challenges, a handful of metrics showed an appealing performance on a year-on-year basis. For example, transaction revenue surged 98% compared to the previous year while total revenues exhibited a 78% increase.

This growth has been supported by the successful development of alternative revenue streams like subscriptions, stablecoin services, and the company’s Ethereum L2 network Base.

The Base network has proven particularly successful as transaction volumes within this L2 blockchain increased by 55% during the quarter.

Meanwhile, stablecoin revenues kept growing, though at a slower rate compared to previous quarters. Armstrong provided additional optimism by noting that subscription and service fees are on track to exceed $2 billion by the end of the year, highlighting the company’s successful efforts to diversify its revenue base beyond just transaction execution services.

Institutional and Retail Interest Wanes as BTC Drops from All-Time Highs

This report from Coinbase (COIN) highlighted the changing dynamics of the market throughout the year as the price of Bitcoin, whose transactions account for over a third of Coinbase’s trading volume, progressively dropped from its peak of $73,000 as the year progressed.

Both retail and institutional trading have been dropping similarly compared to the first quarter of the year when the price of digital assets was higher.

Research from CryptoQuant shows that institutional demand has been shifting to regulated products like the spot Bitcoin ETFs launched at the beginning of the year. This shift has brought some stability to the market as single-day drops have been milder compared to previous years.

Meanwhile, JMP Securities noted that there has been a growing institutional interest in Coinbase stock as the company is becoming a component of various equity indexes.

This benefits the company as it brings stability to its stock price as retail investors no longer have that much influence on the stock’s price swings.

Moreover, although institutional adoption is positive for the market as a whole, the lower volatility experienced by well-established cryptocurrencies like Bitcoin (BTC) has been deterring retail traders as their profit potential is now much lower in the short term.

“This year in particular, there was a lot of negative sentiment which likely deterred traders,” commented Adam Morgan McCarthy, an analyst at data firm Kaiko.

In addition, sentiment among retail traders has also been influenced by major selling events from entities such as the German government and the transfer of previously frozen tokens from the bankrupted Japanese crypto exchange Mt. Gox to its rightful owners.

Coinbase Confirms $25M Donation to Pro-Crypto Super PAC

In these challenging market conditions, Coinbase revealed various strategic initiatives aimed at strengthening its market position and enhancing its financial results.

The company authorized an ambitious $1 billion share repurchase program, which is typically considered a signal that they believe the market is undervaluing its equity at the moment.

Meanwhile, the company provided guidance for the next quarter for some of its revenue sources. For the last three months of the year, Coinbase expects to reap between $505 and $580 million in subscription revenues.

They noted a 10% decline in the price of Ether (ETH) this month as a concerning headwind. Coinbase said that it expects that this weakness may spill over to the last few months of the year, delivering an interesting caution to market participants.

Moreover, the firm noted its political efforts to advocate in favor of the industry on the regulatory front. The company reported a $25 million donation to the political action committee (PAC) Fairshake that seeks to support the election of pro-crypto candidates during the 2026 midterm elections.

US Election Could Tilt the Balance in Favor of Crypto Companies

The upcoming US presidential election has emerged as a crucial catalyst for both Coinbase and the broader cryptocurrency industry.

In their letter to shareholders, Coinbase’s leadership expressed optimism about the industry’s future regardless of the outcome of this event. The leadership team noted a significant shift in political attitudes toward cryptocurrencies.”

“Both presidential candidates, as well as politicians across the political spectrum, have adopted more favorable positions toward crypto, a significant shift from previous years,” the company stated.

Meanwhile, Wall Street analysts have also identified the election as a potential turning point for the crypto industry. For example, Canaccord analysts have maintained a buy rating on Coinbase stock with a $280 price target as they believe that a change in the regulatory regime following the election could lead to the dismissal of the current Securities and Exchange Commission (SEC) case against Coinbase.

In addition, JMP Securities opted to keep an outperform rating with a $320 price target for COIN as they anticipate “greater clarity and building consensus among legislators on both sides of the aisle in the coming months.”

This potential for increased regulatory clarity combined with growing institutional adoption of digital assets and the company’s strategic initiatives could significantly influence the trajectory of Coinbase stock in the coming months.