Digital payment apps like Zelle provide a quick and easy way to transfer money to friends and family, but scammers are increasingly using these apps to trick many people out of their hard-earned cash. Unfortunately, those who fall for payment scams seldom recover their funds. So, is Zelle secure for your everyday payment activities?

Here’s how Zelle scams work and what you need to do to protect your account.

What is Zelle?

Zelle (rhymes with “tell”) is a mobile payment app in the US that allows users to send money to friends and family for free. You can sign up directly in the Zelle app or through your mobile banking app. To send money, you only need the email address or mobile number of someone who is registered.

When you send money with Zelle, it is transferred directly from your bank account to the recipient’s bank account and is typically received within minutes.

Zelle is owned by Early Warning Services (EWS), a legitimate and reputable company co-owned by 7 of the biggest banks in the US The company has come under increasing political pressure to tackle scams that involve the app.

Is Zelle Safe for Sending Money?

Generally speaking, Zelle is a safe way to send money. It has all the security features you’d expect – such as authentication and monitoring – plus you don’t have to share your name or account number with the recipient when you make a payment. If you use Zelle via your mobile baking app, your bank or credit union will also have features designed to keep your Zelle payments safe.

All this should help prevent hacking and unauthorized use of your account but there’s not much Zelle can do to prevent you from intentionally sending money to someone who turns out to be a scammer.

In addition, Zelle transfers are not covered by the same consumer protections as credit card payments or bank transfers. Scammers like to exploit payment apps like Zelle because:

- Money transfers immediately.

- Payments can’t be reversed or canceled.

- It’s easier to evade the law using Zelle transfers than it is using bank or wire transfers.

- Payments made to a scammer are less likely to be investigated than fraud involving unauthorized transactions.

How Common Are Zelle Scams?

In 2023, Americans reported losing over $200m to fraudsters on payments apps. EWS says that 99.95% of Zelle transactions in 2023 occurred without a fraud or scam claim but with over $100m transferred via Zelle every hour, that 0.05% is significant. Zelle scams have come to the attention of the police and the Senate and led to hundreds of complaints to the Consumer Financial Protection Bureau.

Even some local and state police departments have started to distribute warnings about these kinds of scams that are common on payment platforms like Zelle, Cash App, and Venmo.

Common Zelle Scams

Scammers are coming up with creative new ways to scam people out of money all the time, from impersonating a police officer, to selling fake concert tickets, and even switching a company account with a personal one. They may contact their targets via phone calls, text messages, email, or social media.

Here are 7 common scams to watch out for.

Suspicious Activity Scams

In this scam, the fraudster impersonates Zelle or a bank and contacts the victim to inform them of a suspicious payment on their account – which is fictitious.

The fraudster asks the victim for their password or one-time code, claiming this is required to verify their identity or reverse the suspicious transaction, and uses this information to reset the victim’s Zelle password. The scammer then has control of the victim’s account.

Scammers use a variety of social engineering methods to gain access to your accounts so always be wary of any requests for ANY login information and never download remote-access software for strangers (or really anyone). If they can get control of your computer or other device, they will likely be able to get into your various accounts to steal your money and potentially your identity too.

In some cases, the scammer links the victim’s phone number or email address to their own Zelle account. They persuade the victim to transfer money “to themselves” to reverse the suspicious charge. When the victim sends money to their own number or email address, it goes into the scammer’s account. A Florida man stole more than $250k using this scheme.

Zelle Business Account Scams

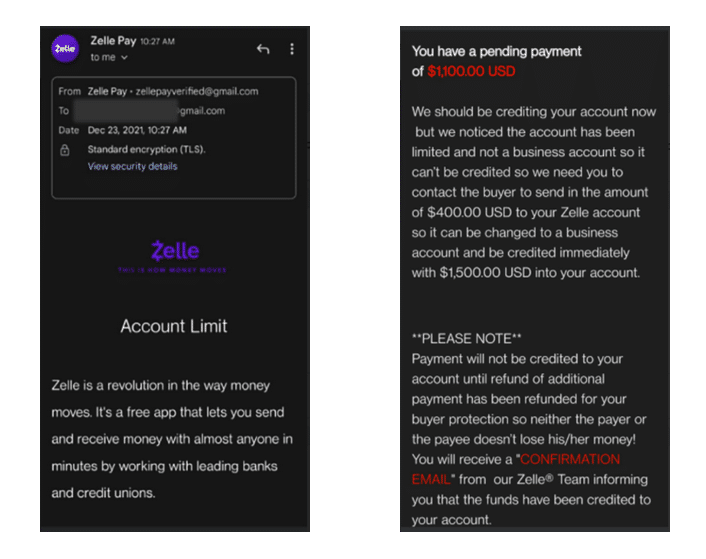

This scam often targets people who have listed an item for sale on a platform like Facebook Marketplace.

The scammer (posing as an alleged buyer) says they would like to send the victim money. They ask for a phone number or email address in order to make a payment via Zelle. The victim receives a message that looks like it comes from Zelle. It tells them to upgrade to a Zelle business account to accept the payment they are expecting.

The message includes a link to make payment for the upgrade which, in fact, sends money directly to the scammer.

Fake Goods or Services Scams

Some scammers list fictitious items and services on online marketplaces like Facebook Marketplace and Craigslist. They demand upfront payment via Zelle and then vanish without ever delivering the goods. Common versions of this scam include:

- Puppy scams. Scammers post pictures of fake puppy litters online and ask for payment to reserve one of the puppies. Listings with stock photos and unusually low prices are a red flag for this scam.

- Event tickets scams. To avoid disappointment, only buy event tickets from approved vendors.

- Rental property scams. If an agent or owner won’t agree to show you the property in person, that’s a red flag. Ask lots of questions and set up a tenancy contract before paying a deposit.

Pay-to-Release Scams

Some scams involve promising victims a big sum of money if they first provide a smaller sum of money.

For example, the scammer may claim the victim has won the lottery or another prize and ask them to transfer a small amount to cover fees, taxes, or some kind of deposit in order to release their winnings.

In another version, the scammer pretends to be an employer or recruiter offering the victim a fantastic job before asking them to send money for training, equipment, or a recruitment fee. Of course, the job doesn’t exist. Real employers don’t ask you to pay them to get a job (unless you work for an MLM scheme).

Romance Scams

In this scam, a fraudster uses a fake online identity to convince their target that they are in love. They often make up excuses as to why they cannot meet up in person. They build up trust over time and then claim to be in urgent financial need and ask for money or trick their target into sharing their banking details.

Investment Scams

Investment scammers may pretend to be financial advisors or telemarketers. They persuade their target to send them money via Zelle, promising to invest it for them in stocks, real estate, cryptocurrency, or any other kind of investment. They’ll often claim to have a “now-or-never” opportunity to rush their victims into a decision. The opportunity may be fake or misrepresented and the target is left worse off.

Charity Scams

Scammers may impersonate a friend or family member of their target and claim to be in urgent financial need, or they may pretend to represent a charity or a cause – such as a disaster relief fund. They will tell a story that tugs at the target’s heartstrings and persuades them to send money via Zelle. Of course, the money goes straight into the scammer’s own pocket.

Will I Get My Money Back If I Get Scammed with Zelle?

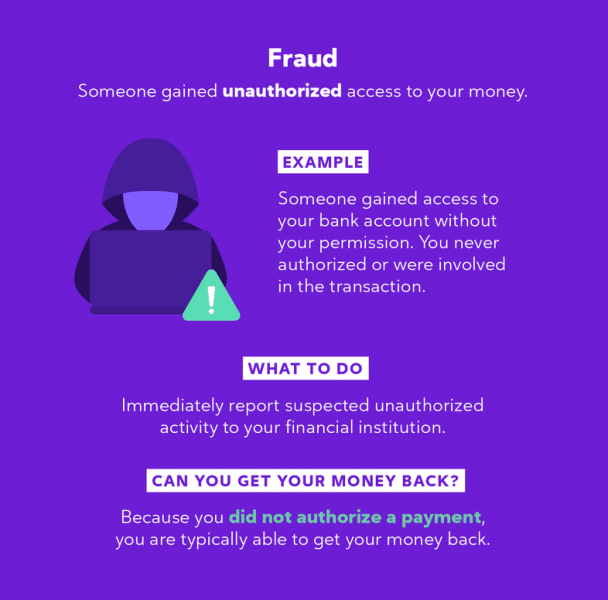

You may be surprised to discover that while your bank or payments provider will likely assist you in the case of fraud, they don’t have to help you recover stolen funds if you’ve been scammed. So what’s the difference?

Technically speaking, fraud is when there is an unauthorized transfer of funds from your account, as might happen if your credit card is stolen. By law, your payment provider must investigate and reimburse you in the case of fraud.

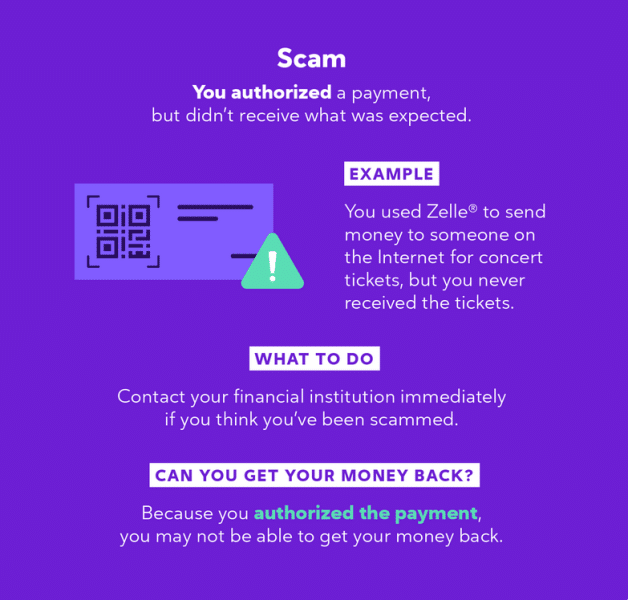

If you authorize a transaction and send money to someone who turns out to be an imposter or a cheat, that’s a scam and you won’t get the same purchase protection. In fact, neither Zelle nor your bank is required by law to help you get your money back.

However, this might be changing. Under pressure from the government, Zelle now does provide reimbursements for some eligible scams and lawmakers are pushing a new bill to help scam victims recover stolen money.

Zelle Scam Red Flags

As a rule of thumb, if it sounds too good to be true, it probably is. Front-row tickets to a sold-out Taylor Swift gig? A purebred puppy at half the usual price? A dream job, apartment, or jackpot prize out of the blue? Sounds unlikely.

If someone is pushy or asking for urgent payments, that’s also suspicious. Take your time and don’t make a rushed decision that you’ll regret.

Any unusual messages from your financial institution that don’t look like their usual correspondence should also be treated with caution.

Any text or email message that includes a request for personal information should be carefully assessed and verified (you can call the official phone number found on the official website, not the number provided in the suspicious correspondence).

11 Ways to Stay Safe and Avoid Scams When Using Zelle

- Treat it like cash. Sending money on Zelle is like handing over cash. You can’t just cancel the transaction. Make sure you take care when entering the recipient’s details. If you type in a friend’s phone number incorrectly and send money to a stranger, you won’t get it back.

- Check email addresses. If you receive an email from a Zelle, your bank, or a government agency, check the domain. The only domain extension used by Zelle is @Zellepay.com, never <@gmail.com> <@aol.com>, <@yahoo.com>, or any other common domain.

- Use the app. If you receive a call, text or email about your Zelle account, log into your app to verify the information directly.

- Do your homework. If, for example, someone promises you a job, Google the company and phone the number on their website. If someone is offering you a rental apartment, view it in-person.

- Call them back. If you get a call from the bank, Zelle, or another organization, hang up and call them back using the number on their official website or in the app.

- Never share your login details. Zelle will never ask you for your password in a text or email.

- Set up 2FA. Use your fingerprint, an authenticator app, or text messages to add a layer of security to your accounts.

- Think twice before hitting send. Before you send money to someone you don’t know, always think about whether they are genuine and whether it could be a scam.

- Switch to a non-bank payment app. Zelle is linked directly to your bank account so if someone gets control of your account, they can likely clean you out. You might consider using a payments app that is only linked to your credit card to avoid this risk.

- Be mindful of what you share online. Scammers can use personal information they find online to make themselves sound more convincing. For example, imagine calling a bogus help line and the caller knows your address.

- When in doubt, use a credit card. If something goes wrong, you are more likely to have a chance of getting your money back with a credit card payment than with a Zelle payment.

What to Do if You Fall For a Zelle Scam

First, prevent any further losses. If you have given away your password, reset it as soon as possible. In the unlikely event that you have sent money to someone who has not yet registered with Zelle, you can cancel the payment. You should also block and report the scammer on the app.

Second, seek support immediately. If you use Zelle via your mobile banking app, contact your financial institution to see if you’re eligible for reimbursement. They are likely to help you if the losses are considered to be fraud or if your bank has a zero liability policy. Your bank may also initiate a dispute with Zelle. If you’re enrolled directly through the Zelle app, contact Zelle toll-fee at 844-428-8542.

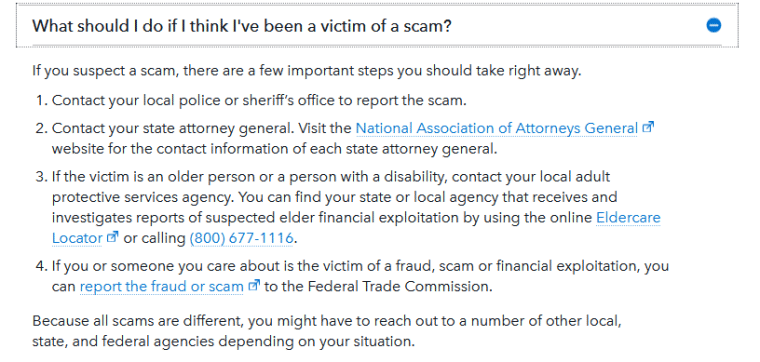

Finally, you may wish to report the scam to the police, Federal Trade Commission, or Internet Crime Complaint Center.

So, Is Zelle Safe?

Zelle is a safe way to send and receive money when you’re dealing with people you know and trust. It has all the security features you’d expect from one of the most popular financial apps in the country. However, if you type in the wrong email address or send money to a scammer, you’re unlikely to get your money back (unless a proposed new law comes into effect).

Always think twice before making a Zelle payment to someone you do not know. The golden rule is, if it’s too good to be true it probably isn’t true. If you’re contacted by Zelle or a bank representative, always verify that the message or caller is genuine before you share any sensitive information. If in doubt, use a credit card instead.